Here is a look at gold mining stocks plus a look at bulls and bears.

Gold Mining Stocks

September 11 (King World News) – Graddhy out of Sweden: Shared this gold miner chart at green dots stating it was the next big buy/add point. It was. All three times. Up another 92% since green dot at blue backtest at 280.00.

KING WORLD NEWS NOTE: HUI Gold Mining Index Is Headed Radically Higher Than What Is Being Quoted Today

Note that pink arrow is unchanged since draw it in back in 2022.

As said for years – I am convinced this chart will play out.

It is now happening.

Bulls & Bears

Peter Boockvar: The gap between the mood of professional investors and retail really widened out this past week with my guess again that the former is just reflecting sentiment following price while the latter expresses concern about the economy. The Bull/Bear spread in the Investors Intelligence survey got to 37.7, nearing the 40 that I consider a red flag from a contrarian perspective. While Bulls fell slightly to 54.7 from 54.9, Bears are now at just 17 vs 17.6 last week.

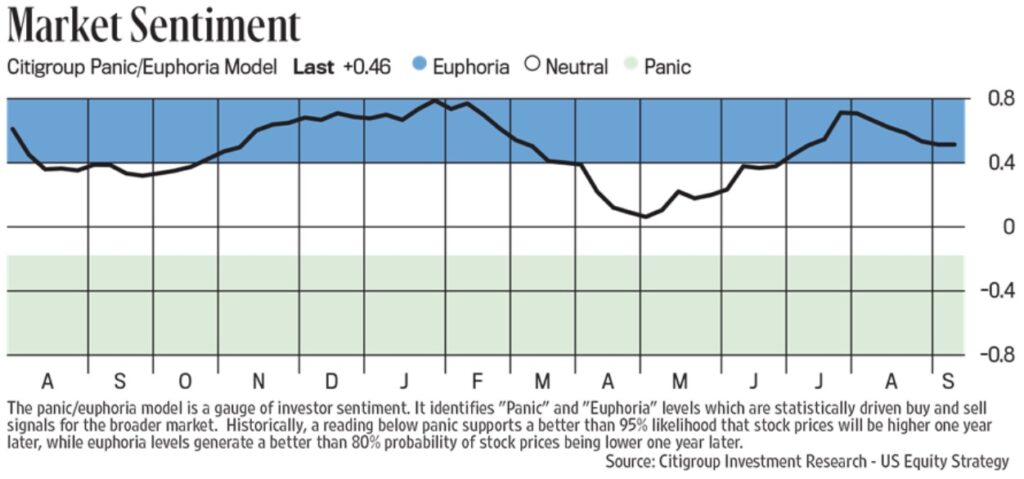

On the complete flip side, AAII today said Bulls dropped to just 28, down 4.7 pts w/o/w, the lowest since early May. Bears rose by 6.1 pts to 49.5, the most since May. The Citi Panic/Euphoria index at .46 is still above the .41 threshold of Euphoria but the CNN Fear/Greed index is spot on 50, thus can’t be more Neutral. We’ll get an updated Exposure Index figure from the NAAIM today where last week it was at 82, down from above 90 in the prior two weeks.

Bottom line, it’s confusing in terms of calling a market response here looking at just sentiment but II is something that should not be ignored as well as the Citi index because AAII is just hugely fickle week to week.

Days after the Bloomberg story that said the BoJ is gearing up for rate hikes after next week’s meeting, Reuters has a story today saying “The Bank of Japan is firming up a strategy to unload its huge holdings of risky assets that will likely center on a plan to gradually sell exchange traded funds (ETF) in the market, said three sources familiar with its thinking.” But, “There is no consensus yet on when a decision about that would be made, the sources said.”

Understand how the huge this possibly is as they own about $250 billion worth of ETFs (37 trillion yen) that they bought over a 13 yr time frame but that really ramped up in 2013 when Abenomics took hold. I do expect, and hinted at in the article, that any selling will be extremely gradual but point being that this is just another step in the BoJ’s attempt to wean itself out of the markets and reduce its presence where they’ve made a massive footprint over the past few decades.

The ECB is expected to leave rates unchanged at 2% as they’ve already taken REAL rates down to zero.

$10,000 Gold

To listen to Gerald Celente discuss his prediction for $10,000 gold CLICK HERE OR ON THE IMAGE BELOW.

Gold Blastoff!

To listen to Alasdair Macleod discuss $100,000 gold and the wild trading this week in gold, silver and the mining stocks CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.