Trouble is brewing as we are seeing another global long term rise in interest rates.

Another GLOBAL Long Term Rise In Interest Rates

October 23 (King World News) – Peter Boockvar: To highlight AGAIN that the interest rate rise is global, last week the 10 yr JGB yield was up 8 bps, its 40 yr yield higher by 13 bps. The Australian 10 yr yield jumped by 29 bps. The German 10 yr bund yield was up by 17 bps. The 10 yr UK gilt yield was up by 29 bps. The Italian 10 yr yield was up by 15 bps and the US 10 yr yield as of this writing is higher by 32 bps.

This is on fully display today too as the Japanese 10 yr JGB yield rose another 3.5 bps to near .88% on a story over the weekend in the Nikkei business daily that the BoJ meeting at the end of the month will be discussing a further tweak to YCC as the 10 yr yield gets closer to the upper end of its bound of 1.00%.

With the yen back at 150, I’m sure a debate on getting out of negative rate policy will also be part of the discussion. Also, the 40 yr JGB yield, the part of their yield curve that is least influenced by BoJ policy, jumped 8 bps to 2.17% overnight.

In turn, European bond yields are jumping with the German 10 yr yield nearing 3.00%, a level last seen in 2011.

The Italian 10 yr yield is close to 5.00% at 4.95%, the highest since 2012.

The US 10 yr yield is finally at 5.00%.

No doubt too that global QT is having a big influence here so while we talk about ‘the market’ doing the job of central bankers, the central bankers themselves are a catalyst for the rise in long rates with that, along with the BoJ tightening up policy. Importantly from Powell last week was his acknowledgement that QT could be a factor in the rise in long rates because it means that if he wants to tighten again, he can lean on QT as the lever to do so rather than by another fed funds hike.

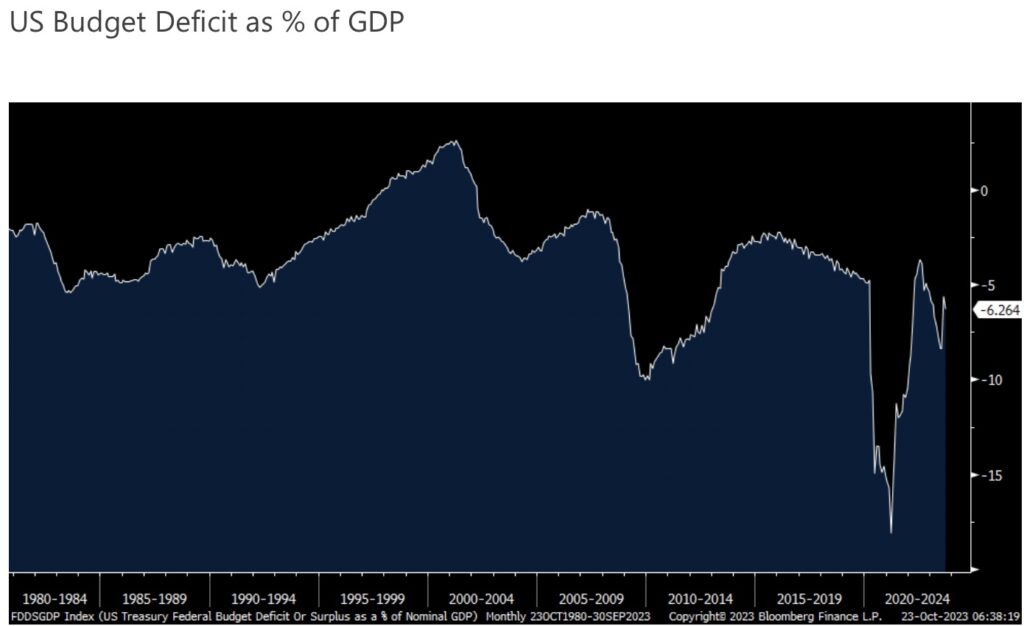

Also, on the US supply side, the 2023 fiscal yr ended September fiscal situation for the US government ended with a budget deficit as a % of GDP of 6.2%. Not including the spike in Covid, it ended September 2019 at 4.5% and trended between 5-10% in the GFC and in the few yrs after. In the early 1980’s and 1990’s recessions, it bottomed around 5%. I expect a double digit deficit in the next recession.

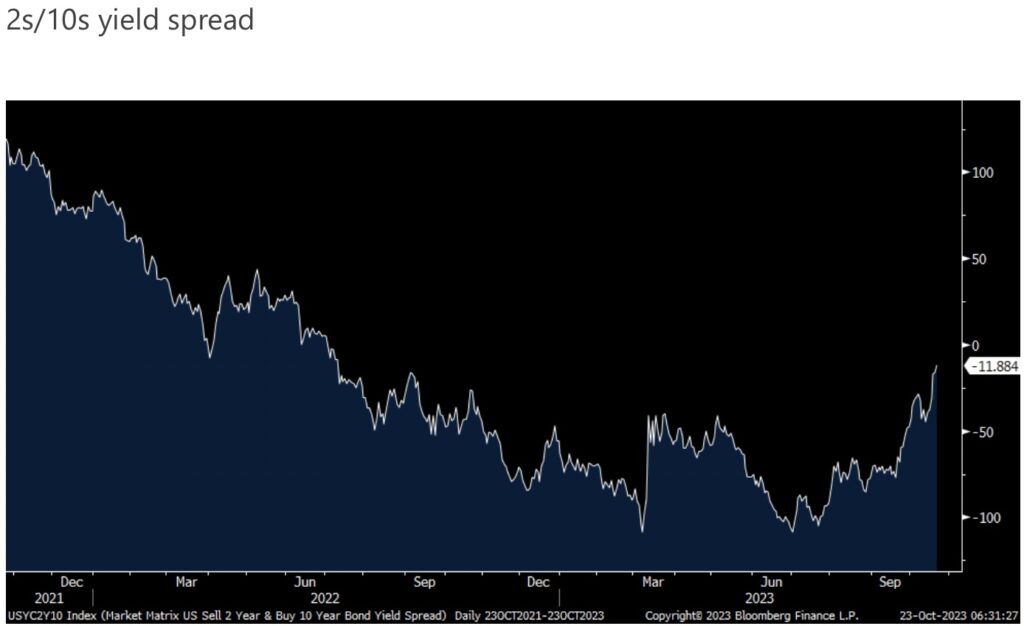

The US bear steepening taking place as the 2s/10s spread now at the most narrow since July 2022 at 12 bps.

Earnings Troubles Continue

The earnings trouble on Friday came from Regions Financial, a large regional bank in case you missed it with the stock down 12%. Here were some notable things that was heard in their earnings call:

“During the quarter, we continued to experience elevated levels of check related fraud. Our third quarter results reflect an incremental $53mm in losses stemming from a 2nd fraud scheme, which also began in the 2nd quarter, but was unknown to us at the time. This scheme manifested itself in delayed returns. And as a result, has had a much longer tail.” They expect a $25mm loss in Q4 related to this and believe check related losses relative to last yr are up 40%.

“Client sentiment varies across industries with some continuing to expect growth, while others have a more muted outlook. Commercial commitments are down 1% compared to Q2. Average ending consumer loans increased 1% as growth in mortgage and EnerBank (home improvement) was offset by declines in home equity and runoff exit porfolios.”

“Looking forward, the higher rate environment, a tightening Federal Reserve and heightened competition will likely continue to constrain deposit growth and pressure cost for the industry through yr end and into early 2024.” Loan charge offs and delinquencies were higher and net interest income was down by 6.5% in Q3.

Fitch On Auto Credit

From Fitch a few days ago, specifically on auto credit, the percent of subprime auto borrowers at least 60 days past due on their loans in September rose to 6.11%, and that is the most in data going back to 1994. Someone in their ABS group said “The subprime borrower is getting squeezed. They can often be a first line of where we start to see the negative effects of macroeconomic headwinds.”

From AMEX:

“We saw strong growth across our geographies and customer types, spending from international consumers and from international SME and large corporate customers, each grew 15%. Overall, strength and spending growth from our US consumers and card members outside of the US continues to offset the softness with commercial services.” As stated Friday, strong T&E spend was the best performing category.

On credit quality, “our card member loans and receivables write offs and delinquency rates both remain fairly flat to last quarter and below pre-pandemic levels. Going forward, as we’ve talked about for many quarters now, we continue to expect these delinquency and write-off rates to increase over time and is likely to remain below pre-pandemic levels in the 4th quarter.”

Separating out Chinese consumer spend on travel and entertainment from the rest of the Chinese economy, Las Vegas Sands (a stock we own) said last week that in Macao, “room occupancy was 96% vs 95% in the same period of ’19.”

Gold Price Will Explode $600 Higher In 60 Days!

To listen to Michael Oliver’s remarkable predictions for the price of gold, silver, mining stocks and other major markets CLICK HERE OR ON THE IMAGE BELOW.

ALSO JUST RELEASED: BUCKLE UP: Debt, Currency Debasement And War Unleashed CLICK HERE

ALSO JUST RELEASED: Michael Oliver – Gold Price To Explode $600 Higher In 60 Days CLICK HERE

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.