Bull market #3 is alive and well in this key asset and it will be a game-changer for the world.

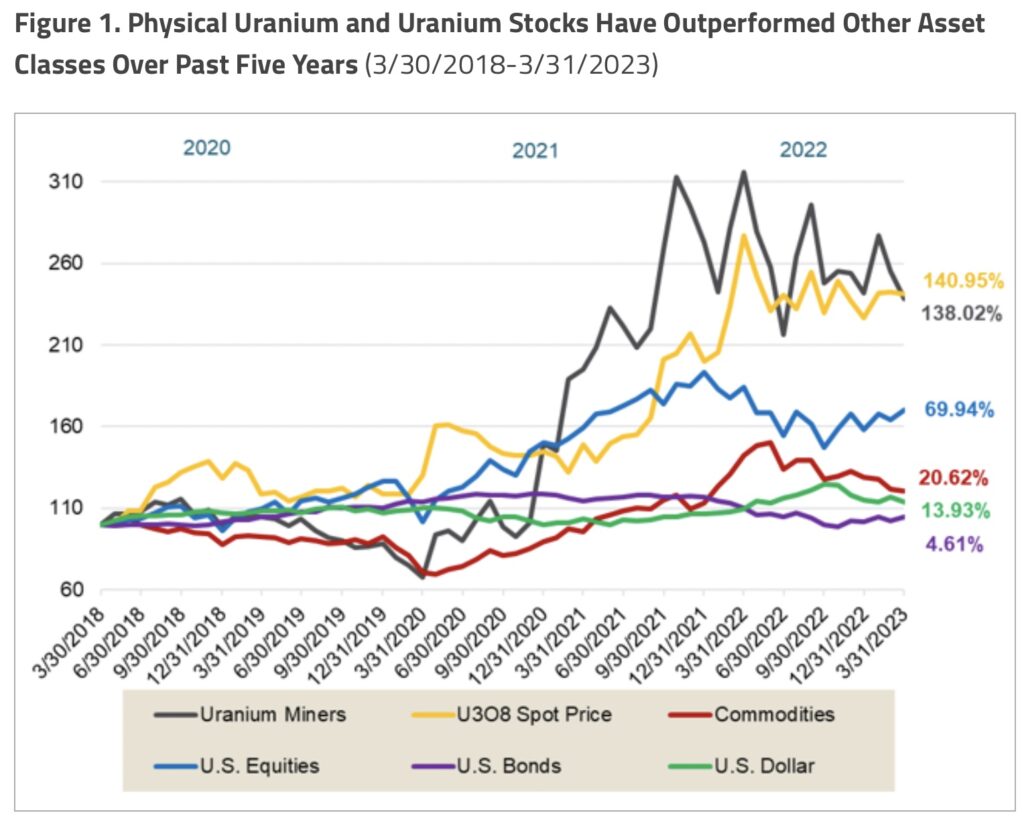

Uranium Outperforms Commodities

April 17 (King World News) – Jacob White at Sprott Asset Management: The U3O8 uranium spot price fell slightly from $50.85 to $50.70 in March and remains up 4.93% year-to-date as of March 31, 2023, showing strength relative to other commodities, which declined 6.47% YTD (as measured by the BCOM Index). Over the longer term, uranium has demonstrated even greater resilience within the commodity space. For the five years ended March 31, 2023, U3O8 spot appreciated a cumulative 140.95% compared to 20.62% for the BCOM.

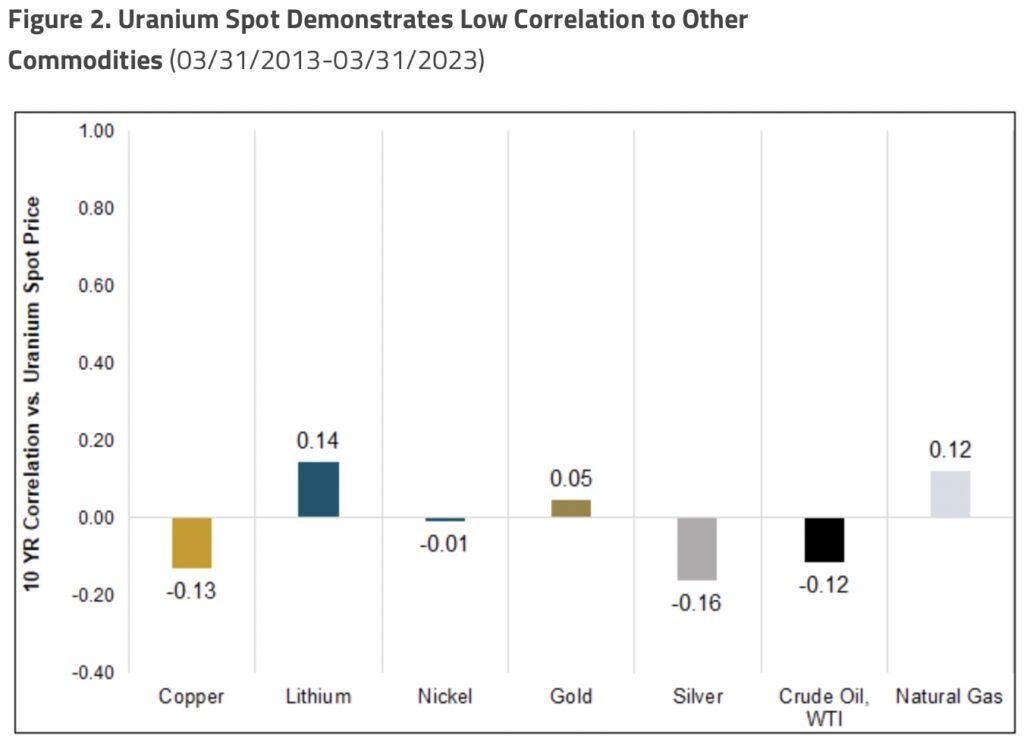

We believe that uranium market fundamentals, which are the most positive in over a decade, will continue to support prices. Physical uranium, which demonstrates low correlation to other major asset classes (see Uranium’s Mixed February), also shows low historical correlation to other commodities, as shown in Figure 2. These characteristics make uranium an attractive option when considering portfolio diversification.

Uranium Miners Suffer a Drawdown

Uranium mining equities, in contrast to physical uranium, fell 6.74% in March and are off just 1.48% year-to-date, buoyed by January’s stellar performance. Like physical uranium, uranium mining equities have had notable long-term results, having gained a cumulative 138.02% for the five years ending March 31, 2023.

In March, a U.S. banking crisis unfolded amid the Fed’s fight against inflation. The collapses of Silicon Valley Bank and Signature Bank, along with the emergency UBS buyout of Credit Suisse, surprised markets. The banking crisis raised alarms on uninsured deposits, fueled contagion fears and caused a liquidity crunch as capital came off the table. This macro environment was especially difficult for lower-liquidity assets, such as small-capitalization equities. As a result, small-cap equities generally underperformed their larger-cap counterparts, e.g., the large-cap oriented S&P 500 Index outperformed the smaller-cap Russell 2000 Index in March.

Uranium equities were impacted by March’s challenging headwinds, and smaller-cap, junior uranium miners were the main detractors for the month. The junior miner profile of lower liquidity and earlier-stage mine development can increase volatility and lead to larger drawdowns in tough market conditions. These qualities, however, may give junior miners the potential for greater upside in uranium bull markets. Despite the selling pressure in March, junior uranium miners continue to make progress with production restarts, uranium contracting with utilities and exploration programs.

Uranium Supply Response Energized by Restarts

Uranium’s strength, having appreciated significantly in the past couple of years, continues to incentivize production. enCore Energy Corp. (enCore) announced its decision to resume uranium production at the Alta Mesa Processing Plant in early 2024, estimated to have an operating capacity of 1.5 million lbs of U3O8 per year. This represents enCore’s second restart, following the “Rosita” plant restart scheduled for 2023, which has an annual capacity of 800 thousand lbs of U3O8.

Several other junior uranium miners have restarts in the works:

- Paladin Energy Limited announced in July 2022 the restart of its Langer Heinrich mine for the first quarter of 2024. The project previously had a capacity of 5.2 million lbs of U3O8 per year.

- Boss Energy Ltd. announced in June 2022 the restart of its Honeymoon ISL project for Q4 2023 with a capacity of 2.45 million lbs of U3O8 per year.

- Peninsula Energy Ltd. announced in March a delay in the restart of its Lance ISL project to mid-year 2023. The project has a capacity of 820 thousand lbs. of U3O8 per year.

- Ur-Energy Inc. announced in December 2022 the restart of its Lost Creek project for 2023. The project has a capacity of 1.2 million lbs of U3O8 per year but will target 50% of this.

By contrast, Kazakhstan’s uranium supply response has been to decrease production guidance. NAC Kazatomprom JSC (Kazatomprom), the biggest producer of uranium in the world, announced that it was reducing production guidance from 22,500-23,000 to 20,500-21,500 tonnes of uranium in 2023. This followed a previous decrease of 5,000 tonnes in guidance for 2023. Kazatomprom attributes the latest drop in production guidance to COVID-19 and supply chain challenges, which indicates how future supply may be disrupted. Thankfully, Kazatomprom doubled its year-over-year profit in 2022 due to a 31% increase in the average realized uranium price.

While the stronger uranium price is encouraging the restart of idle capacity, pricing remains well below the levels required for new greenfield production. In addition, while utilities have contracted to purchase the highest amount of uranium in 10 years, their purchasing activity remains below annual replacement levels…

To Find Out Which Uranium Company Is Positioning Itself To Become A Powerhouse In Nevada Click Here Or On The Image Below.

Governments Continue to Embrace Nuclear Power

The energy transition movement is structural and we believe nuclear energy is a crucial solution for decarbonizing the global energy supply. Growing global recognition by governments, catalyzed by the need for greater energy security, is likely to continue to be a dominant theme. Positive news headlines continued in March. In the U.S., on March 2, the Biden administration offered $1.2 billion for distressed nuclear power plants and, for the first time, the funding was available to recently closed plants. The Vogtle nuclear reactor Unit 3 in Georgia became the first U.S. reactor in seven years to start up and is scheduled to be fully in service in May or June. The UK announced it would increase nuclear’s capacity to supply 25% of the country’s electricity, up from 15% currently. European Union negotiators reached a deal on scaling up renewables and agreed to a provision allowing hydrogen produced with nuclear energy to be considered green. Nuclear-produced-hydrogen, a major issue in the negotiations, was championed by pro-nuclear France as a way to decarbonize heavy industry in the EU.

Nuclear Energy is Crucial to the Energy Transition

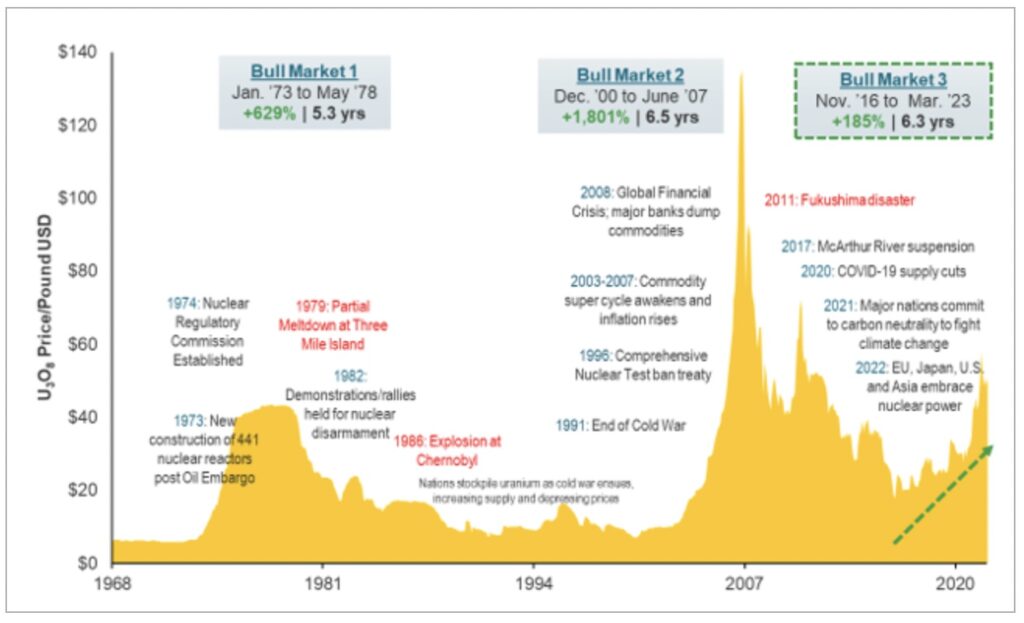

The performance of uranium miners in March did not reflect the sector’s increasingly bullish fundamentals. We believe the uranium bull market still has a long way to run. Conversion and enrichment services price increases may likely cascade to the uranium spot price and support uranium miners. Over the long term, increased demand in the face of an uncertain uranium supply may likely support a sustained bull market.

Nuclear energy and uranium’s critical role in energy security may likely be paramount going forward. Russia’s invasion of Ukraine sparked a global energy crisis that forced many countries to reimagine their energy supply chains. In past years, Western countries’ energy policies have predominantly favored renewable energy to reduce reliance on fossil fuels. However, renewables often suffer from intermittency and low capacity and require offsets with baseload energy sources, such as coal, natural gas or nuclear power plants. Of these, nuclear power has the highest baseload capacity. We believe ongoing supply chain risks may likely cause utilities to seek out the baseload reliability of nuclear power.

We believe the uranium bull market remains intact despite the uncertain macroeconomic environment. There has been an unprecedented number of announcements for nuclear power plant restarts, life extensions and new builds that are likely to create incremental demand for uranium. However, the current uranium price still remains below incentive levels to restart tier 2 production, let alone greenfield development.

Figure 3. Uranium Bull Market Continues (1968-2023)

ALSO JUST RELEASED: Greyerz – This Everything Global Collapse Will Be Unlike Anything Seen In History CLICK HERE.

**To listen to Alasdair discuss the collapsing available physical gold and the other big catalysts for the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.