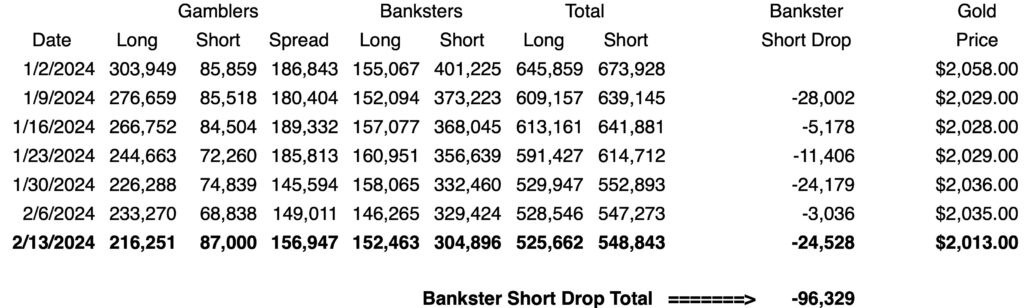

It appears that bullion banks have covered a massive amount of gold short positions, but the biggest surprise is how they did it. Take a look…

February 18 (King World News) – Email from KWN reader Charles P: Here’s another view of the gold COT [Open Interest] collapse, in a tabular format that gives a very clear picture of where the gold COT has been going since the first of the year. I’ve renamed the ‘NON-COMMERCIAL’ as “Gamblers” and the ‘COMMERCIAL’ as “Banksters” so there’s no doubt about who’s whom in this game. As Alasdair notes, quite stunning, this is a nearly 25% drop while gold itself has meandered in a ~$50 range, all above $2000, closing basis.

Bullion Banks Covered 96,000+ Gold Shorts Even Though Gold Only Traded In A $50 Range!

King World News note: The bullion banks have covered a massive number of gold shorts. King World News will keep a close eye on the bullion bank short position and immediately flash positive as soon as the setup turns bullish. To be clear, the COT is approaching an extremely bullish position in terms of commercial shorts, so if you are accumulating physical gold and silver, continue to do so on any dips. With silver you may have be be a bit more aggressive because that market may have already bottomed. As for gold, a sideways churn could see the bullion banks cover the rest of their shorts, so just dollar cost average into that market at the usual time you make your scheduled purchases; each week, month, or quarter.

To listen to Alasdair Macleod discuss what is happening behind the scenes in the war in the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.