Always remain focused on the big picture during periods of volatility. Gold’s price target is $10,000-$15,000, but silver will rise to unimaginable levels. Take a look…

Silver Will Rise To Unimaginable Levels

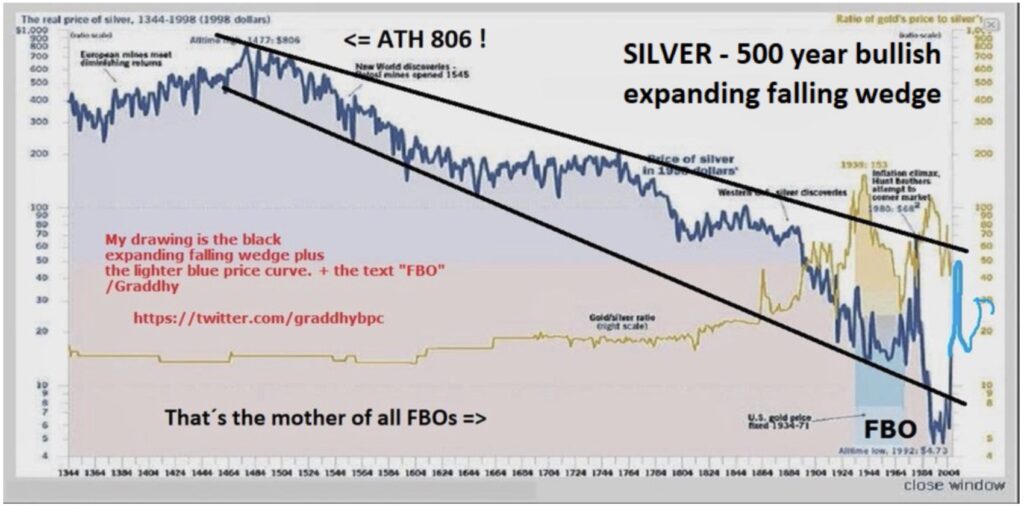

June 13 (King World News) – Graddhy out of Sweden: Still doubting that silver can reach almost unimaginable levels?

Then ponder that silver’s all-time high is not $50, it is $806. In 1998 US dollar value… And in 2023 US dollar value that is $1,506, using Fed’s massaged inflation calculator…

Silver’s Inflation-Adjusted High In 1980 In Today’s Dollars = $1,506

Silver had been in decline for 500+ years when it bottomed around the millennium. Could $800 or higher happen briefly again when silver goes ballistic at the end of the commodities bull? Absolutely.

Gold’s Consolidation

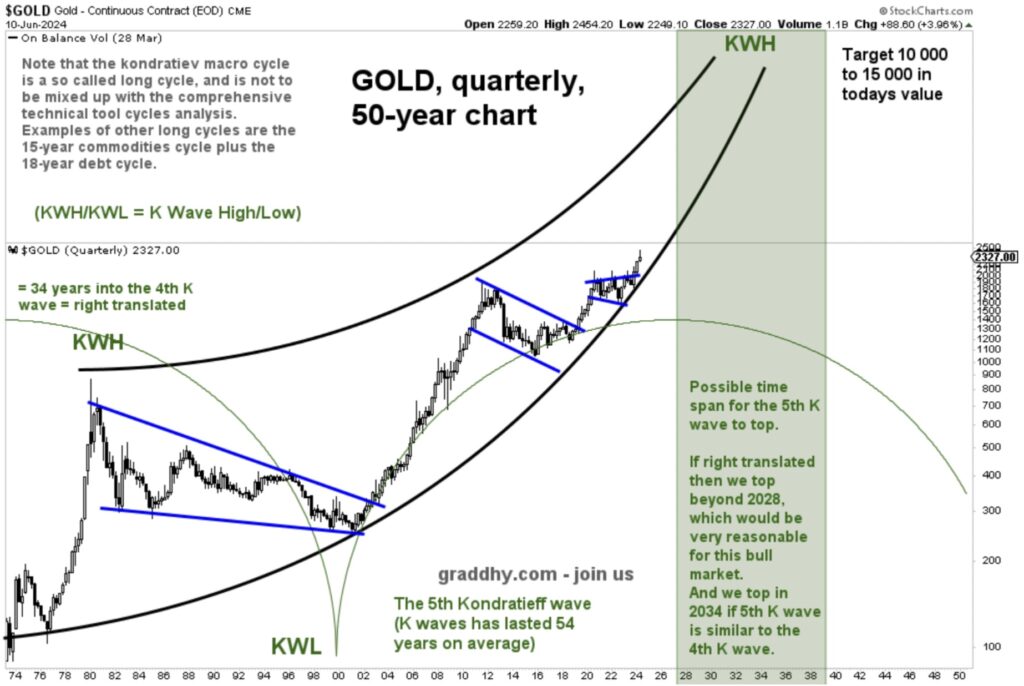

Graddhy out of Sweden: Gold is now in a much needed pullback/consolidation. Do not get beat down by declines, or lose interest during them. Understand them, be ready for them. Do not fight yourself, just focus on price. I have been in this game for 29 years. Know if it is your system, or yourself.

Gold Going Through Much Needed Consolidation

Gold’s Long Term Price Target

Graddhy out Sweden: This gold roadmap first posted back in 2019, is still showing the way.

Another blue mega breakout 5 months ago.

Bull market price objective $10,000-$15,000, but could briefly go much higher at end of the bull.

$10,000-$15,000 Price Target For Gold Remains Intact

Opportunity of a lifetime.

Always know the bigger picture.

Friday’s Gold & Silver Takedown

To listen to James Turk discuss Friday’s orchestrated $82.50 takedown in the gold market and $2.20 in silver CLICK HERE OR ON THE IMAGE BELOW.

Friday’s Gold & Silver Takedown

To listen to Alasdair Macleod discuss Friday’s orchestrated gold and silver takedown as well as what the Chinese are up to and more CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.