On the heels of the Nikkei stock market crashing in Japan and markets all over the world plunging, many investors wonder what is next? During times of great volatility it’s always important to take a step back and look at the big picture.

Buckle Up

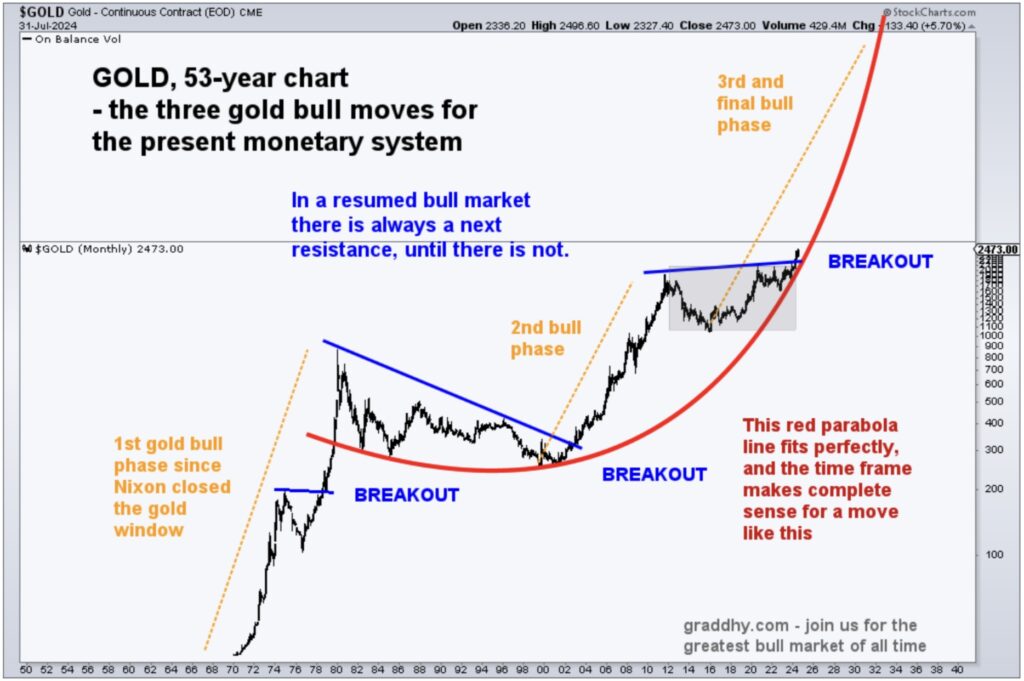

August 5 (King World News) – Graddhy out of Sweden: The inverse correlation gold vs US dollar can be strong shorter term, but longer term it is not an issue for gold. Said recently this chart is about to break out. It now has. So now also this very important, big picture chart, shows that the next historical leg up for gold is here.

BUCKLE UP:

Gold Has Started The 3rd Leg Of The Bull Market

Gold

Graddhy out of Sweden: GOLD: This very simple chart WILL play out. Doubting this will be the biggest mistake in your lifetime.

This chart is both the largest opportunity you will ever have, and also the largest threat you will ever face.

THE RED PARABOLA:

Investors Should Remain Focused On The Red Parabola As A Roadmap For This Leg Of The Gold Bull Market

The Great Rotation

Graddhy out of Sweden: The opportunity here with precious metals is just mind-blowing.

This week, it (HUI Gold Mining Index vs SOXX Tech Semiconductor Index) gapped up above that 13-year blue trend line. This means the move (in mining stocks) is (just getting) starting, plus that the trend line was correctly placed.

HUI Gold Mining Index vs SOXX Tech Semiconductor Index

HUI Preparing To Blastoff vs Tech Stocks During The “Great Rotation”

And the black untouched arrow at the very lows when we saw the bullish engulfing reversal materialize.

This ratio chart now trying to break out is the start of the global sector rotation I have been warning is coming. More and more capital will finds its way from general equities into precious metals and the whole commodities space…

ALERT:

To learn about one of the greatest gold & silver royalty companies in the world CLICK HERE OR ON THE IMAGE BELOW.

The Inflationary 2020s

Graddhy out of Sweden: This ratio chart is building out the right shoulder in its 44-year inverse head & shoulders pattern. And, now it has a pink double bottom (reversal pattern) breakout & backtest, followed by a higher high confirming the double bottom breakout.

Gold Preparing For A Historic Move vs Copper During The Inflationary 2020s

Gold is a proven safe-haven, and copper is a base metal that usually does well in good economic conditions (=”Dr Copper”). Look at the huge ratio move during the inflationary 1970s. It then consolidated the 1970s move for 40+ years. It now looks ready again.

I said 4 years ago when I shared this chart for the first time, as the right shoulder was bottoming, that it was time for another inflationary period like the 1970s. And since then inflation has risen hugely, but unfortunately it is only getting started. I also predicted the start of the commodities super-cycle bull market at the same time back in early 2020.

Bottom Line

King World News note: There will be a great deal more inflation in the years to come as the Great Rotation plays out, and the price of gold skyrockets thousands of dollar higher or even tens of thousands of dollars higher (depending on the level of currency debasement). In the meantime, continue to use bouts of significant weakness to accumulate physical gold and silver as well as the high-quality companies that mine the metals.

Nomi Prins Says Gold Price Will Continue To Soar

***To listen to Nomi Prins discuss where the price of gold is headed, the wild trading that is unfolding in global markets as well as what to expect next CLICK HERE OR ON THE IMAGE BELOW.

JUST RELEASED!

To listen to Alasdair Macleod discuss the wild week of trading in global markets, gold, silver and much more CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.