Today Michael Oliver, the man who is well known for his deadly accurate forecasts on stocks, bonds, and major markets, warned King World News that the unwinding of the “everything bubble” will be unlike anything we’ve seen before.

One Of The Most Important Charts Of 2024

March 26 (King World News) – Michael Oliver, Founder of MSA Research: Filling the tank:

THERE WILL BE HELL TO PAY:

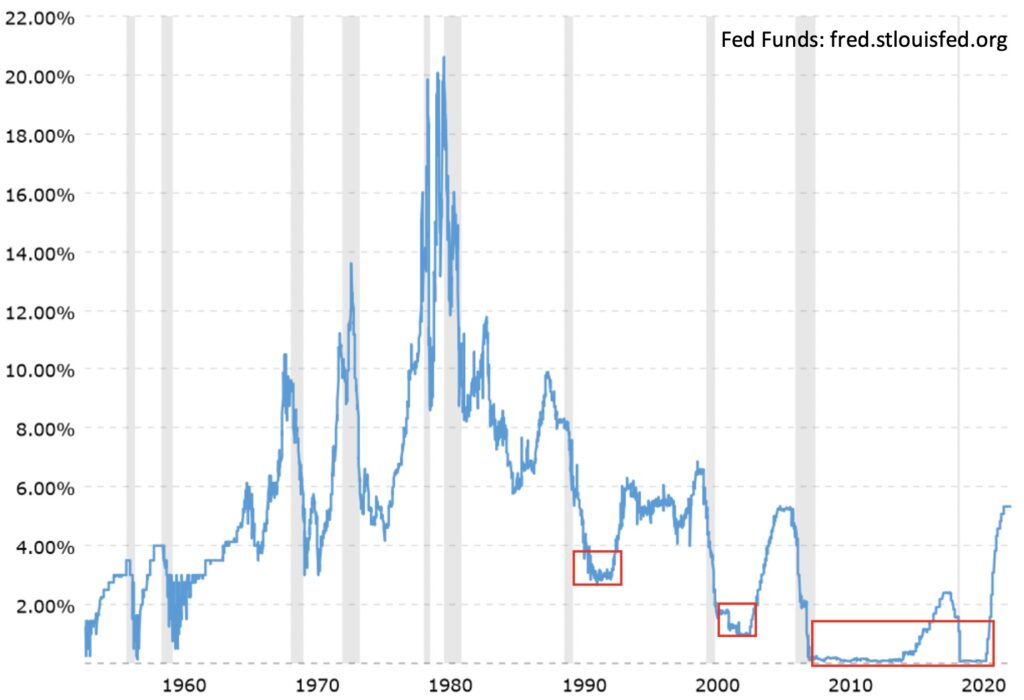

70 Years Of Fed Funds Rates

1) 1992 to 1994: the lowest rate in twenty-five years. The dotcom bull and bubble followed from 1995 to 2000.

2) 2001 to 2004: the lowest rate in forty years. The stock market (and real estate) bubble followed. Much pain, negative data points, and consequences in the street (not just for stock market investors) followed.

3) 2008 to 2022: the lowest rate in sixty years (ever). The stock market mega-bubble followed. And in 2020 when certain favored assets were threatened, the Fed filled the tank yet again.

The Unwinding Will Be Unlike Anything We’ve Seen Before

However, reality ultimately reprices assets to where they should/would be, and in that process often overcompensates. What preceded the current aged and mass-multiple bull isn’t like anything we’ve seen before. The unwinding consequences could reflect that. To receive the special KWN discount to subscribe to Michael Oliver’s internationally acclaimed MSA Annual Research which is used by serious investors and professionals all over the world CLICK HERE.

To listen to Alasdair Macleod discuss China losing control over the price of silver and what this will mean for the silver market in 2024 CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.