The price of gold soared to a new all-time high above $2,230, but take a look at this…

March 28 (King World News) – James Turk: Eric, the mainstream media has been bombarding us with the term “higher for longer.” It is being broadcast relentlessly by Federal Reserve officials and their acolytes.

It’s meant to imply that the Fed is not lowering interest rates anytime soon, or at least not as quickly as stock market investors expect or want. But I do agree with one wag who has said that when you hear “higher for longer,” think inflation and not interest rates. The term could become as infamous as “transitory.”

Nevertheless, the prospect of higher interest rates has some gold buyers worried. They shouldn’t be. They mistakenly believe that the higher interest rates are bad for gold, despite actual evidence and logic to the contrary.

Let’s consider the evidence first. Interest rates rose throughout the great 1970’s bull market in gold. More recently, consider what’s been happening over the last couple of years. The Fed raised interest rates to 5% from near zero, yet gold has plowed to new record highs. And look what is happening in Japan as more proof.

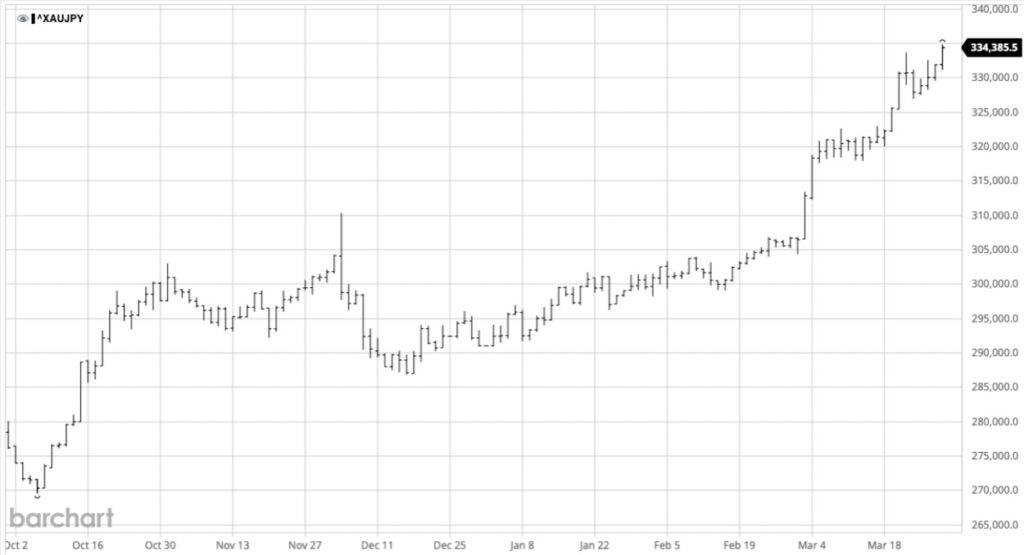

The Japanese central bank was the last holdout to raise rates. Its recent rate hike hasn’t stopped gold from rising in terms of yen, as we can see on this chart.

Gold Continues To Hit New All-Time Highs Priced In Japanese Yen

And what’s happening in yen is pretty much happening throughout the world. Gold is setting new records against fiat currencies even though interest rates have risen from the artificially low levels of a few years back.

Having considered this evidence, we next need to consider the logic of why higher interest rates are not stopping gold’s bull market. And here we need to look at what caused Silicon Valley Bank to fail. It’s basic double-entry accounting, or in other words, we need to look at the value of assets that back liabilities.

Silicon Valley Bank collapsed because the value of its fiat-currency-denominated financial assets fell as interest rates rose, just like what happens to T-bonds or any other debt instrument, and the longer the term of the debt, the worse the decline in price. But the bank’s fiat-currency-denominated liabilities remained – the dollars its customers deposited with it – in effect creating a ‘black-hole’ in its balance sheet because the decline in assets was greater than the bank’s equity. The bank was bankrupt because the value of its assets was less than the amount of its liabilities.

What we need to do next is relate this basic accounting to fiat currency in the aggregate, which we can do by viewing the assets of all banks globally, commercial as well as central banks.

These banks issue all the fiat currency in the world, and they have essentially two different types of assets backing their fiat-currency-denominated liabilities. They own gold and fiat-currency-denominated assets.

So when interest rates rise, the value of their fiat-currency-denominated assets declines, creating a black-hole, just like what happened to Silicon Valley Bank. But here’s the key point.

Investors react to black-holes on balance sheets because of the risk. When assets that are backing liabilities lose value – as they do when interest rates rise – bank depositors move their wealth out of banks. With some of that they buy gold – like they did in the 1970s and are doing again now – with the consequence that its price rises to bring the aggregate balance sheet of global banks back into balance. The rising gold price fills the black hole.

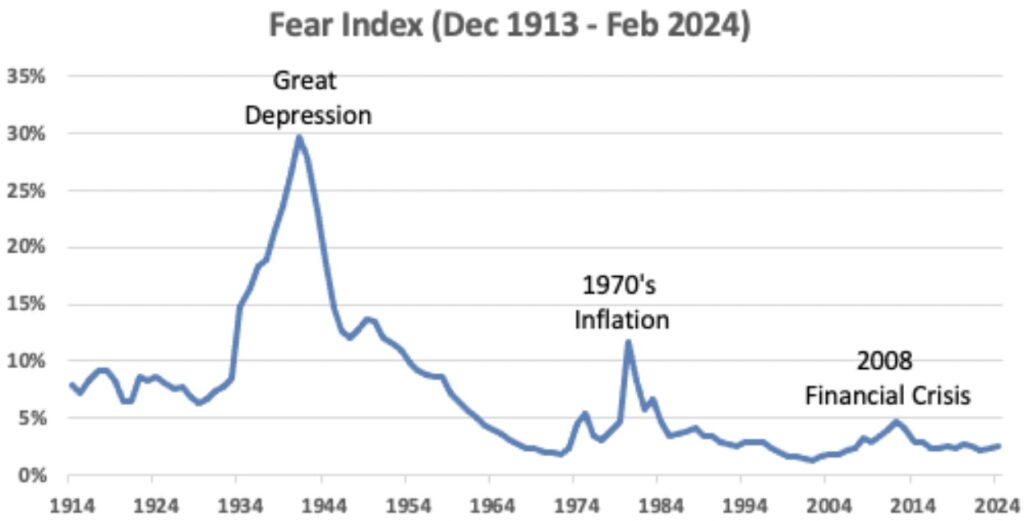

We can measure this relationship. I call it the Fear Index, and I’ve written a lot about it over the decades in my books and numerous articles. It’s my principle means of valuing gold. It’s calculated by taking the market value of gold held in reserve by banks, divided by their fiat-currency-liabilities, or M2, which is what I use in the following chart that measures the Fear Index for the US dollar.

There are three major swings in the Fear Index on this chart. What’s clear from the chart is that fear and the Fear Index rise when events shake people’s confidence in fiat currency and the banking system that propagates it, regardless of whether the event is bank failures or inflation.

Importantly, we can see from this chart that confidence in the system is high at present, which to me means that gold is undervalued. Even if interest rates don’t rise further, the magnitude of the mountain of debt enveloping economic activity today is an unsustainable burden, so I expect debt defaults and more black holes in bank balance sheets, which will cause fear and gold to rise.

That’s been gold’s primary trend since the Fed was created in 1913, when $20.67 could be exchanged for one ounce. It’s been 111 years of inflation from dollar debasement.

Perhaps more importantly, it’s clear from the Fear Index chart that these calamitous events recur. There have been three of them so far. We can expect another and each of the past three events coincided with record high gold prices. Given gold’s new record high in all fiat currencies, we need to prepare for the fourth event by owning things, not promises.

So there is one key question that everybody needs to ask themself, Eric, are you confident about the future of fiat currency and the safety of your bank? If not, consider accumulating gold, silver, and other tangible assets to avoid the counterparty risk posed by fiat currency and the banks that spawn it.

In case you missed it…

Ultra-High Grade Gold Discovery Continues To Mirror Fosterville!

Bryan Slusarchuk: The ultra-high grade discovery we made at Comet, just south of Agnico’s Fosterville Mine is the same age of rock as Fosterville, same mineralogy as Fosterville, same geology as Fosterville, and then extremely important to note; the same type of structural setting as Fosterville. So the discovery was made where the western dipping faults intersect the anticline. It’s really textbook Fosterville. The discovery was extremely high-grade. It was right around 8 meters at 106 grams per tonne. And the really high-grade core of the discovery ran 5 meters at 166 grams per tonne gold. And within that there were some intervals that ran 400+ grams per tonne gold.

After that extremely high-grade discovery we got a diamond drill rig onto the site, and we’ve already drilled a few more holes. What we have now seen post the initial discovery is not only do we have same age of rock as Fosterville, same mineralogy as Fosterville, same geology as Fosterville, same structural setting as Fosterville, but the diamond drilling has confirmed the gold rich quartz veined fault zone is extending to depth and laterally, and the high-grade mineralization remains open in all directions. This is also similar to what occurred at Fosterville.

Mirroring Fosterville In Virtually Every Detail!

But as we wait for the results from our second diamond drill hole, what we saw in that second hole was stacked zones of mineralization. This is again very similar to what you see at Fosterville. So post the initial discovery we knew that we were in the same structural setting, same age of rock, same geology, same mineralogy, same eye-popping ultra-high grades, but now after these first few diamond drill holes we now know the deposit is mirroring Fosterville in virtually every detail in the early stages.

In fact, that second hole was designed to terminate at approximately 150 meters, but we ended up pushing the hole in excess of 250 meters because we kept seeing these stacked zones. What this second hole shows us is the potential for big scope, big scale, big size with extremely high-grade gold as we wait with excitement for further drill assay results. And even though it is early days, everything is lining up with these Fosterville like characteristics, which means we may very well be dealing with a historic discovery — a second Fosterville. Great Pacific Gold Corp, symbol GPAC in Canada and FSXLF in the US.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.