Today the US dollar reversed lower as the price of gold surged $20 and silver advanced 50 cents on the heels of the US Non-Farm Payroll Report. The dollar his since recovered its losses, the price of gold has retreated along with silver, but here is the big picture.

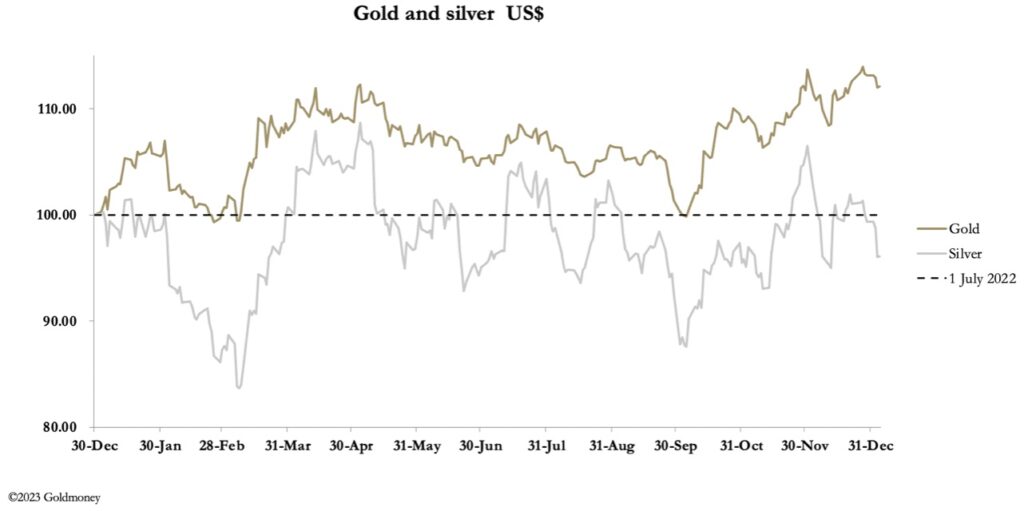

January 5 (King World News) – Alasdair Macleod: Gold and silver prices eased this week over the New Year break during which markets were closed. Turnover was subdued. In European morning trade, gold was $2038, down $24 from last Friday, and silver $22.95, down a heftier 80 cents.

King World News update: On the heels of the US Non-Farm Payroll Report being released, gold has surged $20 and silver 50 cents in early US trading.

With every goldbug predicting higher prices in 2024, perhaps this reaction was to be expected. It is now likely that gold will drift down toward the symbolic $2k level, where more serious demand should materialise.

The question on everyone’s minds must be whether if challenged, will that level hold? For guidance the technical position is our next chart.

While technical analysis is for from infallible, as a guide to future prices the chart above is about as bullish as it gets. But as a marker of public sentiment, global net investment demand is subdued. According to the World Gold Council, European ETFs liquidated 20.1 tonnes net in November, taking the total to that date for 2023 to net sales of 155.4 tonnes. Asian demand was a paltry 0.6 tonnes and 15.9 tonnes respectively, but then Asians like to possess their gold. North American November demand was 10.4 tonnes making net sales of 93.1 tonnes for the year to November.

Clearly, global investors are not generally on board with gold, and are yet to buy into a rising price. The November total for all physical ETFs was 3,234 tonnes. In a tight physical market, if the general public takes the view that gold prices are rising the ensuing marginal demand could have a dramatic effect — only offset by bullion banks accessing ETF custodial bullion as a source of liquidity. This is not meant to happen, but where there’s a will there’s a way.

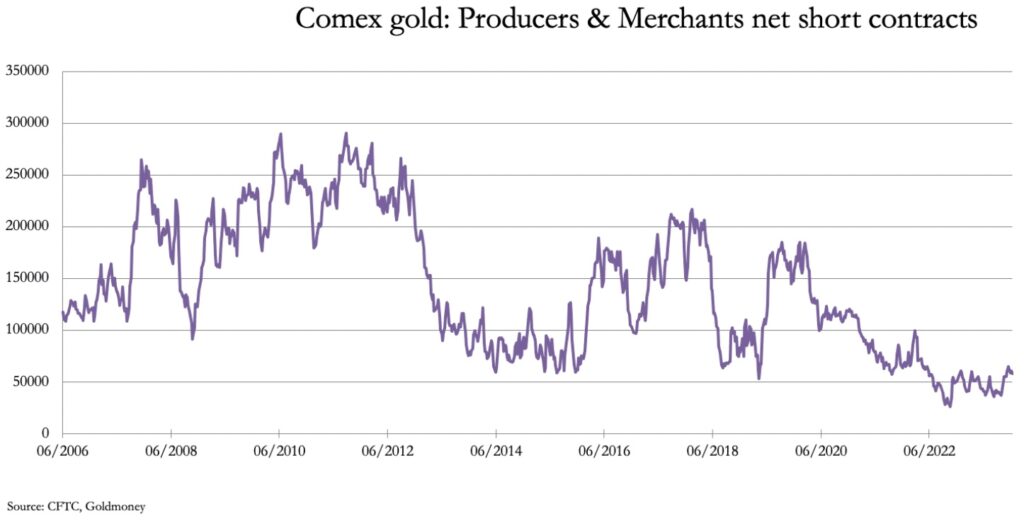

Paper markets are evolving, making life increasingly difficult for the short side in gold. In the past, the bullion banking establishment has managed to persuade producers (mines and processors) to hedge prospective inventory forward, relieving pressure on market makers’ and bullion bank traders’ short positions. According to the CTFC’s Commitment of Traders statistics, this source of hedging supply has diminished, throwing the short burden onto purely financial players. This is up next.

It is as if this category, which deals in the real stuff, has learned that hedging is a costly activity rather than a risk control mechanism. The changing scene is also reflected in the declining influence of the Manged Money category (hedge funds), who surely have learned that they are usually suckered into long positions at the top and shaken out at the bottom, just like any other amateur punter. This effect is clearly visible in my next chart.

Clearly, the trend for Managed Money net longs has been in decline since 2019, while the gold price has been rising, indicated by their respective pecked lines. Having consistently got the trend wrong, hedge funds have yet to join the gold train.

You would have thought that the investing public and professional dealers would have an eye on escalating risk in credit markets, from which gold acts as the refuge. The fact of the matter is that in this Keynesian world gold is regarded as a generally speculative asset, not real money. When it gradually dawns on participants that gold is not going up, but that credit represented by fiat currencies is declining in value, then demand for physical gold will escalate in a tight market.

Perhaps that is what gold’s technical chart is telling us.

JUST RELEASED: Major 2024 Surprises & Predictions!

To listen to the man who helps oversee $130 billion discuss the major surprises he expects to see in 2024 CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.