The price of gold continues trading at a record $100 premium in Shanghai because China may finally peg their currency to gold.

Gold: The Chickens Come Home to Roost

November 14 (King World News) – John Ing: Why does the world seem falling apart? Wars, pandemics, anti-semitism, polarization, and it goes on. What happened to civility? How did it come to this? To revive the world economy following the 2008 crisis, governments embarked on a tremendous spending binge during the past 16 years, with debt and spending rising faster than GDP. In the US, lacking in savings, they added to an already heavy debt burden because when it came to fund those widening budgetary deficits, the Federal Reserve bought tens of billions of bonds and mortgages with newly printed money (quantitative easing), so that money was essentially free. Under this fiscal free lunch, interest rates went down to the lowest in history.

The supply of Treasuries exploded over $25 trillion or five times since the beginning of the financial crisis of 2008. A rising tide lifts all boats. Inflation and several asset bubbles, including those in real estate and bonds, were driven by this liquidity. And if you go back further, both Presidents Obama and then Trump too pursued spending freely, because there was no penalty, lulling investors into complacency.

As a consequence, amid entrenched inflation, financial reality has intervened. As part of a quantitative tightening campaign, the Fed is attempting to decrease the money supply (M2) after four rounds of bond purchases that increased the size of the Fed’s balance sheet from $1 trillion in 2007 to over $8 trillion. As a result, interest rates are at 22-year highs. Yet Mr. Biden keeps spending. His big climate law, the misnamed Inflation Reduction Act feeds inflation demanding even more debt issuances. Simply inflation remains high because structural forces threaten to keep it there. Not surprisingly the economy remains resilient. Unemployment is under 4% and workers are getting big pay raises complicating the inflation fight. The Fed now warns us that rates will stay “higher for longer.” Amid this fiscal profligacy, America faces a debt reckoning. Those chickens are coming to roost.

Then there are the tectonic-scale geopolitical changes that are putting America to the test. The hegemon for much of this century, facing wars overseas and cultural wars at home, America seems oblivious, since Biden’s foreign policy initiatives were secondary to the limitless domestic spending such as the greening of America or plying the populace with free money during Covid. Since the early 1900s isolation succeeded in helping America’s national security and prosperity and then in a reversal, Harry Truman’s network of global alliances enabled America to lead the world in a unipolar globalization role. That worked.

But today after the humiliating retreat from Afghanistan, a term of Donald Trump and a dysfunctional Capitol Hill, Mr. Biden’s turn away from globalization started by his predecessor resulted in the loss of leverage on the world stage. Today, with Russia threatening Europe, China as a peer competitor has filled the vacuum. We now live in a fragmenting multi-polar world with geopolitical risks the highest in half a century. That said, Ukraine and now Hamas may force the US to end its isolation. It may be too late…

ALERT:

Legendary investors are buying share of a company very few people know about. To find out which company CLICK HERE OR ON THE IMAGE BELOW.

A Day of Reckoning Looms

US-China relations are the worst in four decades. Economic relations are in a perilous state with the wielding of embargos, tariffs and financial sanctions as a foreign policy tool. Nancy Pelosi’s visit to Taiwan, Trump’s tariffs and newly introduced restrictions on real estate and technology have made re-engagement difficult as realpolitiks obstructs almost a half century commercial relationship. And despite supporting the decades-old “One China” policy, American politicians continue to ratchet up tensions over the future of Taiwan, jeopardizing this relationship.

The rise of China as the world’s second largest economy, global trade hub and superpower has led to a confrontation with the United States where everything Chinese is being demonized. Although both view each other as polar opposites, they are very much alike. Admittedly much is made for political gain, but at a time when political rhetoric is so heated, it is a slippery slope which could spiral into wider xenophobic uncertainties, threatening both global growth and war.

On the other hand, US allies from Australia to Europe want to manage a better relationship as well as American businesses who are pushing back because realpolitiks puts them at a disadvantage. If the business climate is not resolved, it will be more difficult to reverse, particularly in an election year. With supply chains becoming risky and costly to replicate, many companies rely on inputs from China that are hard to find elsewhere such as the critical minerals for making batteries.

Furthermore, China’s leadership position in resources and a key player in energy puts America at a disadvantage. Although America retains harsh sanctions against Russia, Russian oil revenues have doubled helped by the world’s largest oil importer. With over half of their needs coming from the Persian Gulf, China’s new sway among Arab states, Russia and Iran isolates America’s once prime position, challenging political alliances around the world. Chickens have a habit to roost.

Meanwhile for the past two decades, China has been buying up valuable resources around the world to supply its manufacturing industry. China has a monopoly and is many steps ahead of the West holding a leadership position in the processing of raw materials into usable metals in the production of EV batteries and cars. The West went along with this because many countries did not want the toxic materials left over from processing. The conflict in Ukraine, however, only served to highlight the West’s vulnerabilities and strain its supply lines…

This silver explorer recently did a huge transaction with a $4.5 billion market cap producer CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

As a result, despite the current rush for vital resources, there is insufficient processing capacity due to stringent government regulations, high capital requirements, and a dearth of downstream processing activities. Canada has lost much of its mining industry while America only has one lithium mine. Canada is even planning to ship its government-subsidized batteries to other countries for assembly into electric cars. As a result, both countries are now dependent on China’s technology and processing capabilities. Crucially, battery plants are receiving more funding and subsidies than the processing or even recycling of the essential minerals required for electricity networks, EVs or wind turbines.

Another critical problem is who or whom will buy America’s debt? China has become the biggest creditor in the world, the US the biggest debtor. Demand has shrunk. What about bringing back Asian money? However, in the face of increased Treasury supplies, demand from traditional offshore funding sources like China and Japan have dried up as ties deteriorate. Once America’s largest creditor, China’s holdings are down $300 billion since 2021. Wall Street banks, forced to beef up their capital were also big buyers but have been absent, creating a financing problem.

In the past 600 years, we have seen the rise and fall of the Portuguese Empire, the Spanish Empire and now the American Empire. All empires ended when the empires became financially insolvent. While there are hopes that the Biden-Xi summit will help bridge differences, President Xi noted that neither wants to fall into the “Thucydides Trap,” referring to the past 500 years when a rising power threatened to displace a ruling one, history showed that to counteract the economic emergence in 12 of 16 cases, the outcome was war. This new world disorder has just roosted.

The Age of Insecurity

At the same time, as the presidential race draws nearer, the Middle East was shattered by the surprise attack by Hamas creating a trifecta headache for Biden joining Ukraine and China as divisive issues. Domestically, the war has fractured tribal politics opening long-term schisms and a growing race problem. Despite the decades-old goal of the UN’s “two state” solution, the war has shifted global dynamics, already battered by a series of shocks over the past five years. The dynamics of the globe are altered by Saudi Arabia’s strategic collaboration with the Chinese on everything from energy to resources to artificial intelligence to computer chips, and even the brokering of a diplomatic deal between Saudis and Iran. China is now a major actor in the Middle East, the region’s biggest oil importer and a key player in BRICS+, a new global paradigm.

After American policy spent more than two decades of appeasement, disasters in Iraq, Syria and Afghanistan, America’s military footprint has shrunk as it confronts a daunting set of geopolitical challenges. Mr. Biden’s attempt to out-Trump Trump led to a failed Middle East policy from the humiliating withdrawal from Afghanistan to almost handing over $9 billion to Iran, to the lack of ambassadors in Egypt, Kuwait and Oman. Today another miscalculation could spark the next world oil crisis. Wars change nations. From the US misadventures in Iraq to Vietnam, to the Israel- Hamas conflict and threats of an Iranian backed Hizbollah, America’s power is being eroded on multiple fronts at a time when America can least afford it. Ironically, this geopolitical conflict in which the US is not directly involved has exposed deep fault lines both domestically and abroad.

Then on the domestic front, America’s profligate deficit spending is coming home to roost. As yields rise on long dated bonds, the reversal in rates sparked deflationary concerns setting off a sharp sell-off in government bonds and turbulence across debt markets, which inflicted huge losses for banks, insurers, pension funds and asset managers. After 2008, America spent more than a decade making its banks stronger, only to lose three of them when rates rose earlier this year. Of concern is that yields have only returned to the mean levels over the 20th century, whilst inflation is increasing. America’s Covid response cost almost 20% of GDP and 1 million American lives were lost as well as infecting many millions more.

Costly was that their refusal to observe science, lockdowns and hospital bed shortages. At the same time, the Biden administration embarked on the largest spending spree in recorded history including the $400 billion Inflation Reduction Act which followed the extra spending on pandemic relief, fueling the inflation of today. And there is the reflationary monetary stimulus of the government’s unfunded liabilities like Social Security, federal pensions and Medicare which shows no signs of moderation. America’s finances are in disarray – and with it the credibility of US statecraft.

America’s Out of Control Finances

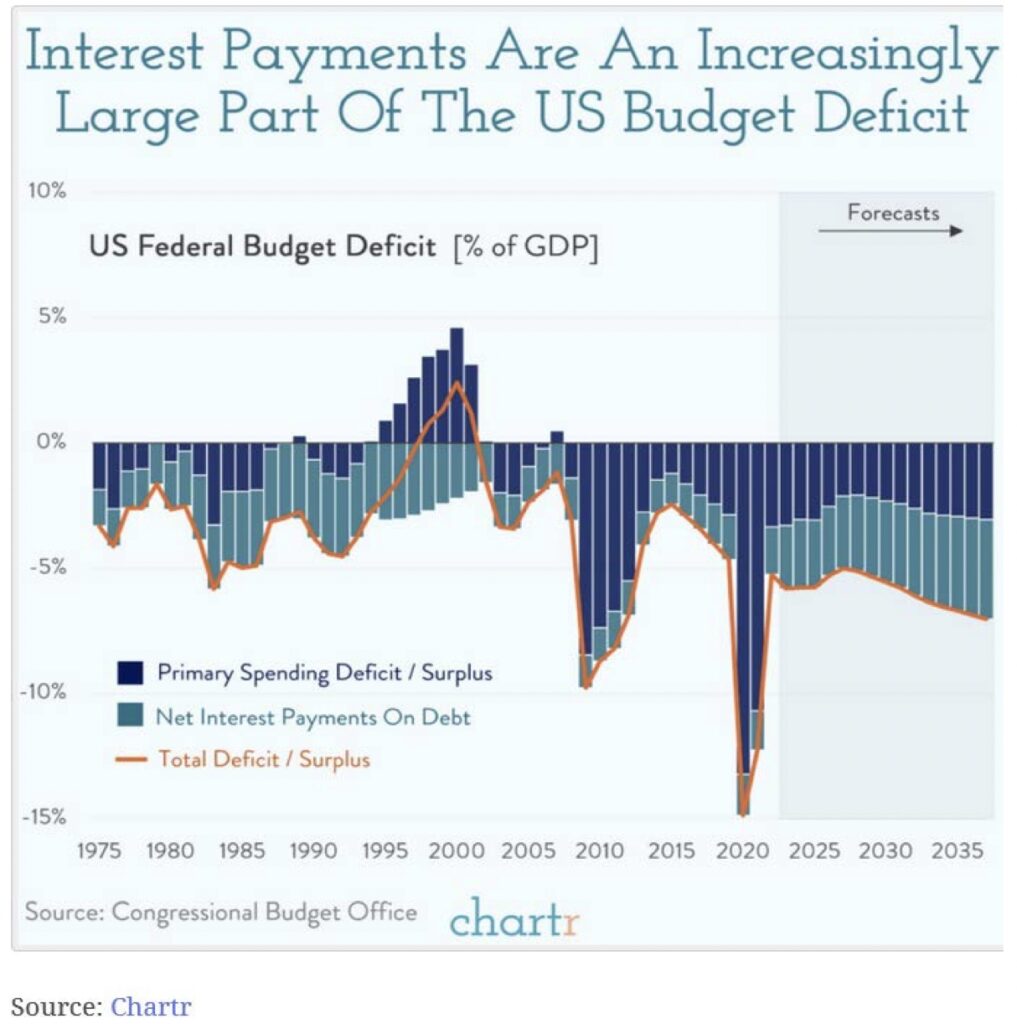

Bidenomics is simply a huge boondoggle wrapped in a zero-emission blanket which hands out trillions in subsidies, warping free markets and risking skepticism of other important policies. It also boosted a protectionist view that caused the US deficit to roughly double to $2 trillion. Deficits today have become the norm. And as America’s military arsenal runs low, it is an inconvenient fact that arming itself will prove very costly and with the upward climb in interest rates, the government’s borrowing costs will climb past $1 trillion on interest payments alone, more than they spend on defense.

Since 1970 onward the US has shifted to a deficit spending model – spending more than current revenues. Not surprising the government is forced to print more money to finance the deficit gap, worrying bond investors, sending long-term borrowing costs up. Deficits didn’t seem to matter, averaging 3% of spending between 1950 and1969. Then President Lyndon Johnson’s “guns and butter” policies saw spending and deficits skyrocket as he tried to finance a war along with a new Great Society, which ended in inflation forcing President Nixon to abandon the gold standard in 1971 as foreign creditors opted to have their debt paid in gold rather than paper dollars. That left Fed Chair Paul Volcker’s storied rate hikes to clean up the inflation mess.

However, without the discipline of a gold standard, governments were allowed to spend whatever they pleased. Deficit spending was the solution. Awash in a sea of debt, the Fed kept the credit wave alive with its fiscal largesse adding to the economy’s sugar rush. In the 1980s when Jimmy Carter left office, the country’s debt to GDP ratio stood at 32% in 1981. Today it is 122% of GDP, excluding entitlements and, the fiscal deficit to GDP is a staggering 8%, the widest since World War II. Long-term bond yields have risen in hocky-stick fashion along with government expenditures, from 3.3 percent during the financial crisis to 5 percent, the highest since 2007.

The biggest threat to the dollar comes not from others but from the US government itself. And that is a worry because the burden of debt is America’s Achilles heel. Currently, President Biden wants to spend trillions on a greener, more sustainable world while also aiding friends wage two battles overseas and a cultural war at home. He will discover a “guns and butter” policy won’t keep the lights on at home.

A meltdown in Treasuries now ranks among the worst Treasury crash in history with 10-years collapsing 46% in the last three years while the 30-year bond erased 53% of gains. The meltdown has just begun. The yield curve has inverted as in 2008. The source of those losses is inflation. Wall Street was rattled by disruption in the $25 trillion Treasury market when Industrial and Commercial Bank of China (ICBC) was hit by a cyberattack and temporarily owed $9 billion to BNY Mellon, the world’s largest custodian to settle trades, exposing the fragility and risk in the US Treasury market.

And where is the saving grace for bond buyers, a recession? Not on the horizon as politicians and central bankers call for more spending despite yet another debt limit showdown. Inflation is here to stay, particularly when the Fed, the world’s biggest issuer of debt made a disastrous mistake of not refinancing its trillions of debt when rates were near zero. Today that mistake has proven costly with borrowing costs at 22-year highs.

With $33 trillion in debt, American debt is the most in the world. The collapse in the bond market has just begun, particularly with US banks’ cumulative losses pegged at $500 billion and soon to breach $700 billion, a new record. The big hedge funds and prime brokers have joined the big banks in a basis trade arbitrage raising risks in the US Treasury market of a repeat of the toxic derivative implosion in 2020 and 2008.

Who will then absorb the additional supply of government debt associated with the higher deficit, and at what price? America’s addiction to low rates and profligate spending debases the dollar, eroding its dominance, central to America’s credibility in financial markets. We believe this fiscal unsustainability will show up in even higher yields and pain, from the shopping cart to corporate balance sheets, to taxpayers as those chickens are only coming home to roost…

Listen to the greatest Egon von Greyerz audio interview ever

by CLICKING HERE OR ON THE IMAGE BELOW.

We also think that the situation is similar to what happened in 1987, when the market fell more than 20% in a single day on October 19, 1987, commonly known as Black Monday, after it had earlier soared in the first part of the year. Computer-driven program trading was given as the excuse and the meltdown ended after newly appointed Fed Chair Alan Greenspan slashed interest rates. However, a strong US dollar put pressure on exports, widening the trade gap with market valuations a lofty 20x. In fact, the Fed’s on and off tightening of today is similar to back then when 10-year yields rose sharply from 7% to 10%. And just as back then, the Middle East is again a powder keg with tensions between Iran and the United States near-war conditions.

This disarray and fragmentation of the world, in our opinion, undermines the dollar’s hegemony as a reserve currency. And as before, crude pushes higher with OPEC+ and Russia now controlling more than half of the world’s supply, trading in other currencies than the dollar. In addition, the US Strategic Petroleum Reserve (SPR) is half empty at 40-year lows following the government’s earlier 200 million barrel release to lower oil prices ahead of the midterm elections last year. That leaves the US vulnerable to supply shocks, particularly if the conflict in the Middle East escalates in a replication of oil shocks of the 1970s and 1980s. There are two types of wars: total war with only one victor and forever or endless wars. Markets are not ready for both.

Guns and Butter Redux

While there has been a liquidity bazooka aimed at greening the economy, much was at the expense of improving economic growth as governments spent trillions in the quest to limit CO2 emissions. Yet scientists know the cause, but no one knows the remedy. Like a black hole, once you are in it, it is impossible to get out. We are currently in a green, black hole when it comes to greening our economy. While EVs are heavily subsidized, public subway and bus systems are left out of the bonanza.

Worrisome too is that despite the billions of subsidies, wind-makers are losing billions as Ørsted, the world’s largest offshore wind developer, cancelled two giant offshore projects to deliver power to New Jersey. Also, Ford announced that they are losing $36,000 on every EV they sell. Yet Chinese carmakers can produce EVs at a profit today. Western carmakers will find profits elusive just as the EV bubble is beginning to deflate. Biden’s Green Deal is something between a mirage and boondoggle as high interest rates, permit delays and supply problems become the new reality.

Meantime, the US dollar itself is changing on a geopolitical level as in regard to oil now that the US has weaponized its usage. Mr. Biden has a problem of his own-making since the major Middle East oil producers have teamed up with Russia and cutback production to boost prices. Further the big Asian buyers are using alternate international payment systems and currencies such as the petroyuan rather than petrodollars. The dollar’s reserve status is threatened by de-dollarization, especially now that the US is exporting energy rather than importing it. Such problems mean fewer recycled dollars and coupled with a dysfunctional government and growing debt sustainability, the dollar is not forever.

The strength of the American economy was one of the main reasons the US won the Cold War with Russia, allowing them to build a global defense behemoth which the Soviet Union could not match. America’s over confidence led to arrogance and now complacency. Today, America is strapped from fighting wars in Ukraine, Middle East and a cultural war at home, akin to Lyndon Johnson’s “guns and butter” spending when he chose both to fight the war in Vietnam as well as fund an ambitious domestic Great Society. That spending ended in inflation and an American default. Today’s high rate of inflation is simply a preview of what might occur if the US is forced to monetize the bulk of its national debt.

The danger is that a US-China financial war is beginning to take shape. China’s economy supports a debt to GDP ratio of 77%. The US debt to GDP is 122%. America is in denial. It will need financing. The state of affairs will be laid out next year in another polarising election when over half of the country questioned the legitimacy of the last one. The next result may be handed to the courts, with an isolationist Trump administration threatening the world’s most powerful democracy. One group being played against the other. Country against country. Gold is going to be a good thing to have.

The Golden Rule

Despite its relative performance, the gold price is frustrating everyone. Gold is difficult to analyse. For a start, there are haters and lovers and a deep divide between the two. To some, it is barbaric (John Maynard Keynes) but others, the ultimate hedge (Auric Goldfinger). Because gold doesn’t pay interest, fundamental players avoid its benefits. Nonetheless, gold has outlasted all assets— including fiat money—for thousands of years.

Simply, gold is an alternative to money and lately has outperformed the greenback. The total supply of gold is limited while the supply of fiat currencies like the dollar is unlimited. Gold cannot be debased nor created by a click of a mouse and thus is an effective inflation hedge. Gold peaked at an all-time high of $2,075 in August of 2020. Since 1971 when President Nixon defaulted and took the dollar off the gold standard, gold has gone up 726% while the US dollar has lost 98% of its purchasing power. Going back further in 1933, President Franklin D. Roosevelt refused to repay Treasury bondholders with gold in yet another default of the dollar. Others including China are aware of America’s historic penchant in abrogating agreements.

Recently China has led central banks as the largest buyer of gold adding to its reserves for 12 consecutive months, underpinning the gold price. The rush to buy gold was driven by gold’s role as a hedge against inflation and reduction of central banks’ reliance on the US dollar. Poland, Singapore and Turkey were also large purchasers. Noteworthy is that the domestic price of gold in China rose to a new all-time high and the country’s reserves stands at 2,215 tonnes.

Equally important is that China’s nearly $3 trillion in reserves allows it to take a leadership in the creation of a new monetary role as part of the multi-polar world. China’s accumulation of gold makes it the fifth largest holder of gold and its currency was once on a silver standard. China is not as indebted as the West nor dependent on outsiders for financing. China could peg the renminbi to gold, given its huge manufacturing base, international profile and the fact that entities such as the Shanghai Gold Exchange is the largest physical gold player in the world. History shows that fiat currencies don’t work so maybe the Middle Kingdom’s renminbi may prove to be the solution to the financial disorder of today. No wonder gold is trading at a record $100/oz premium in China.

Recommendations

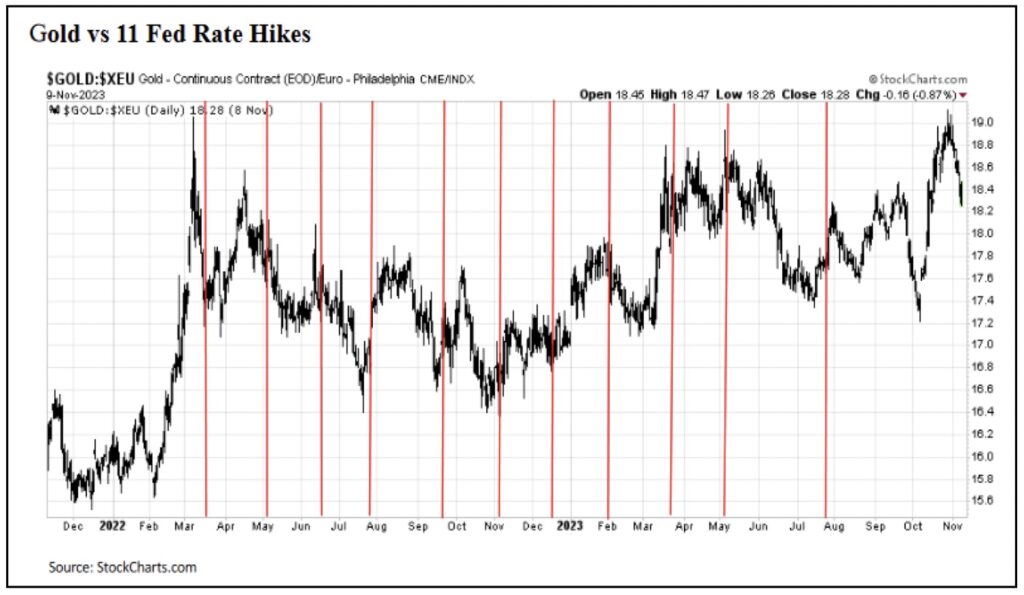

Earlier this year gold flirted with breaking the August record because of the regional banking crisis but subsequently its “non-performance” was due more to the fact that it tends to move inversely with the dollar. The recent strength of the dollar hurt the gold price. However in yen, gold is up 25%, in pounds 11% and in Russian rubles up 81% from a year ago. Our belief is that mounting inflation, de-dollarization, heightened geopolitical risks, global debt and the rise in populism provides a positive backup for gold – it is a good thing to have. We continue to target $2,200/oz.

We observe that ahead of the Fed rate hikes, the market led by the algos dumps gold and buys the dollar. But each time, gold recovers and records fresh highs. Another demand factor is that foreign money and central banks have loaded up on gold instead of US Treasuries. Since March 2022, rates have increased 525 bps. Gold in that time has actually increased almost 2% in dollars and gold/euros is up 7% in the same period, better than markets. Consequently, market fears of higher rates hurting gold are misplaced – simply it is a buying opportunity because gold helps to preserve capital.

Meantime the gold producers are market laggards despite their robust free cash flows, solid balance sheets, dividend increases and historic low valuation of in-situ reserves. The majority of miners had trouble replacing their depleting reserves, despite spending heavily on exploration and production. Moreover, there have been few skookum discoveries. Newmont already the largest gold miner in the world closed on the $19.2 billion acquisition of Newcrest in Australia in a quest for growth. Since reserve growth is a problem, we believe M&A activity will continue but in this game of musical chairs, there are fewer and fewer chairs. Simply it is cheaper to buy ounces on Bay Street rather than spend capital and time on exploration and development.

ALSO JUST RELEASED: This Sums Up The Endless Frustration Of Investors In The Gold Space CLICK HERE

ALSO JUST RELEASED: Last Legs In Japan As Cost Of Capital Soars And Trouble Brews For S&P 500 CLICK HERE

ALSO JUST RELEASED: Michael Oliver – Here Is The Truth About Gold’s Recent Price Action CLICK HERE

ALSO JUST RELEASED: Is China Going To Play The “Gold Card” Next Month? Plus Economy Beginning To Collapse CLICK HERE

Audios Just Released!

To listen to James Turk discuss the takedown in the gold and silver markets and why there are indications that a bottom is at hand CLICK HERE OR ON THE IMAGE BELOW.

To listen to Alasdair Macleod discuss the takedown in the gold and silver markets and what to expect next CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.