Another bull market is about to kickoff as everybody is worried about the US dollar.

Another Bull Market About To Kickoff

November 24 (King World News) – Peter Boockvar: To what NY Fed president John Williams said on Friday that he is leaning to a December rate cut (without actually mentioning December but saying ‘near term’ instead) and the position of monetary authority that the NY Fed has as a constant voting member that does not rotate out, I have to believe Jay Powell blessed the position. Rate cut odds for December 10th went from about 34% on Thursday to 70% today.

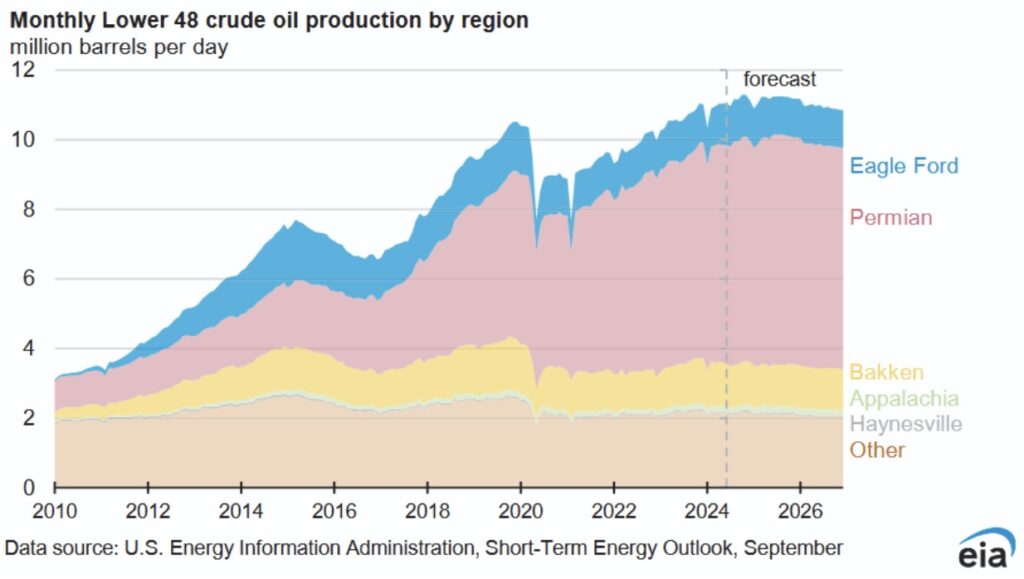

A key part of my bull case for oil prices, one of the cheapest assets in the world right now I believe, is that US shale production is topping out and US shale has provided between 85-90% of non OPEC+ oil supply over the past 20 years according to my friend Adam Rozencwajg at Goehring & Rozencwajg and from the great analytical work they do. Another friend, Luke Groman in his weekend piece of The Forest For The Trees (FFTT, LLC), posted charts from a US Energy Information Administration out a few weeks ago that reflected this where you can see it by major basin below.

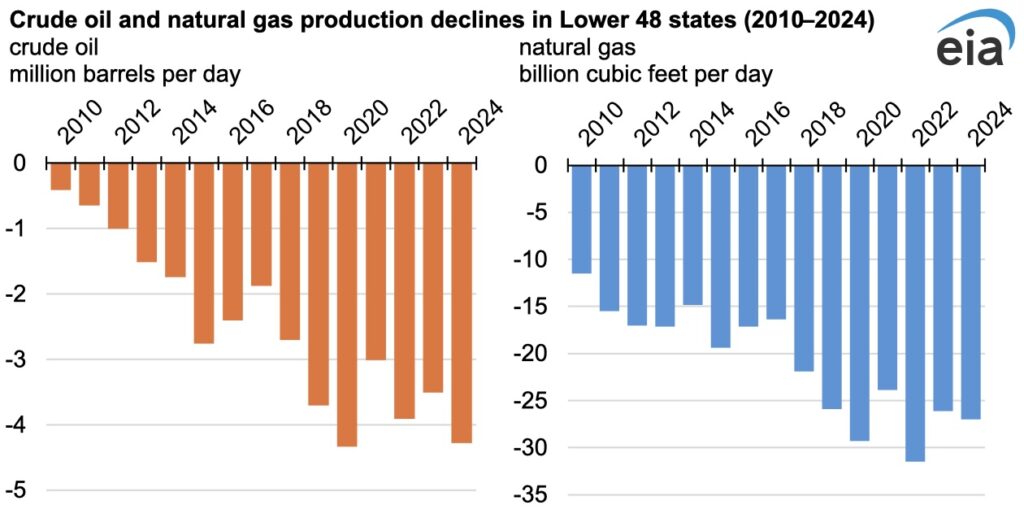

And in the chart below that, the percentage pace of the declines in totality, for both crude and natural gas.

Everybody Is Worried About The US Dollar

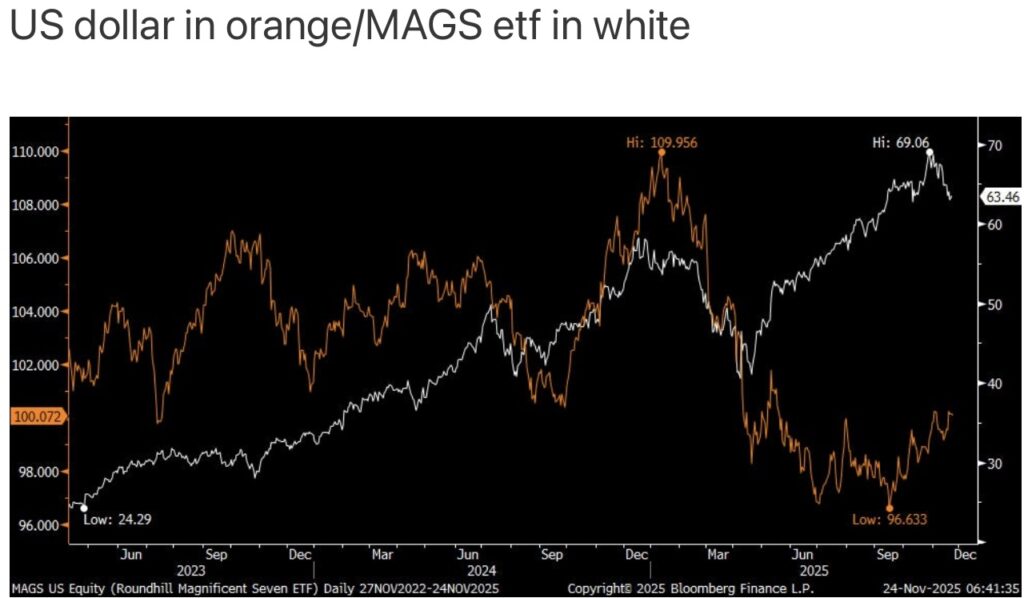

In the beginning of the year I made the case that the Mag 7 basket of stocks became a reserve currency asset for foreigners as they too piled in and that came coincident with US dollar movements. Mag 7 stocks up, US$ up and vice versa. That relationship broke apart though after the April tariff splash and off the market lows where stocks rallied but the US dollar didn’t.

What we’ve seen is that while foreigners maintained and even added to US equity holdings, they hedged up their US dollar exposure when doing so.

Last week there was an interesting article in the FT titled “Singapore’s Temasek warns weak US dollar is hitting returns.” In it they interview the CEO of Temasek where the article said he mentioned that they “had increased its dollar hedging this year in response to the greenback’s fall compared with other currencies. But he warned the cost was becoming prohibitive.”

CEO Dilhan Pillay of Temasek said at a Bloomberg event in Singapore, which the article quotes, “The Chinese are hedging, the European are hedging…it’s come to a point now where the cost of my hedge is becoming too much, that I have to therefore think about a natural hedge. What’s a natural hedge? It means I’ve got to be looking for things that give me on a net basis the return I expect for the risk associated. So some US dollar denominated assets will not give me a net return that would justify my allocation of capital there.”

And “Weakness of the US dollar to a non-dollar denominated investor is a big issue. And that, I think, will have an impact in the capital markets.”

Why is Temasek a big deal and what they say matters? Because they manage about $330 billion around the world. With our money where our mouth is, we find it important to be invested in international markets that have non-dollar exposure.

Expect Major Surprises For The Rest Of 2025 & 2026

***To listen to Gerald Celente discuss what surprises to expect for 2025 & 2026 CLICK HERE OR ON THE IMAGE BELOW.

Something Very Strange Is Going On In The Gold Market

***To listen to Alasdair Macleod discuss the highly unusual events occurring in the gold market CLICK HERE OR ON THE IMAGE BELOW.

ALSO JUST RELEASED: Celente – Surprises To Expect For The Rest Of 2025 & 2026 CLICK HERE.

ALSO JUST RELEASED: Macleod – There Is Something Very Odd Going On In The Gold Market CLICK HERE.

ALSO JUST RELEASED: There Is Something Highly Unusual Occurring In The Gold Market CLICK HERE.

ALSO JUST RELEASED: Harvey Organ Explains The Massive Fraud In The Gold Market CLICK HERE.

ALSO JUST RELEASED: John Ing – Gold’s New Trading Range Ahead of The Move To $5,000 CLICK HERE.

ALSO JUST RELEASED: Silver Just Saw Another Historic Upside Breakout, Plus A Stunning Gold Chart! CLICK HERE.

ALSO JUST RELEASED: UK Regulator’s Admission Of 41% Inflation And Systemic Fear Of Bank Runs CLICK HERE.

ALSO JUST RELEASED: Crisis, Crash, Control The US CLICK HERE.

ALSO JUST RELEASED: Massive Fraud In The Gold Market Just Exposed CLICK HERE.

ALSO JUST RELEASED: Gold, Silver And The Bursting Of A Credit Bubble CLICK HERE.

ALSO JUST RELEASED: Look At What Has Collapsed To Levels Last Seen During 2020 Panic CLICK HERE.

ALSO JUST RELEASED: Here Is The Big Picture As Gold Price Remains Above $4,000 CLICK HERE.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.