Commodities are on a tear, but take a look at silver and the US dollar.

Commodities On A Tear

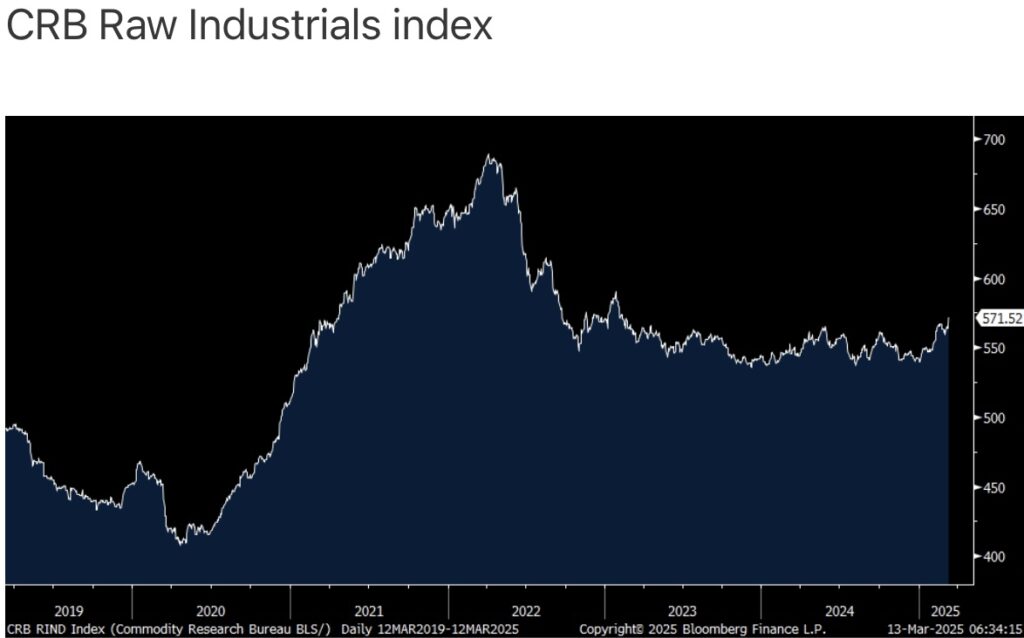

March 13 (King World News) – Peter Boockvar: Post CPI and ahead of PPI, with the help of tariffs and the scramble to procure raw materials ahead of them, the CRB raw industrials index, what’s a really bullish forming chart I showed yesterday, rose another 1% by days end to the highest level since February 2023. While still well off its highs of 2022, the direction is now up.

We remain bullish and long commodities like gold, silver and platinum and commodity stocks in mining, oil/gas, uranium, and fertilizers.

Some of the 13 components in this index include everything from copper, steel scrap, tin, zinc, burlap, cotton and rubber.

Bank of Canada Cuts Rates

Here was the bottom line for why the Bank of Canada cut its base rate by another 25 bps to 2.75% as expected yesterday. “While economic growth has come in stronger than expected, the pervasive uncertainty created by continuously changing US tariff threats is restraining consumers’ spending intentions and businesses’ plans to hire and invest. Against this background, and with inflation close to the 2% target, Governing Council decided to reduce the policy rate by a further 25 bps.”

They also said this, which is revealing too ahead of the Fed meeting next week. “Monetary policy cannot offset the impact of a trade war. What it can and must do is ensure that higher prices do not lead to ongoing inflation.”

US Dollar Troubles

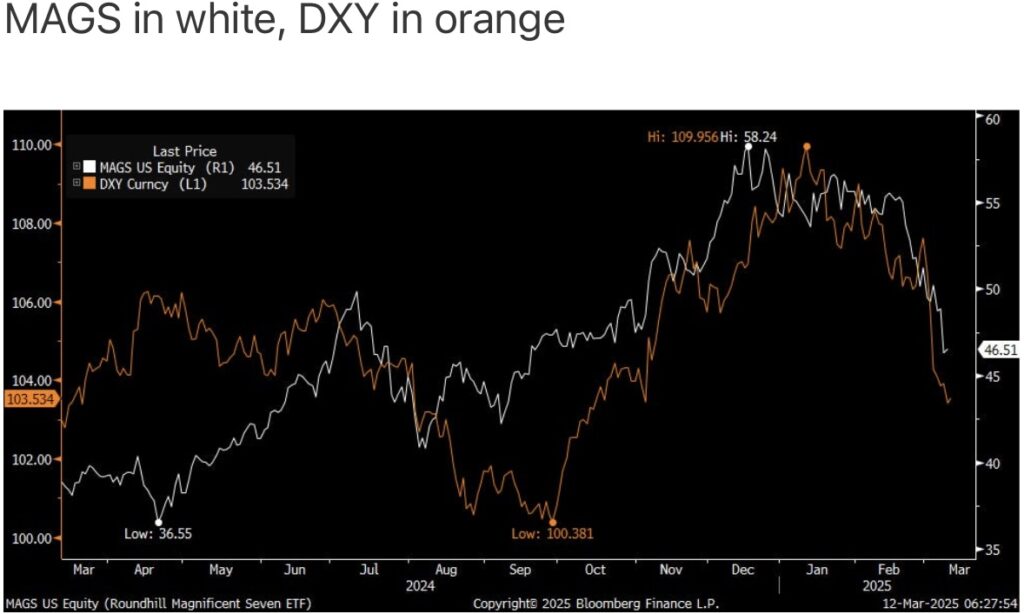

You’ve heard me argue this year that so goes the Mag 7 stocks, so goes the US dollar because of the large holdings of them by foreigners. Here is a chart of the MAGS ETF and the DXY over the past year.

So Goes The Mag 7 Stocks, So Goes The US Dollar

Debate Over Tariffs

In the debate over tariffs, the good thing is that we don’t have to go back too far for evidence of its impact. In December 2019 the Federal Reserve released its economic study on the steel and aluminum tariffs slapped on in 2018. Here is what they said, “A key feature of this analysis is accounting for the different ways that tariffs could affect manufacturers in the presence of global trade and supply chain linkages.

On the one hand, US import tariffs may protect some US based manufacturers from import competition in the domestic market, allowing them to gain market share at the expense of foreign competitors. On the other hand, US tariffs have also been imposed on intermediate inputs, and the associated increase in costs may hurt US manufacturers’ competitiveness in producing for both the export and domestic markets. Moreover, US trade partners have imposed retaliatory tariffs on US exports of certain goods, which could again put US firms at a disadvantage in those markets, relative to their foreign competitors.”

Ok, this sounds like an exact replica of what we are dealing with right now. Their conclusion, “We find that the 2018 tariffs are associated with relative reductions in manufacturing employment and relative increases in producer prices. For manufacturing employment, a small boost from the import protection effect of tariffs is more than offset by larger drags from the effects of rising input costs and retaliatory tariffs. For producer prices, the effect of tariffs is mediated solely through rising input costs.”

Finally, “While one may view the negative welfare effects of tariffs found by other researchers to be an acceptable cost for a more robust manufacturing sector, our results suggest that the tariffs have not boosted manufacturing employment or output, even as they increased producer prices. While the longer-term effects of the tariffs may differ from those that we estimate here, the results indicate that the tariffs, thus far, have not led to increased activity in the US manufacturing sector.”

The US Treasury market knows all of this and can mostly explain why yields have fallen and the curve has reinverted when looking at the 3 month and 10 yr.

Here is the study, https://www.federalreserve.gov/econres/feds/files/2019086pap.pdf

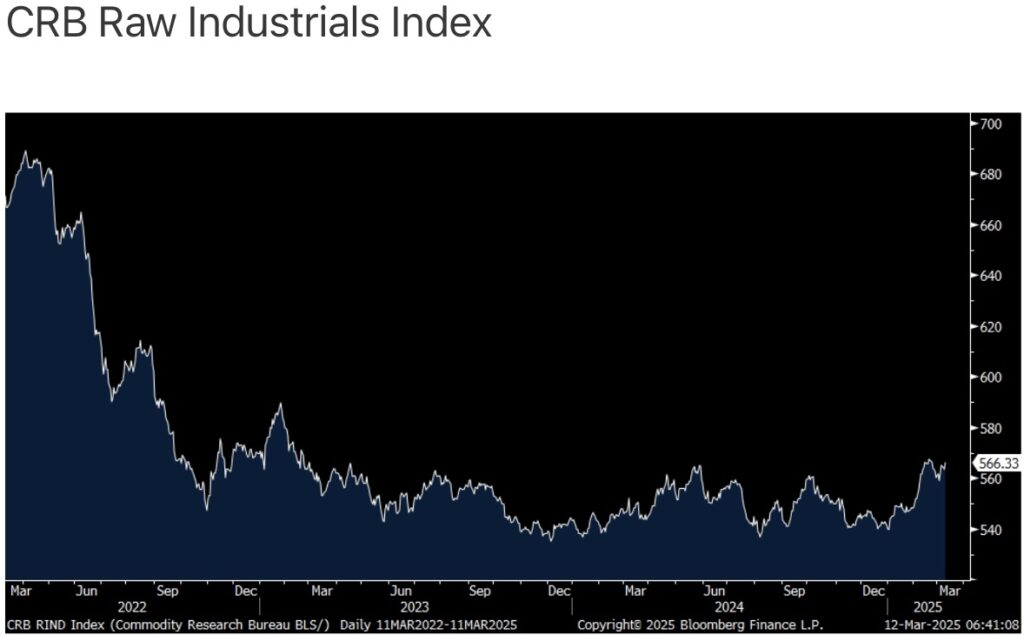

By the way too, here is a chart of the CRB raw industrials index, putting in a classic bottom.

We’re long and bullish commodity stocks, including our favorite right now, silver.

Meanwhile In Japan

Meanwhile, with respect to the continued rise in Japanese JGB yields, Governor Ueda basically said today that they are not going to fight it right now but could if it gets more unstable. “My understanding is that the rising trend since last year reflects the market’s views on the economy and inflation or shifts in interest rates overseas. There is no major gap between our views and the market’s.” Then followed it up with this, “If long-term yields rose sharply in a way that differs from normal market movements, we would conduct operations swiftly and flexibly to promote stable interest rate formation in the market.”

The yen is weaker today but after its big rally to below 150.

Gold Dominating But Look Out For Silver & Uranium

To listen to Nomi Prins discuss the wild trading in global markets, gold, silver, uranium, mining stocks, what to expect next and more CLICK HERE OR ON THE IMAGE BELOW.

WILD TRADING!

To listen to Alasdair Macleod discuss this week’s wild trading action and what to expect next CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.