Today gold futures surged above $2,400 as the price of silver advances toward $32.

Gold & Silver

July 5 (King World News) – Alasdair Macleod: Overnight gold demand from China appears to have returned. Will it follow through?

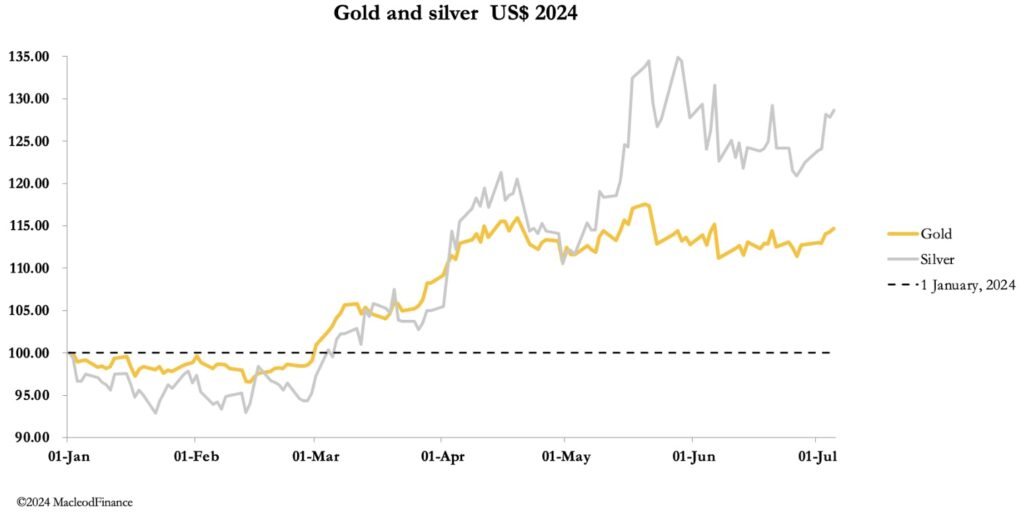

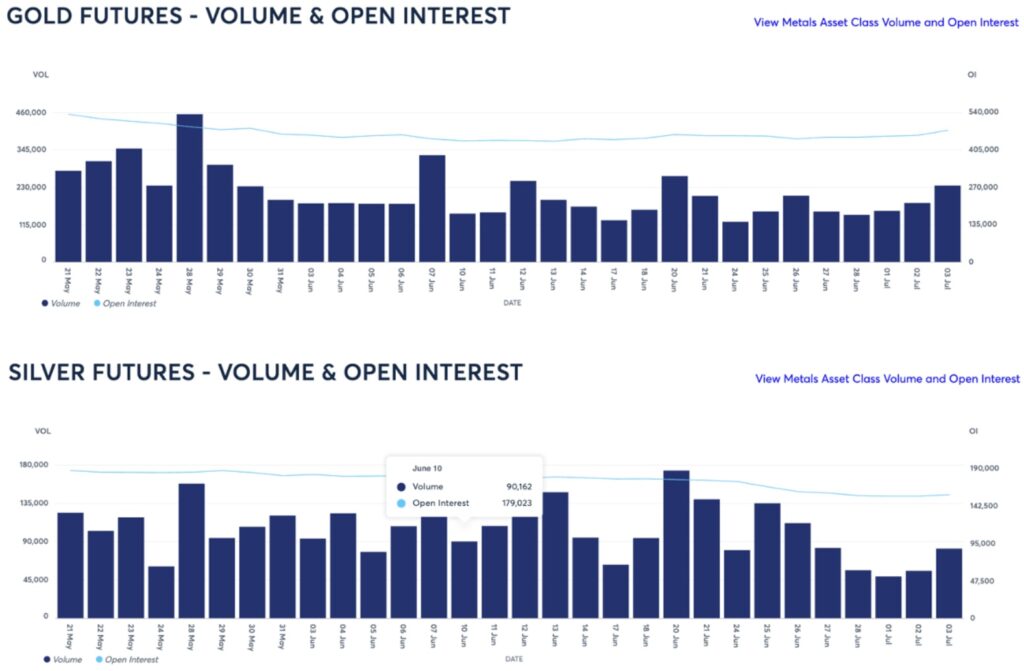

As evident in our headline chart, silver had a better week while gold steadied, seemingly well underwritten at current levels. Gold opened at $2365 in Europe this morning, up $36 from last Friday, while silver opened at $30.60, up $1.46 on the week. Comex volumes were generally lackluster, though they picked up somewhat on Wednesday, shown next.

It was on Wednesday that most of the bull action occurred. From the outset, there appeared to be overnight Asian demand feeding into the London morning fix, and it just continued from there into New York. There was also good demand for Comex gold contracts, when Open Interest increased by over 18,000 contracts. The relationship between Open Interest and prices for gold and silver are shown below.

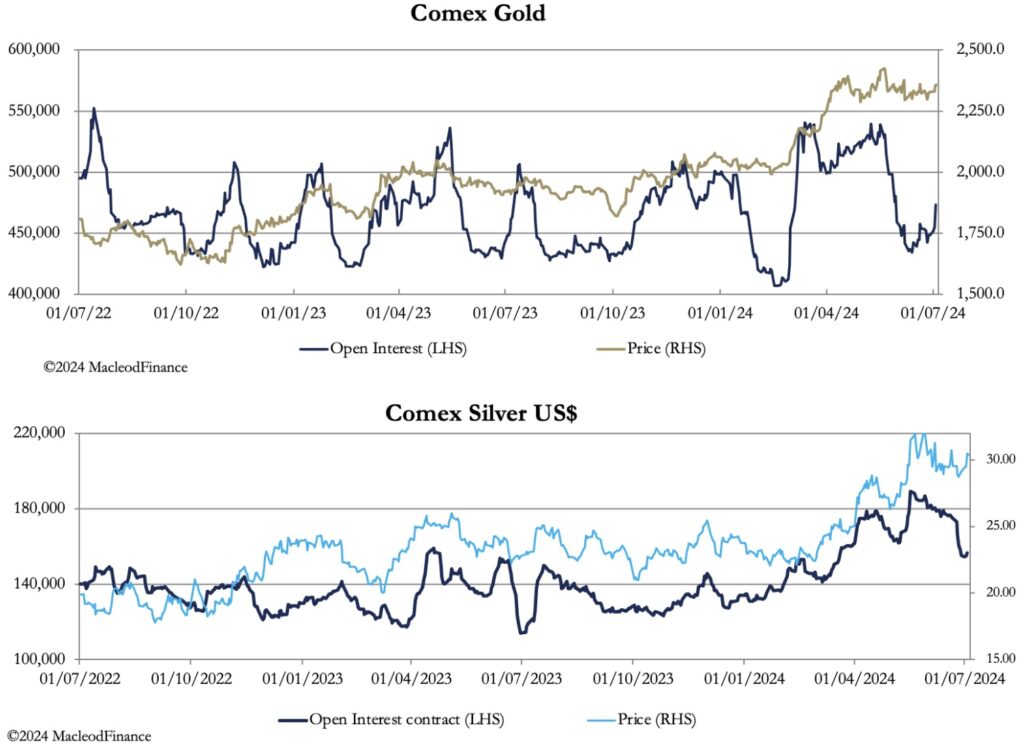

From being marginally oversold, gold’s Open Interest is now neutral with the prospect of further long contract demand driving prices higher. It appears that the hedge funds are going long again — not yet dangerously so. However, we should include additional arbitrage between Comex and Shanghai in our calculations, meaning that some of the buying on Comex isn’t speculative betting. Gold’s technical position is next up.

Support has been established at the 55-day moving average. But while it would be a mistake to rule out a deeper correction to test the longer-term 12-month MA, the market feels very firm underneath. Undoubtedly, this reflects continuing Chinese demand for both physical and futures contracts in Shanghai, now driving prices in western markets.

Silver is following slightly different technicals. Our earlier chart above of silver’s Open Interest and the price shows that silver is rising on declining Open Interest, which indicates bear squeeze conditions. However, the technical chart is similar to gold’s, with support being established at the 55-day MA.

In the wake of the June month end, Comex deliveries are picking up, continuing to drain US vault liquidity. Since the beginning of June, 11,677 gold contracts have been stood for delivery amounting to 36.32 tonnes, and 5,615 silver contracts amounting to 873.2 tonnes.

While technical positions for both gold and silver are looking positive, there is little new happening on the economic front. Everyone is still waiting for the Fed to cut its funds rate, but it needs to fund the government’s deficit. For now, this is being achieved to a degree through the carry trade out of Japanese yen. A cut in the funds rate would almost certainly cause a significant rally in the yen, killing that trade and causing funding difficulties.

In politics, there is now a question over whether Biden will throw in the towel. If he doesn’t, it looks like a shoo-in for Trump. If he does, there is precious little time for an alternative democrat candidate to establish electoral credibility. The British election of a Labour government creates yet to be reflected market uncertainty for sterling and gilts. And we await the second round of the French election this coming Sunday.

Finally, war tensions against Russia and Iran are still quietly escalating like an expanding magma chamber in danger of erupting under foot. It is simply not a time to be short of gold or silver.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged