An epic bubble is still popping as gold surges near $2,400 and silver hits $28.50. Take a look…

An Epic Bubble Is Still Popping

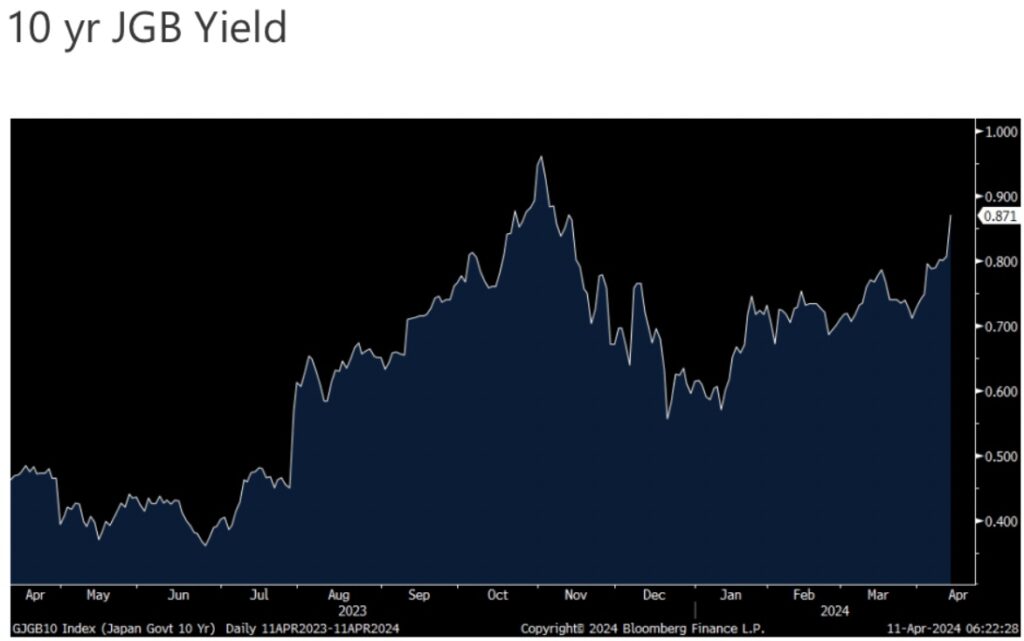

April 11 (King World News) – Peter Boockvar: I’ll say again, and sorry to sound hyperbolic, but the unwind of the great sovereign bond bubble that peaked when $18 trillion of negative yielding securities floated around in Europe and Japan continues on. People everyday are debating whether some stocks/AI related are in a bubble but the real bubble, that being in sovereign bonds, was epic and is popping still.

Japanese Yields Continue To Rise

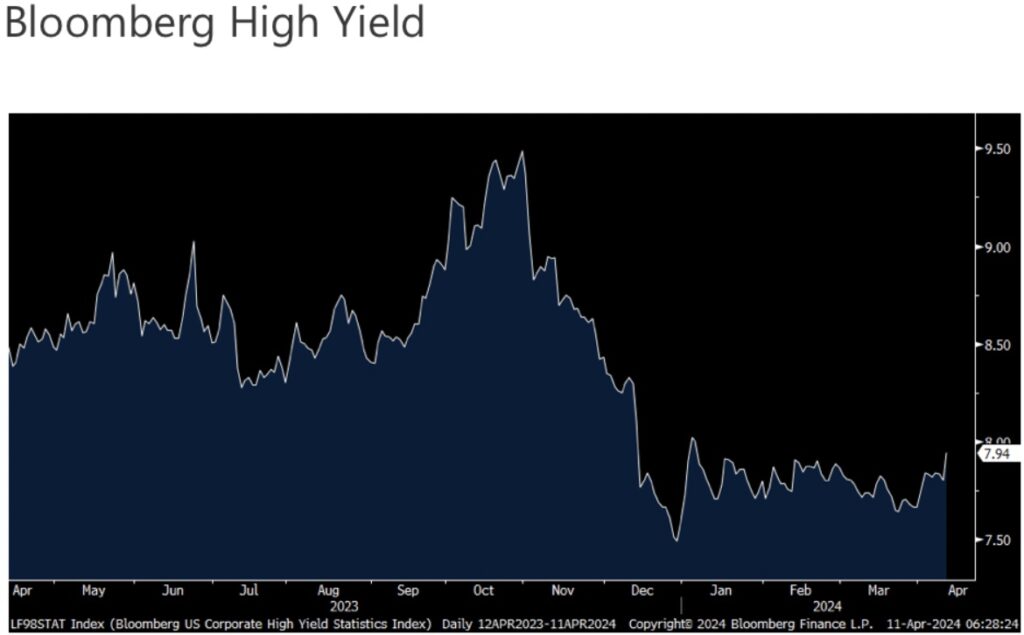

And keep your eye on corporate credit as yields rise here too, though after a ferocious rally. Here is a chart of the yield on the Bloomberg high yield index, it closed last night at the highest level since early January at just under 8%, though spreads remain tight.

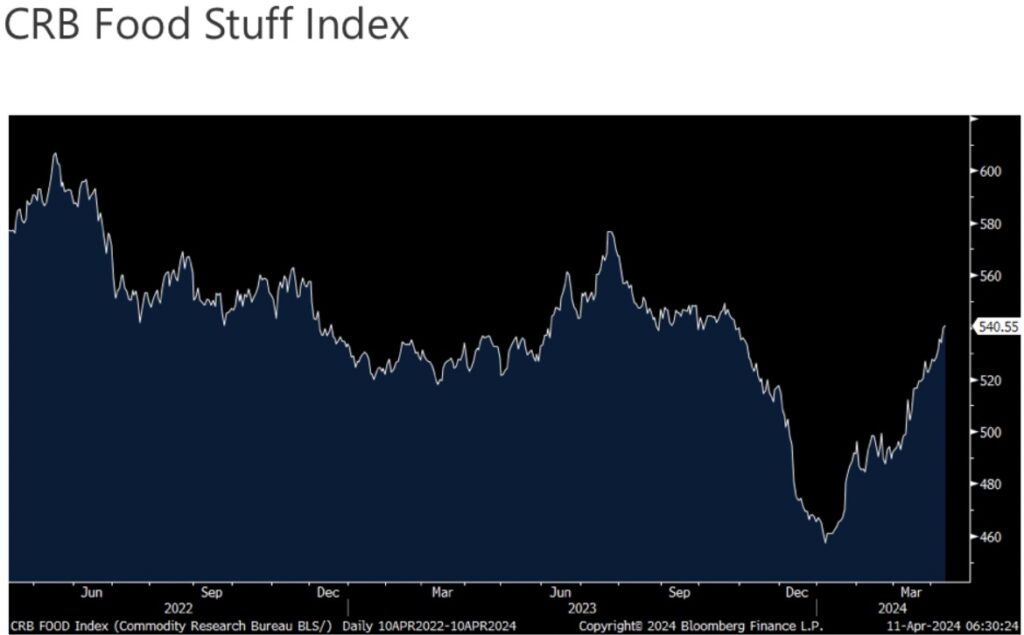

Inflation breakevens in the TIPS market yesterday jumped not only because of the CPI report but because commodity prices continued to rise. The CRB Food Stuff index closed yesterday at the highest level since late October.

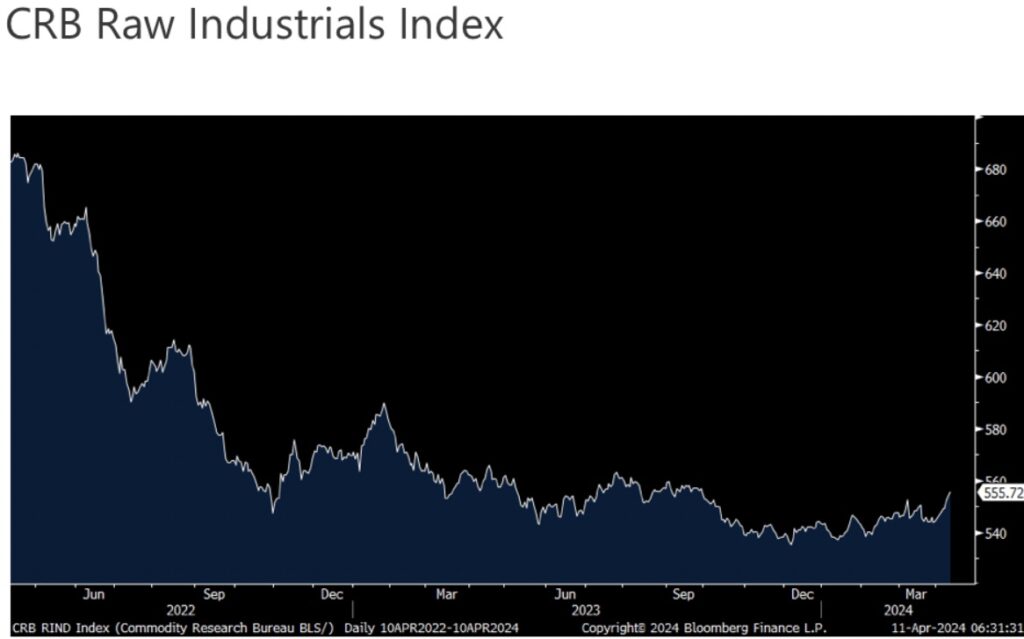

The CRB Raw Industrials index rose .30% yesterday to the highest since September, though still well off its highs. It’s up in 11 out of the last 12 days.

We remain bullish and long a variety of commodity stocks, including the precious metals, as you likely already know as I’ve talked about it seemingly forever.

As for those inflation breakevens, they were up 9 bps yesterday for the 2 yr to 2.90%, a 13 month high. The 5 yr was up 5 bps to 2.54%, also a 13 month high. The 10 yr was up 4 bps to 2.40%, a 5 month high.

Ahead of the ECB meeting today where no rate change is expected but they can’t wait to cut in June, the 5 yr 5 yr euro inflation swap is at the highest since December.

I want to say this about inflation breakevens in the TIPS market and the rate cut/hike odds that we all keep talking about priced into the swaps/fed funds futures market. They reflect how market participants/traders feel today about what will take place but those feelings change everyday depending on what data/Fed comments come our way. So predictive in a sense that people are placing their daily bets but predictions that remain dynamic each day.

The Bank of Canada did nothing yesterday as expected but is also looking for space to cut in June, though that remains uncertain. Governor Macklem said “We are seeing what we need to see, but we need to see it for longer to be confident that progress toward price stability will be sustained.” With regards to a June rate cut, “Yes, it’s within the realm of possibilities” Macklem said in answering a question.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.