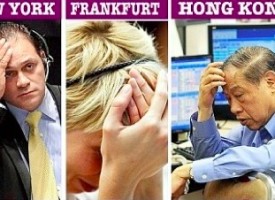

On the heels of the Nasdaq tumbling 160 points and the Dow falling over 360 points, today King World News is pleased to share Bill Fleckenstein’s wrap, plus a bonus Q&A as we continue to see stock market carnage in the early part of 2016!

By Bill Fleckenstein President Of Fleckenstein Capital

January 19 (King World News) – Though my last column was only a few days ago, it almost feels like an eternity, with Friday seeing huge selling, the world stabilizing while we were on holiday, and the market opening today as if nothing bad had happened last week or so far this year. That’s not to say that the market should never bounce, because we often see bounces in bear markets and declines in bull markets.

I am just a little surprised to see so much complacency given the damage that has been done, but I guess since we haven’t seen real fear, as demonstrated by a huge spike in the VIX, perhaps complacency actually fits…

To hear which company Eric Sprott, James Turk and George Soros invested in that is advancing the digital payments revolution and makes it possible for you to spend gold with a prepaid-card globally click on the logo:

Bill Fleckenstein continues: After the over 1% higher opening today, the stock market gave up some of its gains and by midday all the indices sported roughly 0.75% gains, with no particular theme that I could see. From there the indices continued to leak in a pretty orderly fashion and they were lower about 0.75% with an hour to go, at which point they rallied to close with the small gains you see in the box scores (the Nasdaq had a small loss).

Away from stocks, green paper was mixed, oil lost about 3%, fixed income was weaker, and the metals were mixed, with silver gaining 0.5% and gold losing $1.50. The miners, however, were thumped, with most losing 5% to 10% for no particular reason that I could see, certainly nothing that warranted that kind of pounding on top of what has taken place recently, let alone the last four years. Regretfully, I have no decent explanation for why the miners continue to act as poorly as they do. All I can say is that sometimes things just get massively overdone.

“Undervalued” Can Also Mean “Early”

I have a very good friend who, in the wake of the burst dot-com bubble, set up a special fund to go out and comb through the wreckage and find winners. He told me today that at one point he was down 50% in that fund, as companies he had bought at 2x cash traded to 1x or sometimes below. He said he spent about three weeks with those losses as stocks were just sold indiscriminately. That fund ultimately gained about 18x from the lows for a 10-bagger in about two years.

I pass that along because I am sure those with an interest in the miners are either scratching their heads or totally nauseous about what has transpired. The few miners that have reported data, whether that be actual earnings or, as in the case of Pan American today, production guidance and costs, have all read pretty well to me and costs have been coming down, which I expect will continue. But none of that seems to matter. Perhaps we will need to see the Fed actually panic before gold gets going, but the miners are so depressed and cheap (those terms are not necessarily the same) that it wouldn’t take any sort of any uptick in gold to see them rally dramatically if sentiment were to change.

It’s Going To Be a Steep Unlearning Curve

It’s Going To Be a Steep Unlearning Curve

As for stocks in general, the path of least resistance is going to be down. The question is will it be a grinding affair, will we see acceleration at some point, or will there be a bit of a bounce first? All three are possible, but my strongest belief is that any rebound at this point will be minor and eventually we will see real acceleration on the downside. Markets seem to liquidate now even faster than they have in the past, and they always have declined faster than they appreciate. If we look at the way oil and other commodities have been slaughtered, I think that is the recipe for how the stock market might behave as we move forward and the pressures to the downside build.

Included below are four questions and answers from today’s Q&A with Bill Fleckenstein.

Bonus Q&A

Question: All quotes are from Frank Homs: One Weird Trick to Forecast Commodity Trends

“This week spot gold closed at $1,089.03, down $15.02 per ounce, or 1.36 percent. Gold stocks, as measured by the NYSE Arca Gold Miners Index, fell 9.63 percent. Junior miners outperformed seniors for the week as the S&P/TSX Venture Index traded down 5.00 percent. The U.S. Trade-Weighted Dollar Index gained 0.38 percent this past week.”

Yet during the same week: “Over the past five days investors bought 26.8 metric tonnes of bullion through exchange-traded products backed by the metal, according to Bloomberg, the most since January 2015 as seen in the chart below.” “In addition, Reuters says gold and silver demand is off the charts; the U.S. Mint sold nearly as much gold on the first day of 2016 as in all of January 2015, with silver sales equally as astounding.”

While the gold miners energy costs continue to decline. XAU declined 12.1% for the week while the S&P 500 only 2.2%, yet gold miners have very strong product demand and lower energy costs. I can’t think of anything cognitive other than another dam awful week for gold miners in spite of strong ETF and physical demand.

Answer from Fleck: “It is quite bizarre.”

Question: Bill: What is your opinion on what the impact to the price of gold would be if Saudi Arabia and other gulf states removed their peg to the US dollar? More significantly, what would be the impact to gold should China suddenly devalue (10-15%) the yuan?

Answer from Fleck: “I don’t know what will happen, but as currencies collapse why would that be bearish for gold? Holders of gold in those currencies have been protected.”

Question: Hi Bill, what is your opinion of the action of the PM shares today (1/19)? .That is, gold the commodity, is down only a$1.50 but the PM shares are getting ‘creamed”.. some as much as 10-15%. Thanks in advance

Answer from Fleck: “As you can imagine, I have gotten about 10 such emails already today. My opinion is I don’t get it. No idea why they are so weak yet again.”

Question: Hi Bill, any thoughts on how to invest in a potential yuan devaluation? Thanks

Answer from Fleck: “Get long chaos, however you think is the best way to do so. Gold or short stocks seems the best way to me.”

***To subscribe to Bill Fleckenstein’s fascinating Daily Thoughts CLICK HERE.

***To hear the powerful KWN audio interview with Nomi Prins, the keynote speaker who recently addressed the Federal Reserve, IMF And World Bank, CLICK HERE OR ON THE IMAGE BELOW.

***ALSO JUST RELEASED: The Collapse Is Intensifying And Something Terrifying Is On The Horizon CLICK HERE.

© 2015 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.