As stock markets plunge COMEX gold and silver warehouse stocks continue to soar.

In Case You Missed It: Most Fascinating Thing About Today’s Trading

King World News note: The most fascinating thing about the action today is that the HUI Gold Mining Index went from trading down over 5% to positive with Agnico Eagle leading the way hitting new all-time highs in the US. For anyone out there that still believes mining stocks will trade lower with the stock market, history simply does not support that, with the sole exception being the liquidity crisis in 2008. During all other bear markets in stocks one of the primary beneficiaries were mining stocks.

Also, use the current weakness in the silver market to continue accumulating physical silver since it is the cheapest hard asset on the planet. Gold remains expensive vs many other assets, including silver, so if you are accumulating physical – buy silver. And remember, the Chinese and the Russians as well as other BRICS countries are now stockpiling physical silver so there will be a floor at some point during this decline. After the floor, silver will eventually surge decisively above $35 on the way to new all-time highs above $50 on the way over $100.

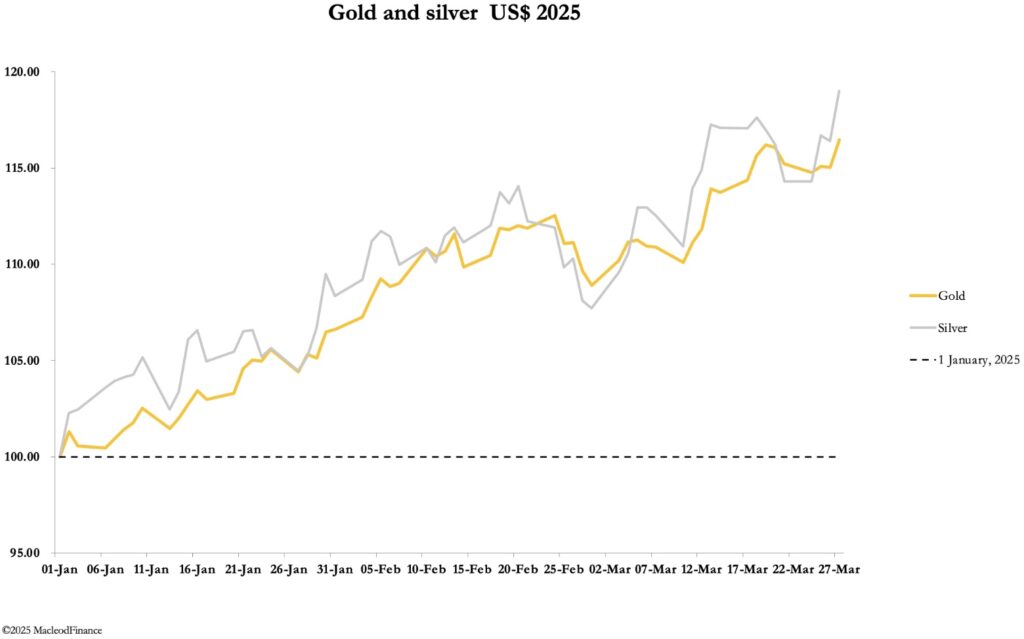

April 3 (King World News) – Alasdair Macleod: Gold and silver outperform. In generally lacklustre financial markets, the standout winners have been gold and silver. This report looks at the consequences for portfolio reallocations in Q2 2025 and beyond.

Gold and silver rose strongly this week on Far East demand. In European early morning trade, gold was $3072, up $50 from last Friday’s close after hitting the $3085 level during Asian trading hours — a new record. Silver stirred at $34.38, up $1.36 on the same time scale. Comex volumes in gold were healthy, while they still remain subdued in silver except for yesterday when silver rose by 2%.

Later today, a dip in gold and silver cannot be ruled out because with Asian trading closed for the weekend, any pause in futures’ demand for gold and silver is likely to be pounced on by the swaps selling to drive prices lower. This is entirely predictable. But it’s the prospect for prices in the following weeks, being the start of a new investment performance quarter and beyond which should concern us.

Gold’s remarkable performance, up 17.3% in the first quarter of 2025 along with silver (+19%) is the best performing asset class compared with other investment media. Yet gold and gold substitutes such as ETFs and mines are unbelievably under-owned in investment portfolios. In a March 17 article for my paid Substack subscribers, I revealed that in the entire portfolio universe of MSCI’s $217.1 trillion value of US and other developed nation portfolios, the entire gold mining universe (bullion, ETFs and gold mines) represents only 0.21% of that total.

The following table shows relative performances of principal asset classes to date:

KING WORLD NEWS NOTE: Gold Leading The Pack In 2025

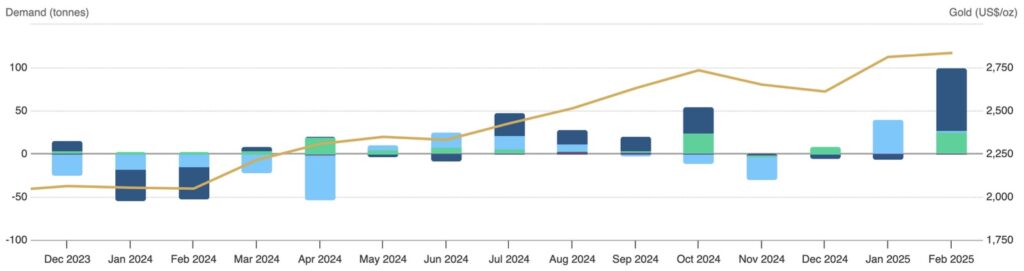

Already, this dichotomy is leading to ETF demand, as the following chart from the World Gold Council revealed:

The dark blue is North America, which in February added 72.2 tonnes equivalent, while Europe (light blue) having added 39 tonnes in January only added 2 tonnes in February. Asia added 24.4 tonnes in February. This tells us that it was only last month that investment managers in the US began the process of reweighting their portfolios in favour of gold.

Asian demand this week appears to reflect major Chinese insurance companies buying gold, having been authorised to do so by the Chinese regulators in a “pilot programme” limited to about $27 billion (280 tonnes). This is a significant amount in global bullion markets already drained of liquidity by the Comex futures market. Given it is only a pilot, future authorisations leading to further relaxing of restrictions will mean larger tonnages being purchased.

Gold is still being delivered into Comex, draining foreign trading centres of their liquidity as MacroMicro’s chart shows:

KING WORLD NEWS NOTE: COMEX Gold & Silver Warehouse Stocks Continue To Soar

The same is true for silver:

The economic background is very favourable for gold and silver as well. Trump continues with his aggressive tariffs, due to bring in a new round on 2 April. This will kill both global and US economies, raising prices in America in particular. Interest rates and bond yields will have to accommodate this fact, along with economic damage leading to soaring budget deficits and springing debt traps on the US, UK, Japan, and various EU governments. The deterioration of their finances is bound to weaken their currencies valued in real money, which is gold and to a lesser extent silver.

Clearly, investors are badly wrongfooted for these developments and will have to rethink portfolio allocations. The bull market in gold for them is only just starting.

Michael Oliver – Invest In This Asset In 2025 To Make A Fortune!

To find out what asset Michael Oliver says will make investors fortunes in 2025 CLICK HERE OR ON THE IMAGE BELOW.

Alasdair Macleod’s audio interview was just released discussing the upside action in gold, silver and the mining stocks and you can listen to it by CLICKING HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.