Today gold futures have rebounded to $2,750 as silver futures surge above the $34 level.

Alasdair Macleod’s latest audio interview has just been released! (Link at bottom). For now…

Another Fascinating Email

October 25 (King World News) – Here is another fascinating email from a King World News reader:

Dear Eric—

Funny how this week you had thoughts from James Turk again, as you often do and have for as long as I’ve been reading and listening to KWN. Have thought a lot lately about how even before Gold and Silver took off in 2010 & 2011 and especially through those tough years 2013-18, James was always saying to consistently add month in and month out, dollar cost averaging over time; One day you’ll be very pleased you did, and you didn’t give up.

Well I am pleased, almost laughing at myself for how cranky I was to add an ounce of Gold in the spring of 2019 — for a whopping $1323. Well, obviously not worried I way over paid now — that purchase doesn’t bug me at all today. Having watched Gold rise some $800 an ounce over the last year I can still hear James in my mind saying, “Add as you can and move out of counterparty risk assets. The time will come when you’ll be very happy you did.” Indeed I am!

Mike

Gold & Silver

Alasdair Macleod: Consolidation for gold and silver is timely, given recent unprecedented performance. But is it sensible to lock in some profits?

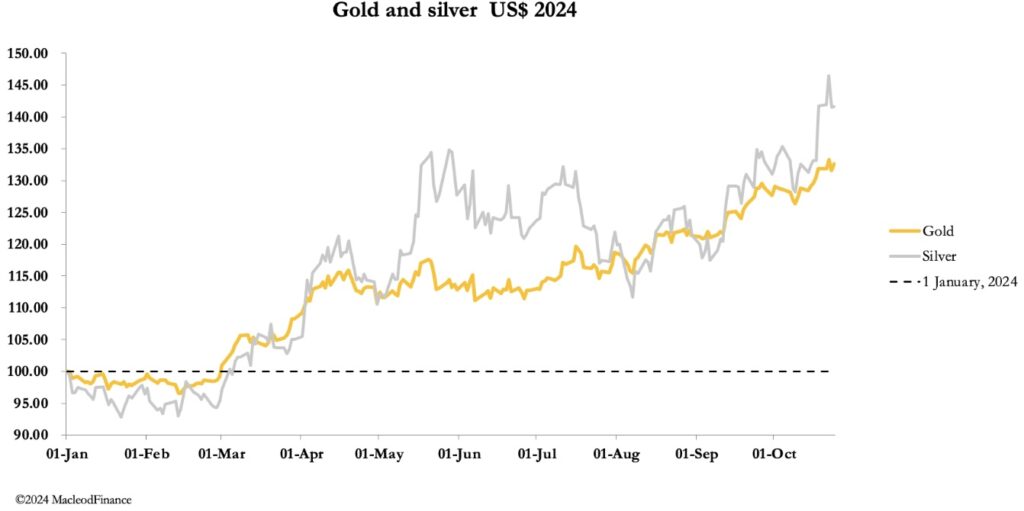

This week, against a background of the BRICS summit in Kazan gold and silver paused, consolidating their recent heady runs. In European trade this morning, spot gold was $2720, unchanged from last Friday’s close, and silver was $33.25, down 40 cents on the same timeframe. Comex volumes were healthy, consistent with bull market turnover.

Undoubtedly, traders will be locking in some profits, because they account in fiat, not gold. But does it make sense for investors hedging fiat currency risk?

The next two technical charts are of gold and silver respectively, to give a sense of where we might be in this bullish move. First up is gold.

Gold is clearly in runaway mode, with the price being chased upwards by the 55-day moving average. And the pace of the 12-month is accelerating upwards as well. Clearly, a more significant consolidation, perhaps ticking back to the 55-day MA currently at 2,578 would be healthy providing a platform for further price increases. Alternatively, the current action could be described as a rerating of the gold/dollar relationship with further to go. Either way, short-term traders might take profits, but more committed souls are likely to stay with it.

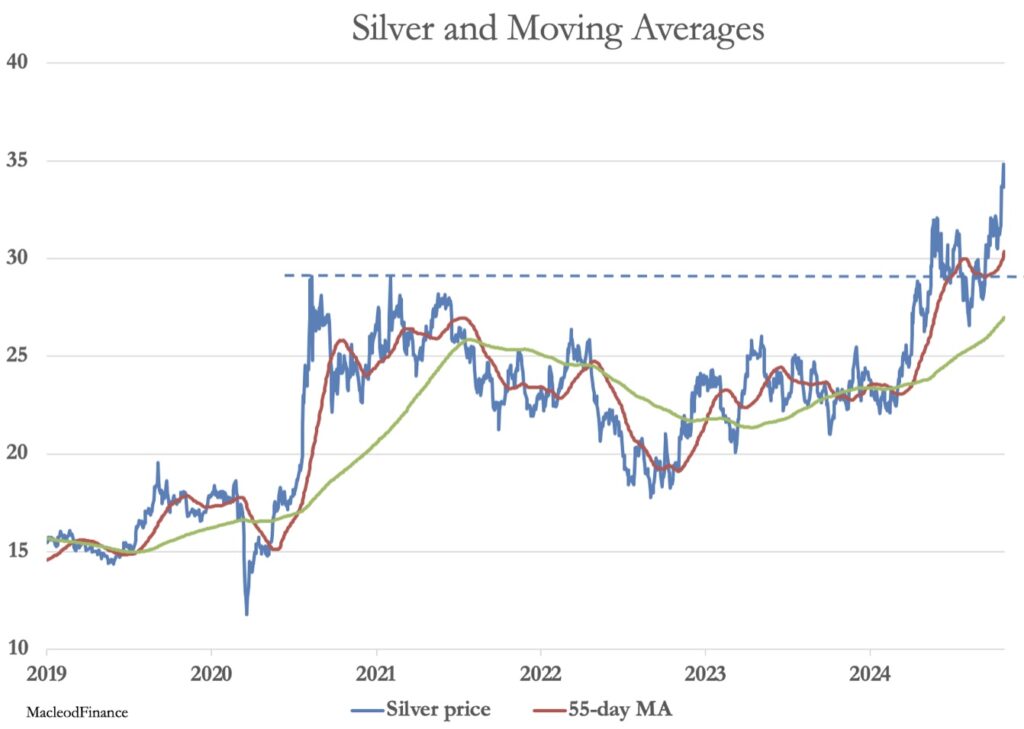

Next up is silver, which having lagged gold for some time now appears to be catching up.

In this case, silver’s consolidation was textbook and is now over. Having broken above earlier highs in 2020/2021, it ticked back to test support (the pecked line, which held). This coincided with the 55-day MA. Silver then embarked on its next bullish phase, which looks set to drive the price significantly higher. A lovely textbook example.

So what’s driving it all? To answer this question, we should invert the gold price chart so that we are looking at how the dollar is declining against gold: the former being detached fiat currency, and the latter international, legal money which is inherently stable.

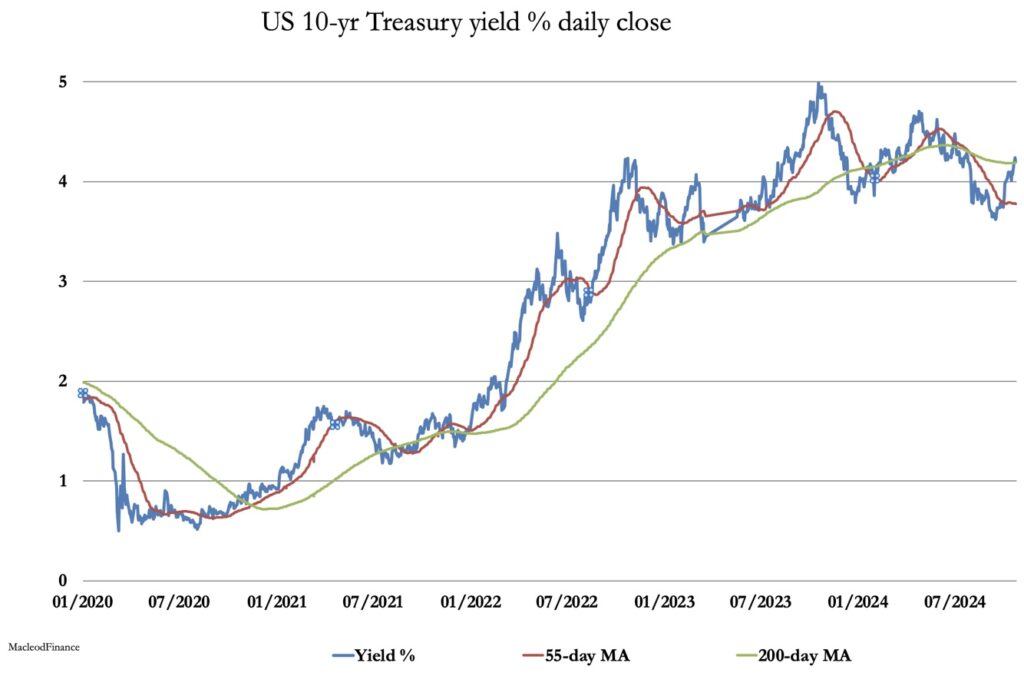

Particularly from 2000 onwards, the dollar’s decline has been going through phases which have accelerated. It is consistent with a growing loss of faith in the dollar’s credibility, coinciding with a growing awareness of the US Government’s deteriorating finances which are leading into a debt trap. Confirming this analysis, we see bond yields rising along the yield curve, at a time when interest rates are still expected to decline and therefore bond yields with them.

Perhaps it’s too early to call it, but the yield appears to have bottomed and is on the turn higher. If this is the case, then not only will we see bond prices declining significantly, but this unexpected development could crash equity markets as well. Given that foreign dollar holdings total about $32 trillion overwhelmingly invested in bonds and equities, we can see that foreign faith in the dollar is being severely tested.

It is a development already in progress, looking at the rate which the dollar is declining against gold (the penultimate chart above). The fact that gold has risen substantially in recent weeks coincides with Trump taking the lead in betting odds for next president. Either candidate winning on November 5 is sub-optimal for the dollar, but Trump has promised higher tariffs (higher consumer prices), tax cuts (higher budget deficits) and lower interest rates (not his decision). These are precisely the policies likely to deter foreign buyers and lead to further falls in the dollar. For what it’s worth, Trump is 33/50 on, while Harris is 6/4 against.

Short-term consolidation maybe; but ducking back into failing fiat to secure some short-term profits looks like lunacy. To listen to Alasdair Macleod’s KWN audio interview that was just released CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.