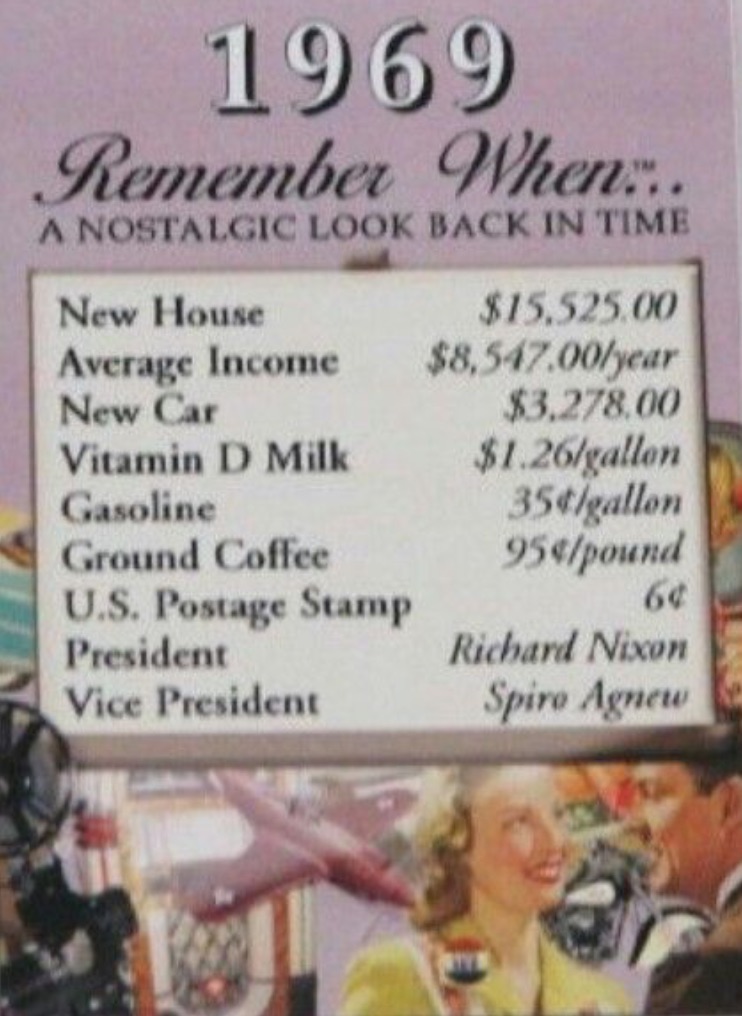

Finally something that is cheap! Most undervalued since 1969!

Finally, Something That Is Cheap!

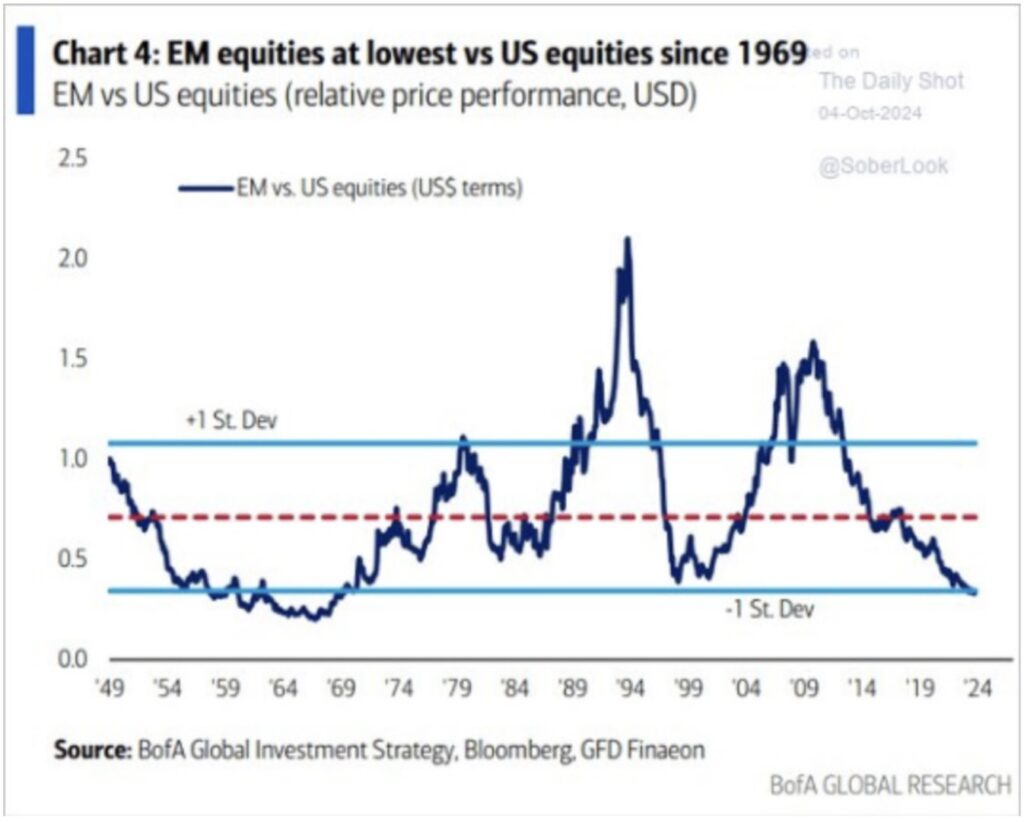

October 7 (King World News) – Peter Boockvar: The rally in Chinese stocks was not out of nowhere in terms of cheap valuations and with respect to the dramatic outperformance of US stocks relative to emerging markets for years. I saw this chart over the weekend on Twitter via BoA on EM vs US equity relative price performance, so a ratio chart. Pretty dramatic undervaluation of the former relative to the latter. Want some real values out there, look to EM, we do.

Emerging Market Equities Most Undervalued vs US Stocks Since 1969!

Chinese Government Intervention Impacting Markets

Speaking of China again, we need to check up on what has been the initial reaction to the policy initiatives announced in hopes of putting a floor under their residential housing market. This was a story I found on Reuters, saying “China’s home sales rose during the National Day holiday period…state media said on Saturday…During the weeklong holiday period that started Tuesday, the number of home visits, which reflects a willingness to buy a home, increased significantly, while sales of homes in many places rose to ‘varying degrees,’ state broadcaster CCTV reported…The number of visits to most of the projects participating in the promotions increased by more than 50% y/o/y, it added.” https://asia.nikkei.com/Economy/China-home-sales-rise-to-varying-degrees-state-media-says

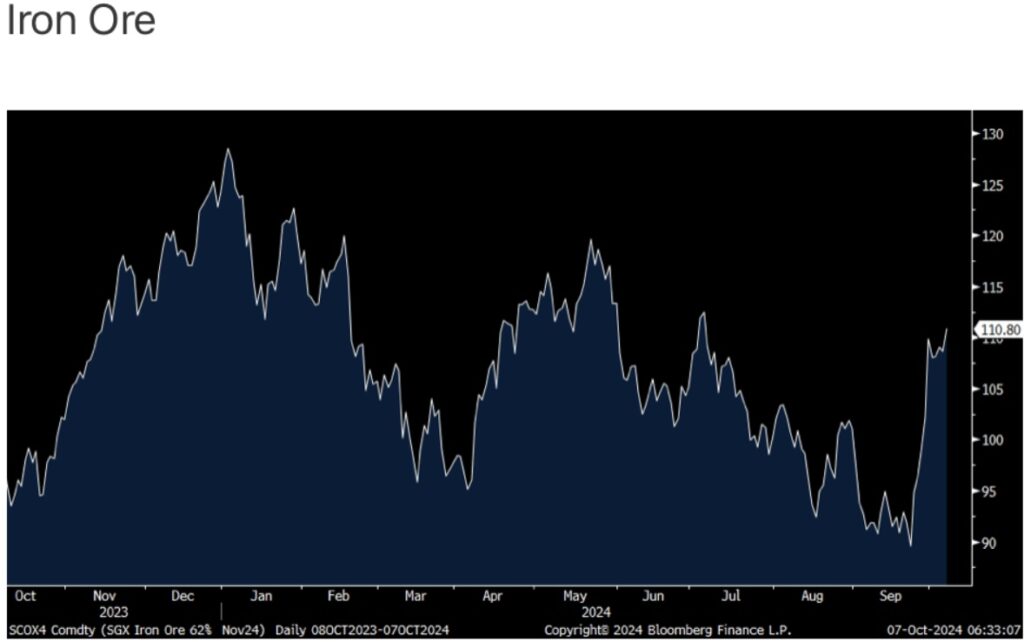

Maybe in response, iron ore is up another 2% to the highest level in 3 months. Also of note in China, the Macau visitor numbers in the first six days of Golden Week have exceeded 2019 levels. We remain bullish and long some Macau focused casino stocks. https://www.asgam.com/index.php/2024/10/07/macau-visitor-arrivals-reach-915696-across-first-six-days-of-golden-week-already-higher-than-2019/

Does China Really Need More Iron Ore For Construction?

It Will Be Interesting To See How Iron Ore Trades From Current Levels

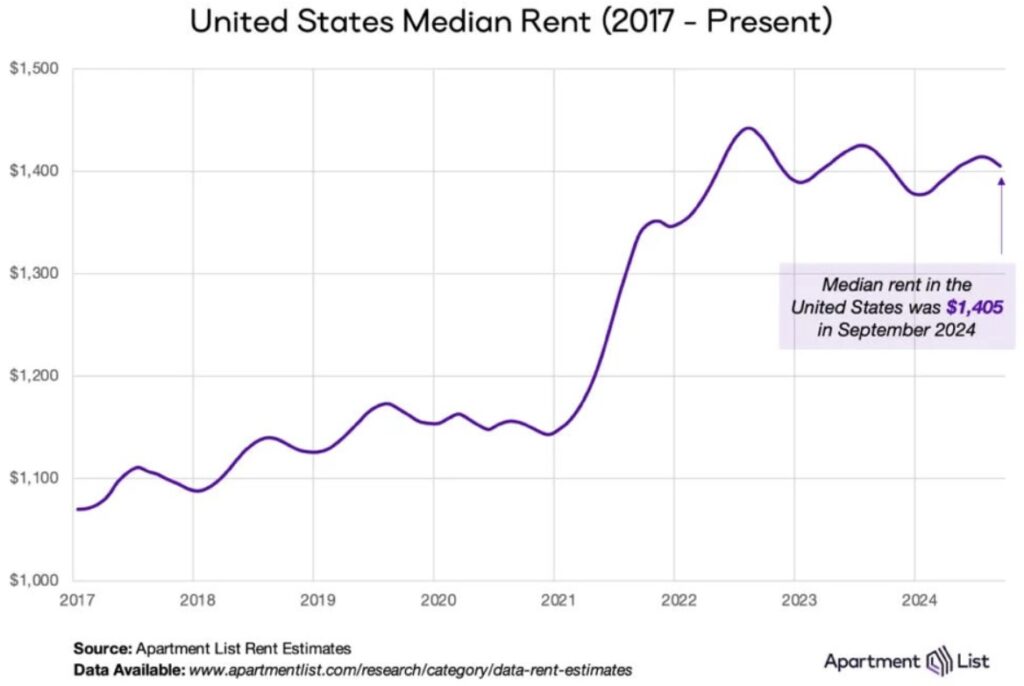

Ahead of the CPI report on Thursday Apartment List late last week reported its survey on September activity. Reflecting the seasonal slowdown after Labor Day, new rents fell .5% m/o/m. Versus last year, they are lower by .7% y/o/y. Also, “On the supply side of the rental market, our national vacancy index remains slightly elevated, currently standing at 6.7%.” That’s the highest since August 2020…

ALERT:

To learn about one of the greatest gold & silver royalty companies in the world CLICK HERE OR ON THE IMAGE BELOW.

The sun belt locations continue to see the softest rent trajectory as that is where most of the supply has been last year and this year. On the other hand, “the fastest rent growth has been occurring in metros across the Midwestern and Northeastern US. These are markets where steady rental demand is not being matched by supply growth.”

Most People Still Saying, “Rent Too Damn High!”

ECB Will Likely Cut Rates Again This Month

Somewhat dated, August German factory orders were weak, falling by 5.8% m/o/m, well more than the estimate of down 2% but partly offset by a 100 bps revision higher to July. This just confirms the industrial recession the German economy is still experiencing. The euro is quietly falling to the lowest since mid August but bond yields are higher across the board in the region following the US selloff Friday and overnight in Asia and the possibility markets have gotten way too ahead of themselves in expecting so many rate cuts.

That said, Governing Council member of the ECB Francois Villeroy said they will likely cut rates again in October. Talk about trying to catch the falling inflation knive. He seems not wanting to wait to see how things play out before cutting again.

Nomi Prins Just Made Two Shocking Price Predictions For Silver!

To listen to Nomi Prins’s two shocking predictions for the price of silver as well as her discussion on gold, uranium, oil, war, what surprises to expect in the last few months of 2024 and much more CLICK HERE OR ON THE IMAGE BELOW.

Just Released!

***To listen to Alasdair Macleod’s just released audio interview covering the wild trading he expects to see in the coming weeks in gold and silver CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.