Today the price of gold is surging toward $2,400 and silver is now near the key psychological level of $30, but look at this…

Beware Of The Fed Put…

May 15 (King World News) – Gregory Mannarino, writing for the Trends Journal: Before we begin, let’s define what a “Fed Put” is…

A Fed Put is defined as a mechanism by which the Fed, by keeping bond yields/rates artificially suppressed, drives cash into risk assets/stocks. This “Fed Put,” was previously known as the Greenspan Put.

Alan Greenspan, the then Fed Chairman, repeatedly lowered rates and implemented easy money policies to prop up the stock market during his tenure,1987-2006.

(A new Fed Put situation is about to begin).

In large part, the mania behind the “Dot-Com” bubble/crash was hyper-inflated via the Greenspan Put.

It was also his tightening of monetary policy in the Spring of 2000, which allowed the bubble to burst…

Listen to the greatest Egon von Greyerz audio interview ever

by CLICKING HERE OR ON THE IMAGE BELOW.

Following the stock market crash/financial meltdown of 2008, the Fed again brought back the Greenspan Put, which has now become known simply as the Fed Put.

Without exception, every single time that the Fed has implemented a “Put” to prop up stocks, it ends in disaster.

Why is that one might ask?

The answer is simple.

Call it what you want, a Greenspan Put, or a Fed Put, artificially suppressed rates/easy money policy drives cash into the stock market therefore inflating a bubble… but it gets worse.

Cash moves through the markets in predictable patterns. Artificially suppressed rates open a doorway for cash to make its way into risk assets/stocks. Think of it like this. If a “Fed Put” is causing cash to make its way into the stock market, then it must mean that cash is coming from other places. Makes sense?

A Fed Put causes cash mainly to be pulled from “risk off” assets, such as commodities. So, the setup here is simple. A Fed Put, BY DESIGN, causes MASSIVE distortions in the price action of assets… it also creates opportunities.

Investors, understanding how a Fed Put works, will overexpose themselves to risk assets/stocks, further exacerbating and therefore fueling a stock market bubble/hyper-bubble.

Investors who are aware that during a Fed Put situation cash will make its way into stocks, also understand that assets like commodities will become massively undervalued.

Therefore, the Fed Put gives investors an opportunity to acquire commodities extremely cheaply.

A Greenspan Put / Fed Put causes massive price action distortions across the entire spectrum of asset classes, and THAT presents an opportunity to make the system work FOR you, and not against you.

Central banks are now setting the stage for a NEW “Put” under the market.

And this includes a series of rate cuts and more easy money policies. What will come along with this is more, and MUCH GREATER price action distortions-and therefore OPPORTUNITY.

Ultimately, this “Put” situation will eventually end just like every single one before it has—VERY BADLY for the stock market. The distortions which are created via the Fed Put situation eventually balance out, and in the end result in a Merry-Go-Round stock market crash situation.

How Will Gold Fare?

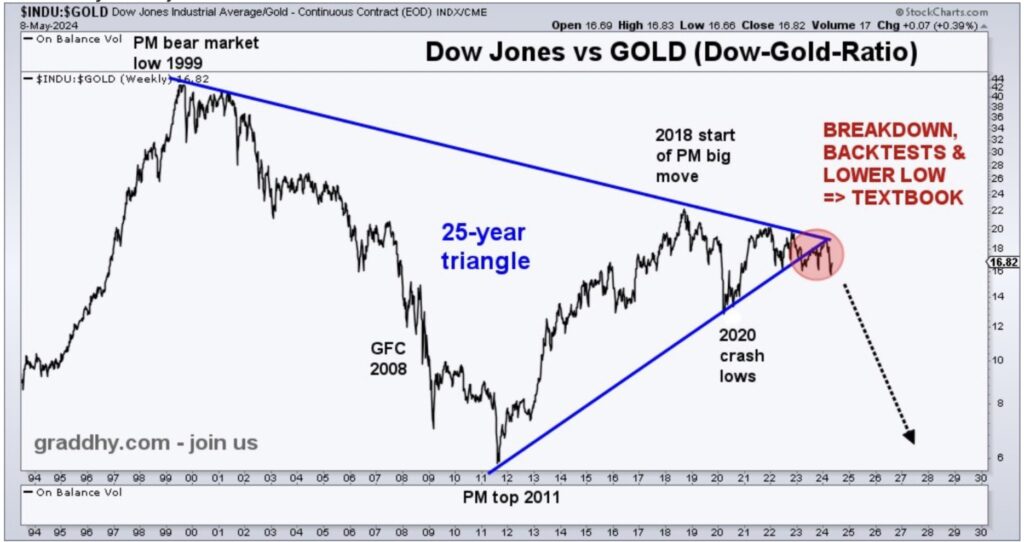

King World News note: The Dow has already broken down vs gold. Meaning gold is set to radically outperform the stock market (see chart below).

Gold Is Now Set To Radically Outperform The Dow, NASDAQ, S&P

Today we seen an example of that with the price of gold surging twice as much in percentage terms as the Dow. Stocks face enormous headwinds going forward whereas the gold market has the wind at its back. Look for gold to eventually break above $3,000 before ultimately advancing thousands of dollars higher. Silver will eventually trade well over $100. But the high-quality mining and exploration stocks will outperform everything. See the interview below where Michael Oliver discusses how investors can target which stocks to buy ahead of the gold and silver mania.

Michael Oliver: Gold’s Upside Acceleration Phase And How Investors Can Target Which Mining Stocks To Buy Ahead Of The Gold & Silver Mania

To listen to one of Michael Oliver’s most important audio interviews ever discussing the gold and silver mania, what to expect from mining stocks, the stock market in 2024 and much more CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.