The price of gold hit another record high this week, but look at this…

KWN has just two powerful audio interviews (LINKS BELOW)! But first…

Gold hits records and silver stirs

February 15 (King World News) – Alasdair Macleod: Behind precious metal markets is new evidence of growing European investor demand at the retail level, while Comex deliveries continue at an elevated rate.

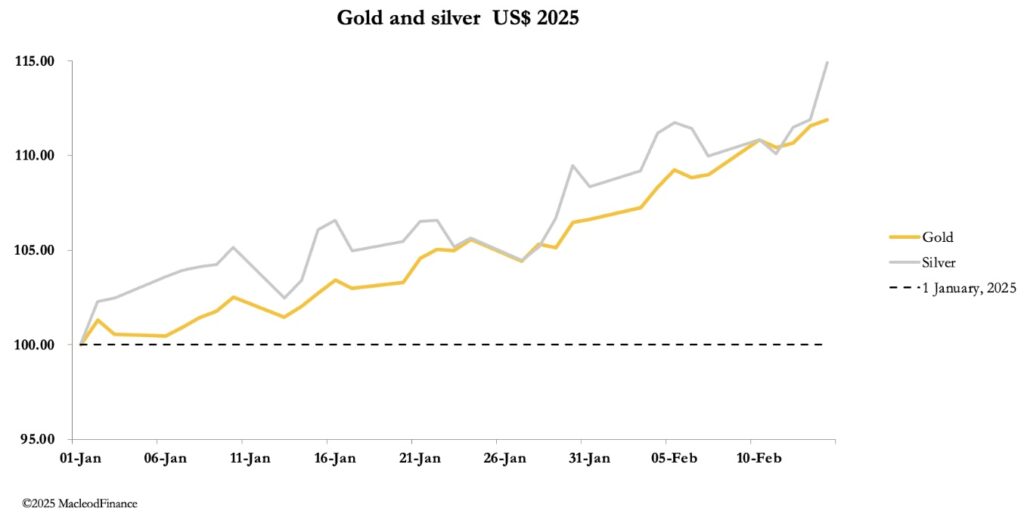

It has been a week of new highs for gold, and silver appears to have broken out of its torpor only this morning. In European morning trade, gold was $2938, up $98 from last Friday, and silver was $33.30, up $1.55 with most of the rise occurring today. The jump in silver is attributed by analysts to strong Chinese PV demand, Indian-pledged PV investment of a further trillion rupees by 2030, and Indonesia promising to adds 17 gigawatts of solar energy through state-owned enterprises.

More importantly, silver has conquered a crucial chart level at $32.50:

Not only do we have confirmation that solid support at $29 provides a launchpad for the next up-leg and that the moving averages are bullish, but conquering minor supply at the $32.50 level (the smaller pecked line) has been achieved this morning. The next supply level to overcome is at $35 then $40 is in sight — probably quite quickly.

Gold’s chart is a classic bull market demonstration of an acceleration phase:

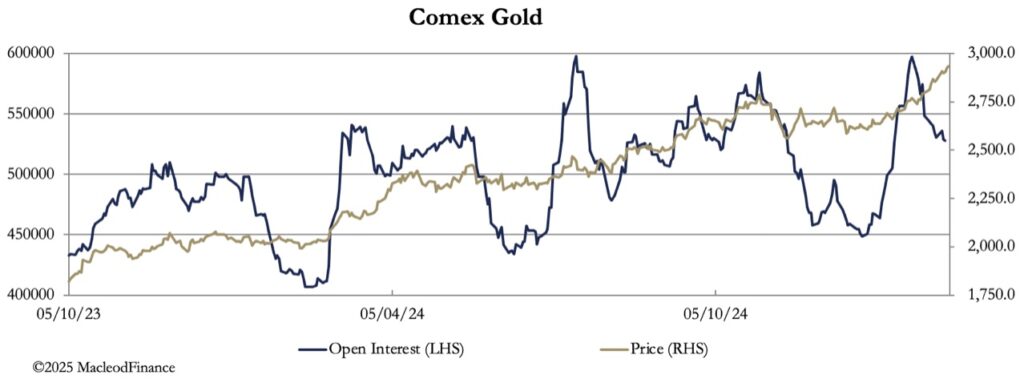

Clearly, gold has led the way for silver, playing a large part in ending silver’s slumbers. It has impressive momentum, capable of taking it into highly overbought territory — but it’s not nearly there yet. As an indication, Comex open interest is 534,126 on yesterday’s preliminary figures, and the next chart illustrates there’s plenty of room to accommodate more futures buying:

So, what’s driving it all?

Firstly, the stand-for-deliveries are continuing at an accelerating pace. In the last five trading sessions a further 8.1 tonnes of gold and 209.2 tonnes of silver have been stood for delivery, making 262.3 gold and 853 silver tonnes for the year so far. Annualised for 2025, that’s 2,186 tonnes of gold, and 7,108 of silver.

No wonder the strains on Comex are showing.

All this has led to wild rumours about how Trump/Bessent are going to revalue gold in the Treasury’s books and regularise the Fed’s balance sheet. Supposedly, this will reduce Treasury debt (?) and be part of a national wealth fund or of a new national balance sheet to include government-owned real estate as assets.

I suggest rather than uniformed speculation, it is better to wait and see what transpires.

More importantly, two of my European sources in the retail market tell me that public demand in Germany for small bars is strong and growing, and a similar message comes to me from the Netherlands. Interestingly, this is not yet reflected in the World Gold Council’s statistics on ETFs. Nor, it seems, is it reflected in the UK’s retail market.

Germany is interesting. Next week there are new elections, and the right-wing (actually libertarian) AfD could come out on top. They have been right about Ukraine as Trump’s détente with Russia proves only this week, there has been an horrific immigrant episode in Munich, and it is reasonable to suggest pollsters underestimate AfD’s support. All this feeds a general gold-buying paranoia.

Undoubtedly, there is a growing recognition among ordinary investors in Europe and elsewhere in the western world that they are underweight in gold as part of their asset mix, and that they can no longer ignore gold’s bull market. Furthermore, it is a sentiment likely to spread throughout the investment management industry.

This is precisely the sentiment being reflected in gold’s technical chart. It also tells us that this run could take gold well above $3,000 but then a consolidation will be required, because while public enthusiasm can be a considerable market force, when it becomes widespread it is a reliable indicator of approaching overbought conditions. Meanwhile, traders on the bull tack can enjoy the ride.

Another bit of news in recent days is that the Chinese authorities are now permitting some insurance companies to allocate 1% of their assets into gold. This amounts to about 240 tonnes at current values. One suspects that the authorities came under significant pressure to grant this permission from insurance companies whose premiums invested in yuan debt yield very little. But equally, the regulators will be acutely aware that in current conditions insurance fund demand is far higher, potentially swamping China’s bullion markets.

JUST RELEASED! Gold Hits New Record High This Week!

To listen to Alasdair Macleod discuss gold hitting a new record high this week as well as some surprises happening in the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

GOLD PRICE PREDICTION 2025!

To listen to one of Gerald Celente’s best interviews ever discussing his shocking predictions for 2025 CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.