Gold futures have surged back toward the $2,700 level, but take a look at this shocker.

Michael Oliver’s audio interview has now been released (link below)! In the meantime…

November 29 (King World News) – Alasdair Macleod: Evidence is mounting that the dollar’s recent strength has been a temporary phenomenon, which is positive for gold and silver.

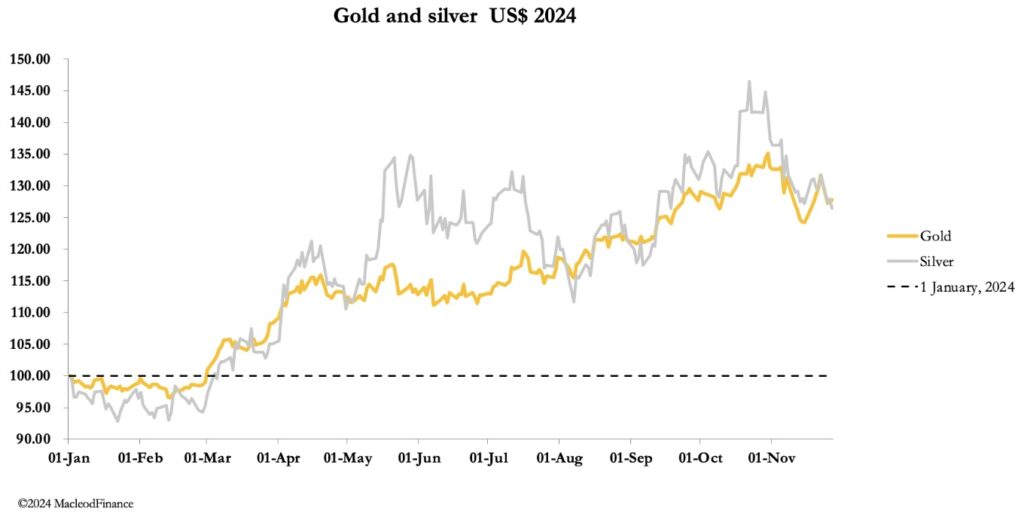

Gold and silver were in consolidating mode this Thanksgiving week following sharp falls on Monday. At Friday’s trading in Asia, gold was $2637, down $77 from last Friday’s close, and silver $30.20, down $1.13 on the same timescale. Turnover declined over the week into Thanksgiving, which is a public holiday in America. Additionally, December’s Comex contracts were running down with first notices for delivery due today.

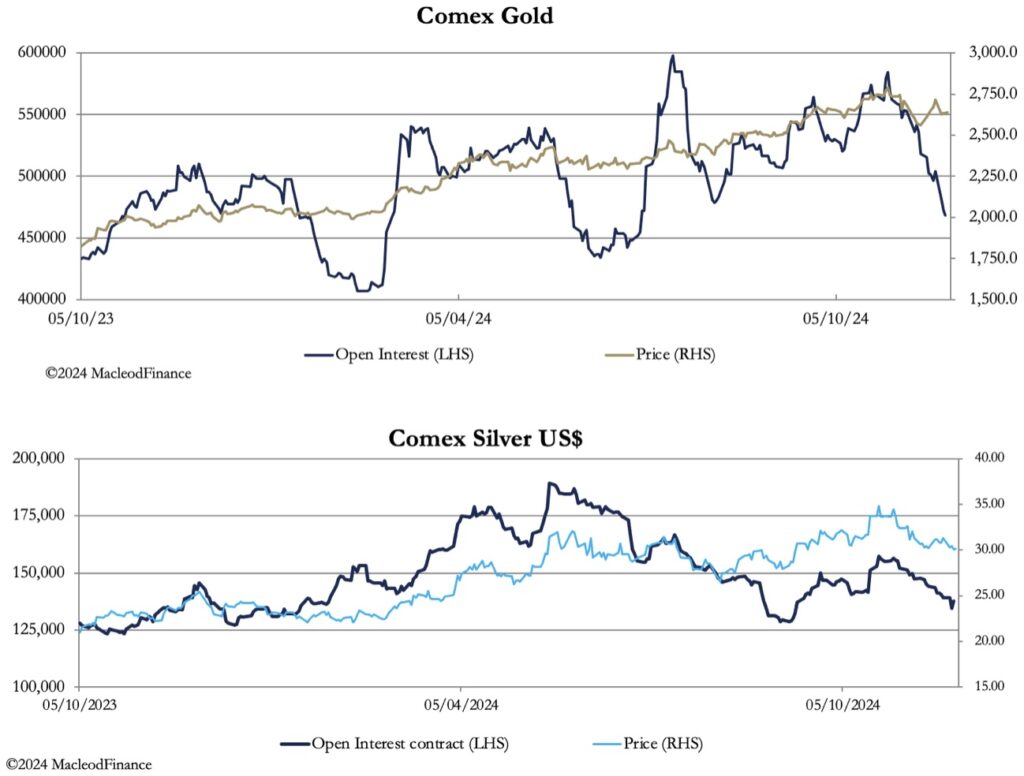

The combination of contract expiry and the market consequences for the dollar of Trump’s successful presidential challenge has shaken bullish speculators out of futures, leading to a collapse in Comex’s Open Interest in gold and a significant decline in that of silver. These charts are next:

While this changed landscape against a background of dollar strength has injected uncertainty into bullish speculation, it is notable how the gold price has held up while Open Interest imploded (see the upper chart). This represents an immensely strong underlying performance. And taking Open Interest as an approximate overbought/oversold indicator, the risk now is of a rising gold price continuing to squeeze the shorts, and not of further declines in the gold price.

The relationship between the silver price and its Open Interest is normal for a continuing bull market. Because what happens to gold sets silver’s timing, no further comment is necessary.

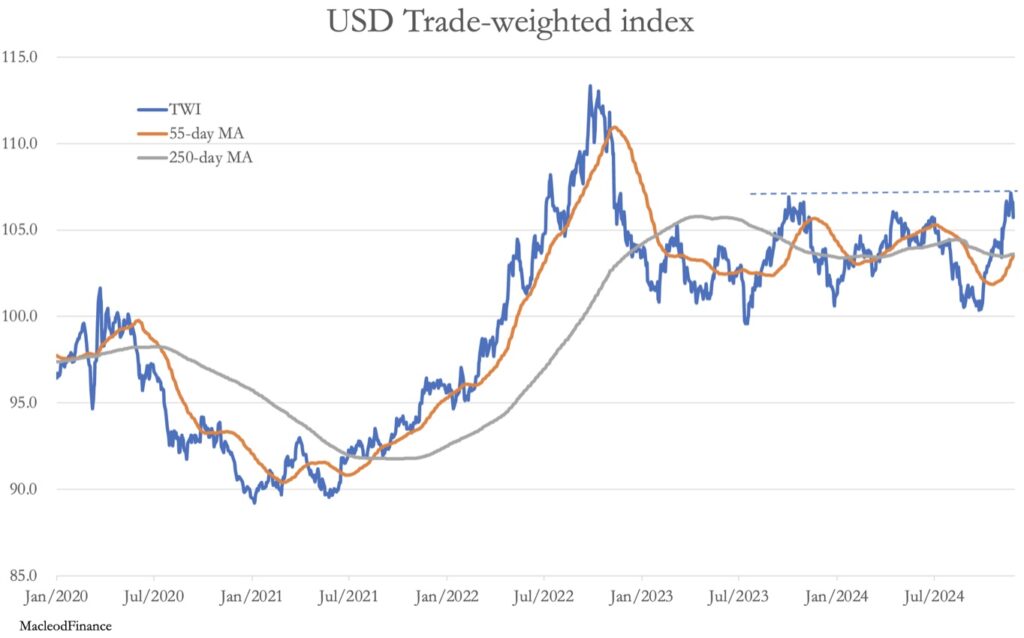

The other side of the hedge funds’ pairs trade is the dollar. Its recent strength has undoubtedly wrong-footed them, forcing them to close out their long gold positions, and if anything, go short to compensate for their losses. In fact, it is remarkable that the fall in the price of gold futures has not been greater, only explained by the lack of physical liquidity. My chart of the TWI is next:

This index appears to have run into a hard stop at the high point of an established trading range, which on Wednesday turned the index down 0.75%. Meanwhile, the moving averages look positive but have been oscillating indeterminably for the last two years throwing out false signals. A clear break above 107.50 is now needed to confirm a bullish reading. Currently, the TWI stands at 105.88.

A market analysis rather than a technical one helps to clarify the position. The dollar’s rally has been entirely due to Trump’s successful election, leading to an adjustment of currency positions. The buyers of dollars are predominantly wrong-footed shorts, a phenomenon which is a one-off. I doubt that foreigners are tempted to become dollar bulls, given their scepticism of Trump’s policies based on their experience of his first term. If anything, they are likely to sell into strength, which is probably what we saw on Wednesday.

The implication is that the correction in gold has run its course, and even speculators should consider accumulating long positions here.

So there we have it — three reasons which suggest that gold’s consolidation is over:

- Comex Open Interest has virtually collapsed, indicating that if anything gold is now marginally oversold.

- December’s contract expiry gives gold futures a clean sheet running into the year end.

- After a one-off jump, the dollar is set to decline, which should propel gold prices higher.

All Hell Is About To Break Loose!

Michael Oliver just predicted all hell is about to break loose CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.