The stock market mania continues to make history the public inflates stock market bubble to new record highs.

Déjà vu

June 18 (King World News) – Peter Boockvar: I’m posting here again an E-Trade commercial from either 1999 or 2000, something I did in the zany meme stock craze in 2021, after watching the Keith Gill bizarre call a few weeks ago and in light of what the stock has done since and after yesterday’s shareholder meeting.

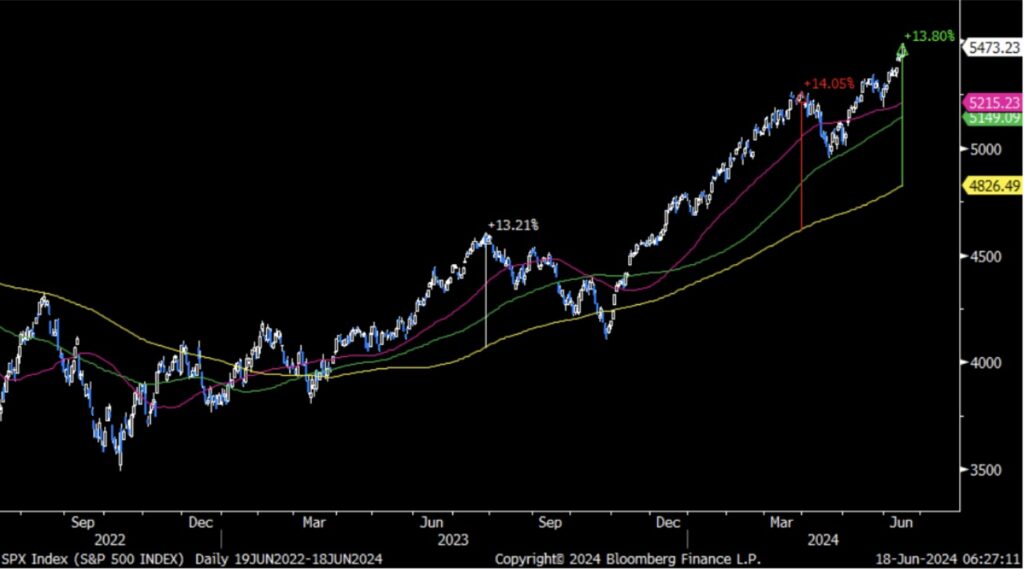

Here is a bit of short term perspective on the S&P 500 because we’re now about 14% above its 200 day moving average. The chart below shows the prior two times over the past two years that we reached similar levels.

Stock Market Mania Continues To Make History As Madness Of The Crowds Inflates Stock Market Bubble To New Highs

Housing Shortage?

This was from the Lennar press release “against the backdrop of evolving market conditions as interest rates rose for most of the quarter and then subsided as the quarter closed” :

“Although affordability continued to be tested by interest rate movements and simultaneously challenged consumer sentiment, purchasers remained responsive to increased sales incentives, resulting in a 19% increase in our new orders and a 15% increase in our deliveries y/o/y. The macroeconomic environment remained relatively consistent with employment remaining strong, housing supply remaining chronically short due to production deficits over a decade, and demand strength driven by household formation.”

There was a 5% drop in the average sales price of homes delivered “primarily due to pricing to market through an increased use of incentives and product mix.”…

Listen to the greatest Egon von Greyerz audio interview ever

by CLICKING HERE OR ON THE IMAGE BELOW.

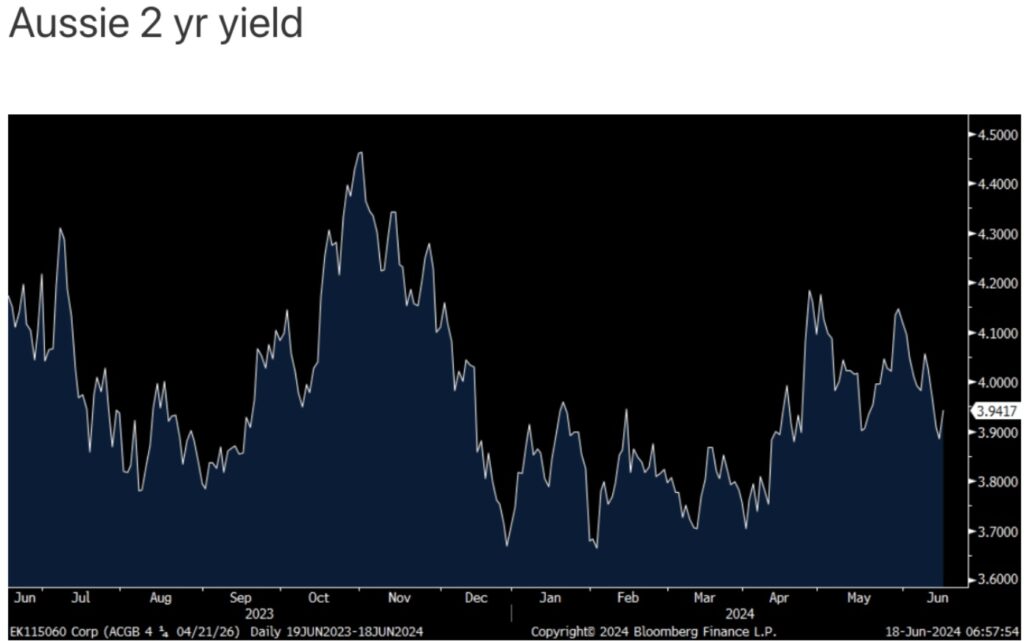

Meanwhile In Australia

The Reserve Bank of Australia kept its benchmark rate at 4.35% and is very much sitting tight for a while it seems. Governor Michele Bullock said “The recent data have been mixed, but overall, they’ve reinforced the need to remain vigilant to the upside risks to inflation.” She also said, “I really genuinely feel that we’re in quite a complex situation here. We’ve got balancing risks on both sides. Earlier on when we were raising rates, it was obvious what we had to do, it’s not so obvious now.”

The 2 yr Australian bond yield jumped 5.6 bps in response to no signs of a cut. This yield rise comes though after declines in 11 in the prior 12 days.

The Aussie$ is little changed while the ASX rose 1%, following US stocks.

Just Released!

Alasdair Macleod discusses collapsing Open Interest in the gold market as well as some other wild developments from around the world CLICK HERE OR ON THE IMAGE BELOW TO LISTEN.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.