Today the gold and silver breakouts continue as silver attracts a new group of investors.

Silver Has Attracted New Group Of Investors

November 11 (King World News) – From Sprott Asset Management: Silver has attracted a new subset of investors.

Common perception is that precious metals investors tend to be conservative, looking to preserve accumulated wealth and hedge against market risks. While silver also has these investors, it has recently garnered a unique and much different cohort of investors. In 2020, the phrase #silversqueeze hit the press, as retail investors from Reddit and Twitter piled into the metal in an attempt to push up prices.

From the lows in 2020 of $11.98/ounce to its peak of $29.13/ounce later that year, silver appreciated by 143.16%. Is the #silversqueeze community the Gold Bugs of the youth generation? In reality, while silver is more volatile than gold, the average of silver’s 10 best returning years have also been nearly double that of gold and nearly triple that of stocks.

Gold Breaks Out With Dollar Rallying Strongly

Graddhy out of Sweden: Did you notice that GOLD broke strongly above the 1850 level yesterday while USD had a strong upday? Important…

Insiders just invested another $56 Million in this 12 million ounce

Canadian gold company! TO FIND OUT WHICH ONE

CLICK HERE OR ON THE IMAGE BELOW.

Unsustainable

Otavio Costa: Just a friendly reminder that gold/silver producers are still trading at ridiculously cheap free-cash-flow multiples.

High-quality explorers offer even better value and appreciation potential.

Perhaps the most asymmetric opportunity I’ve seen in my career.

MINING STOCKS PREPOSTEROUSLY UNDERVALUED

AND UNLOVED, BUT THAT WILL CHANGE:

2022 Free Cash Flow Estimates

For Gold & Silver Miners

Gold & Silver

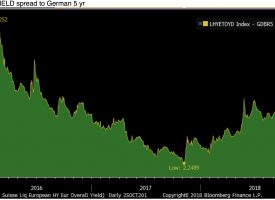

Top Citi analyst Tom Fitzpatrick: Gold and Silver: Gold and Silver both made notable breaks yesterday suggesting the potential for strong gains in the weeks ahead.

Gold: Gold broke above pivotal resistance at $1,831-$1,834 yesterday suggesting further gains towards at least $1,917. A weekly close above here, if seen, would suggest these gains could extend to new all-time highs around $2,100.

Silver: Has completed an inverted head and shoulders pattern that suggests extended gains towards $28+. Interim resistance is met at the 55 week and 200 day MA’s ($25.26-$25.37).

10% Price Increases Are Now Small?

Peter Boockvar: I’m going to say again, the Fed’s idea of confronting now 6% inflation is to take their balance sheet higher by another $500b over the next 8 months and still have rates at zero. At least right now they are not credible but we’ll see if the reality of the data and/or markets forces their hand to act more aggressively but to the risk of market valuations and eventually the economy. Tough spot but one self imposed.

The dollar is up again with the euro/yen heavy DXY at the highest since July 2020 and I’m guessing reflects faith that the Fed will get back control of inflation via higher rates or the market will do it for them. That’s the only way I can explain this dollar move because typically higher inflation is currency negative. Just ask Brazil and Turkey.

Here are some more inflationary anecdotes, not that we needed any more convincing of the new environment we’re in. Bloomberg is reporting that Uber is raising base fares in London by 10% so they can find more drivers. A spokesman for the company said “We’re making these changes to help provide a better rider experience, by signing up more drivers to meet the growing demand. This small fare increase will help reduce wait times.” A 10% increase is now considered ‘small’ I guess.

Shipping Watch is reporting what the global head of ocean freight at DHL Global Forwarding thinks, “The extraordinary container market will continue throughout 2022 and most likely ease somewhat in 2023…Dominique von Orelli doesn’t see the current state of the container market abating anytime soon.”

***ALSO JUST RELEASED: BREAKOUT DAY! Gold Is Still Radically Undervalued, Plus Silver’s Playbook CLICK HERE.

***ALSO JUST RELEASED: Massive Gold & Silver Break Out! CLICK HERE.

***To listen to the remarkable audio interview with Matthew Piepenburg where he discusses why the Inflation Tsunami and Gold are about to rock the world CLICK HERE OR ON THE IMAGE BELOW.

***To listen to the remarkable audio interview with Matthew Piepenburg where he discusses why the Inflation Tsunami and Gold are about to rock the world CLICK HERE OR ON THE IMAGE BELOW.

© 2021 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.