As we kickoff the final three weeks of trading in November, some are wondering if China is going to play the “Gold Card” next month? Plus the economy is beginning to collapse again.

The “Gold Card”

November 12 (King World News) – Email from KWN reader C. Perkins: I’m seeing rumours about an upcoming PBOC (People’s Bank of China) meeting early next month to the effect China is finally going to play “The Gold Card” (presumably with Russia’s wholehearted support and endorsement). And, if true, this would certainly provide the impetus for the next move higher in gold, and that will take silver along for the ride. And then, the miners. Or, they might play their “canary” role and start moving ahead of the metals themselves, as they oft-times do.

Alasdair knows where all the bodies are buried; what’s he hearing about this? Or any other of your go-to China-watchers, such as Ing.

The recent beating they’ve been giving gold and silver and the capitulation in the miners you’ve chronicled this week suggest to me the Banksters are aware of what’s coming and this is their last chance to twist the knife before the knife gets taken away, perhaps for good.

Keep up the good work!

C. Perkins…

Listen to the greatest Egon von Greyerz audio interview ever

by CLICKING HERE OR ON THE IMAGE BELOW.

The Economy Is Beginning To Collapse…Again

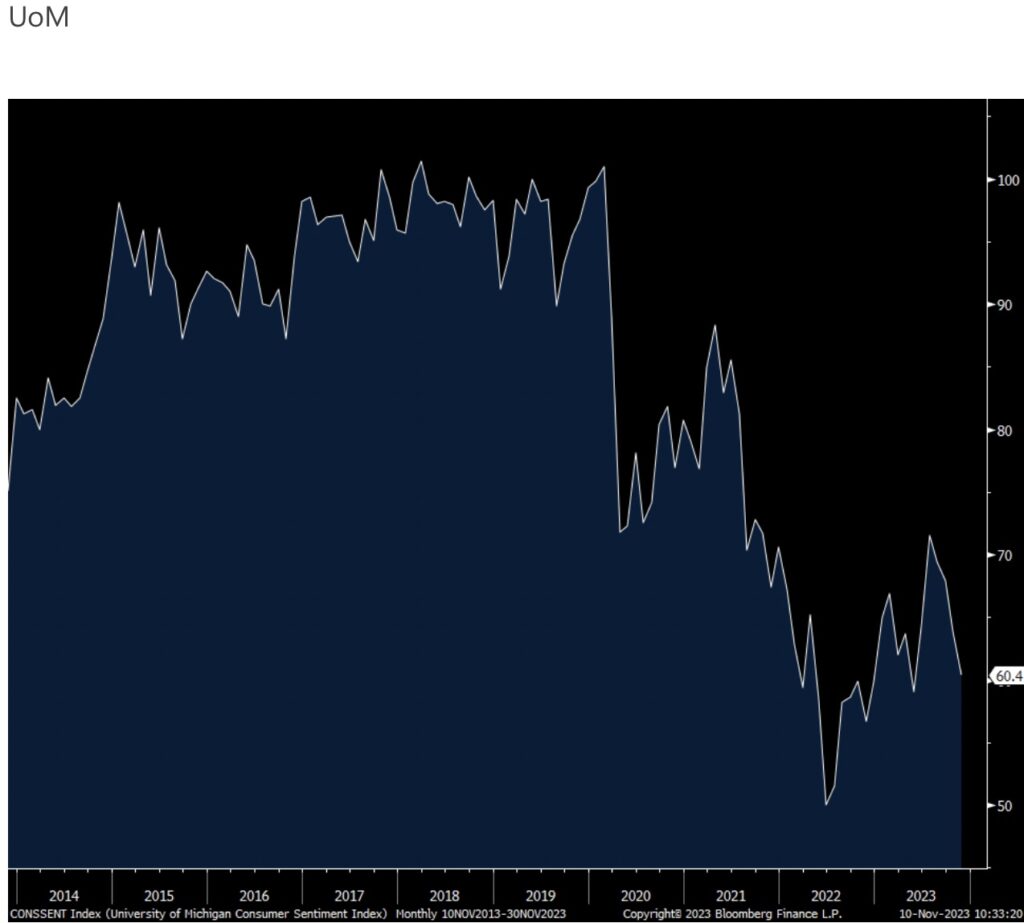

Peter Boockvar: The preliminary November UoM consumer confidence index fell to 60.4 from 63.8 and where the estimate was for little change at 63.7. That’s the weakest since May with both the Current Conditions and Expectations components lower m/o/m.

Consumer Confidence Collapsing…Again

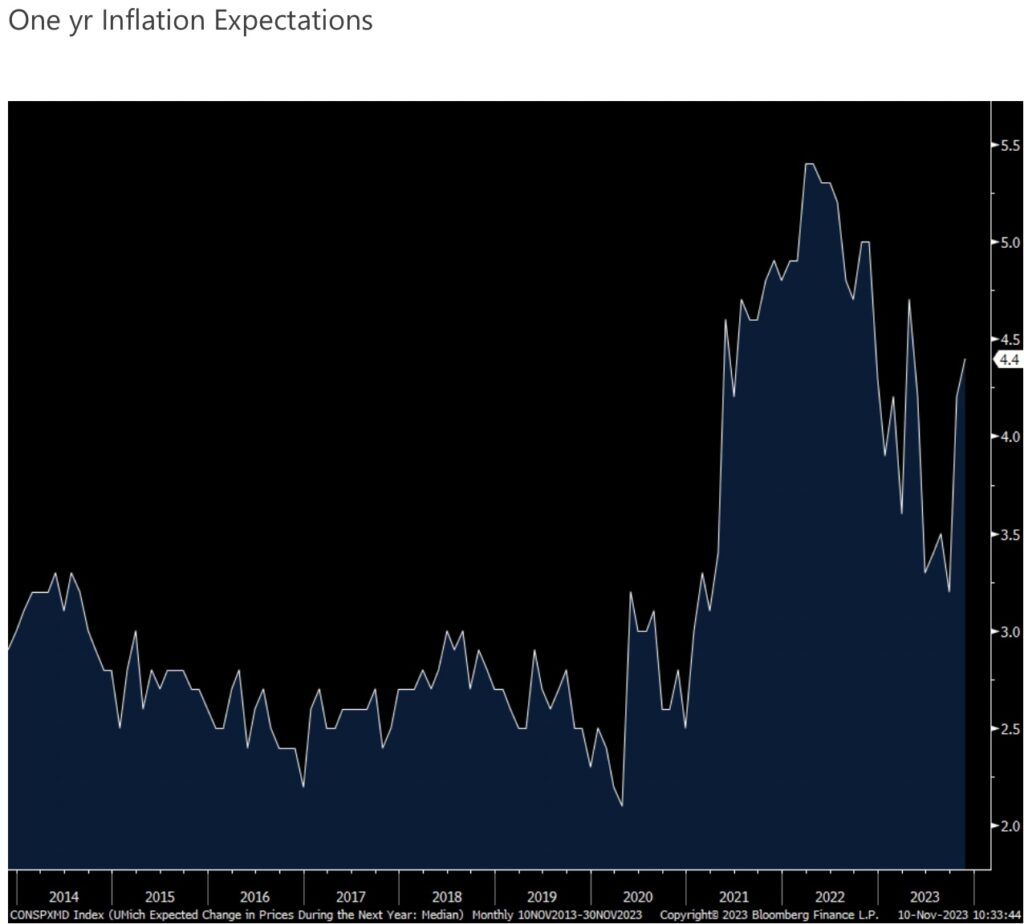

Inflation worries are clearly apparent as the one yr expectation for inflation rose to 4.4% from 4.2%, the most since April and the 5-10 yr guess was up 2 tenths m/o/m to 3.2%, the highest in 12 years.

Inflation Expectations Heading Higher…Again

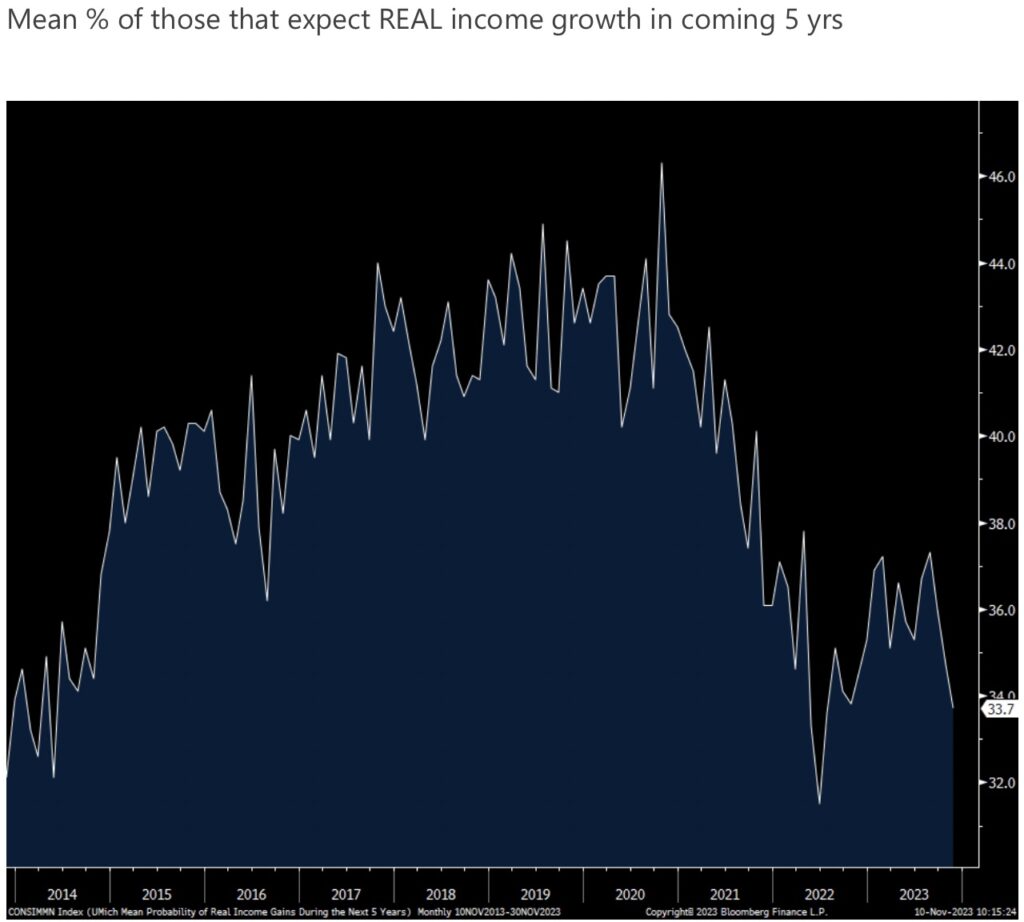

To this, the mean percentage of those that expect their income to exceed inflation in the coming 5 years fell to 33.7%, the lowest since July 2022.

Those Expecting Their Income To Exceed Inflation Is Collapsing…Again

If you take away Covid, that’s the softest since 2014. Like I said the other day, only Wall Street and the Fed live on rate of change while the average consumer is trying to manage a 20% rise in their cost of living as measured by CPI over the past few years and add much higher interest rates on top of that for those that have debt.

This of course mostly impacts that lower end income consumer while the upper end is excited by the higher stock market which means that the recession debate needs to include ones view of the stock market.

Expectations for employment fell 3 pts from October to the lowest since June and follows growing evidence of a cracking in the labor market. The income component was unchanged for a 2nd month but at the lowest since January 2021. Personal finances did improve though a bit.

Expectations for business dropped by 8 pts to the lowest since May.

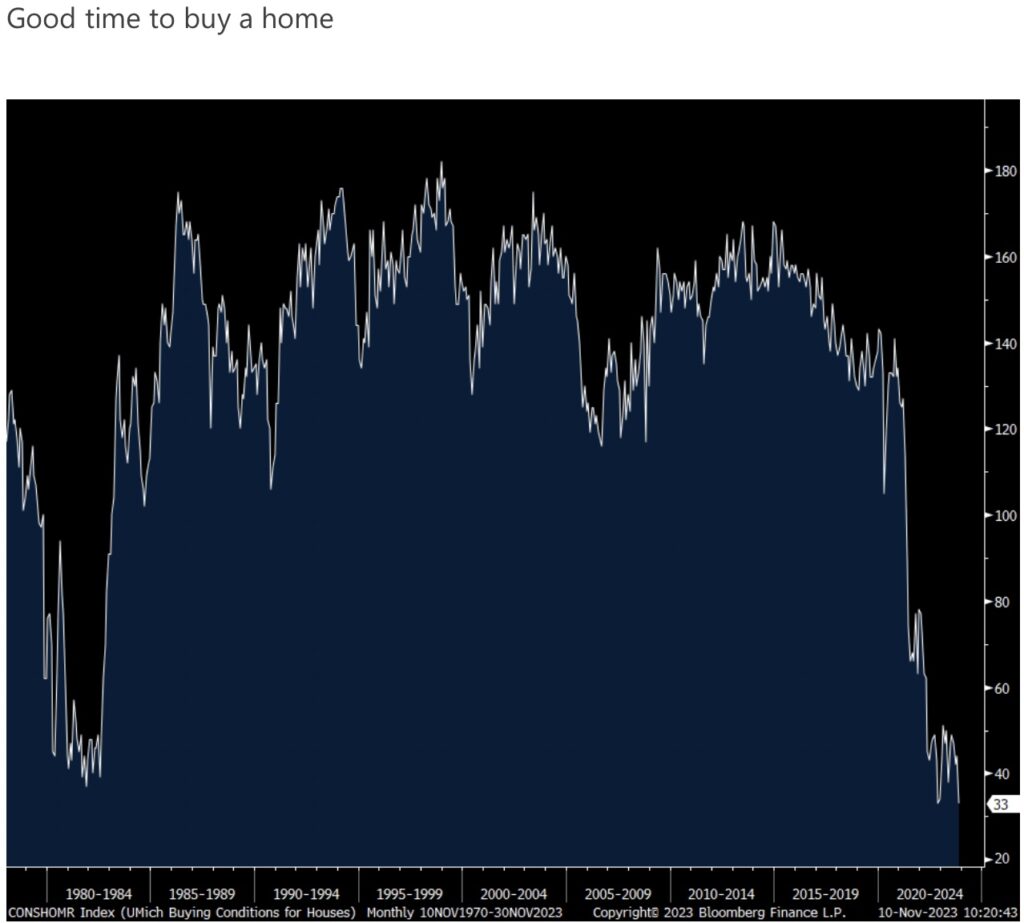

High prices and the high cost of funding big ticket items led to a notable drop in spending intentions. Those that said it’s a good time to buy a home dropped 11 pts m/o/m to 33, matching the lowest level on record dating back to 1978.

Those Thinking This Is A Good Time To Buy A Home Collapses To 45 Year Low…Again

Intentions to buy a vehicle dropped 3 pts to the weakest since December 2022. To this, “About 36% of consumers spontaneously blamed high interest rates or tight credit for poor buying conditions for vehicles; this is the highest share on record.” For those buying a major household item, it was down 16 pts to the softest since May.

The bottom line from the UoM: “While current and expected personal finances both improved modestly this month, the long run economic outlook slid 12%, in part due to growing concerns about the negative effects of high interest rates. Ongoing wars in Gaza (me: they should have said Israel too) and Ukraine weighed on many consumers as well. Overall, lower income consumers and younger consumers exhibited the strongest declines in sentiment. In contrast, sentiment of the top tercile of stock holders improved 10%, reflecting the recent strengthening in equity markets.”

They finish their press release with this, “The combination of expectations for persistently high prices, high borrowing costs, and labor market weakness does not bode well for the prospect of continued strength in consumer spending and economic growth.”

I agree.

Audios Just Released!

To listen to James Turk discuss the takedown in the gold and silver markets and why there are indications that a bottom is at hand CLICK HERE OR ON THE IMAGE BELOW.

To listen to Alasdair Macleod discuss the takedown in the gold and silver markets and what to expect next CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.