Today gold futures topped $4,000 for the first time as banks push clients into gold while mining stock remain incredibly cheap.

$4,000 Gold

October 7 (King World News) – Old Hansen, Head of Commodity Strategy At Saxobank: COMEX gold futures kissed $4,000 earlier, with XAUUSD so far falling short, as some light profit-taking emerged amid a stronger dollar—especially against the euro, which is being dragged lower as the French political circus forces elevated EUR longs to reduce exposure. A deepening French crisis may inadvertently support gold allowing bullion and dollar to rally at the same time.

Goldman Raises Gold Price Forecast

Holger Zschaepitz: Goldman Sachs has raised its December 2026 Gold price forecast to $4,900/oz (from $4,300 prev), citing strong & persistent inflows that have fueled a 17% rally since Aug26. The bank says continued buying from Western ETFs and Central Banks appears to be durable, prompting it to lift the base level of its pricing outlook.

A Nugget From Bank of America

Ronald Stoeferle shares this note from Bank of America: “Gold is tactically ‘overbought’ but structurally ‘under-owned’; gold = 0.4% of private client AUM [assets under management], 2.4% of institutional AUM.”…

Listen to the greatest Egon von Greyerz audio interview ever

by CLICKING HERE OR ON THE IMAGE BELOW.

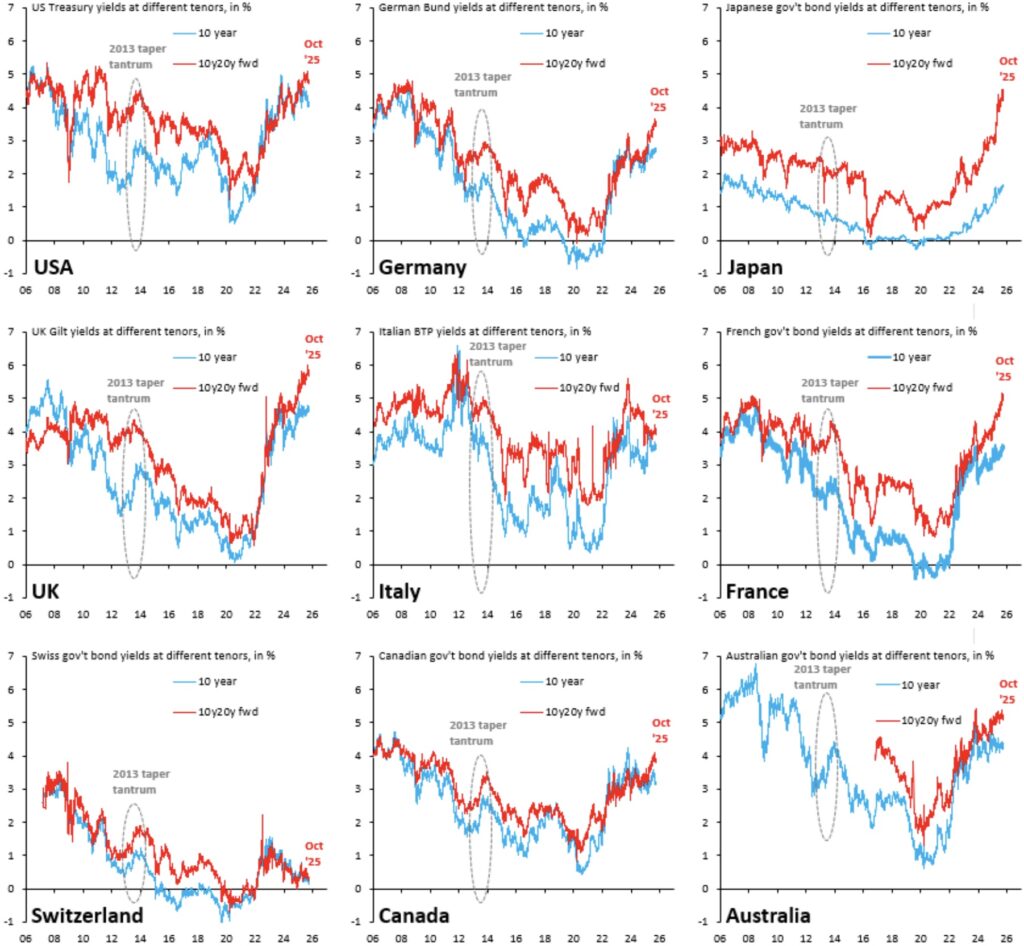

Global Debt Crisis

Robin Brooks: The global debt crisis – like all crises – advances in fits and starts. Yesterday, longer-term yields globally rose because of a sharp spike in Japanese yields on news of a fiscal dove as likely new prime minister. There’s just too much debt everywhere.

Gold Stocks Incredibly Cheap

Peter Schiff: Despite gold mining stocks rising about 140% so far in 2025, they’re actually cheaper now than they were when the year began. In fact, despite prices going up, mining stocks get cheaper every day as their earnings rise faster than their share prices. Investors still don’t get it.

Party Like It’s 1999

Peter Schiff: According to Paul Tudor Jones, today is like 1999. But when it comes to gold, it’s nothing like 1999, when gold was near the bottom of a twenty-year bear market. The gold market is telling us that the bust that’s coming will be much worse than the bursting of the dot-com bubble.

Gold & Silver!

To listen to Alasdair Macleod discuss the massive gold deliveries from Comex as well as the price of silver surging toward an all-time high CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.