An agent of chaos is about to unleash hell in global markets. Here is what you need to know…

The Good ‘Ole Days

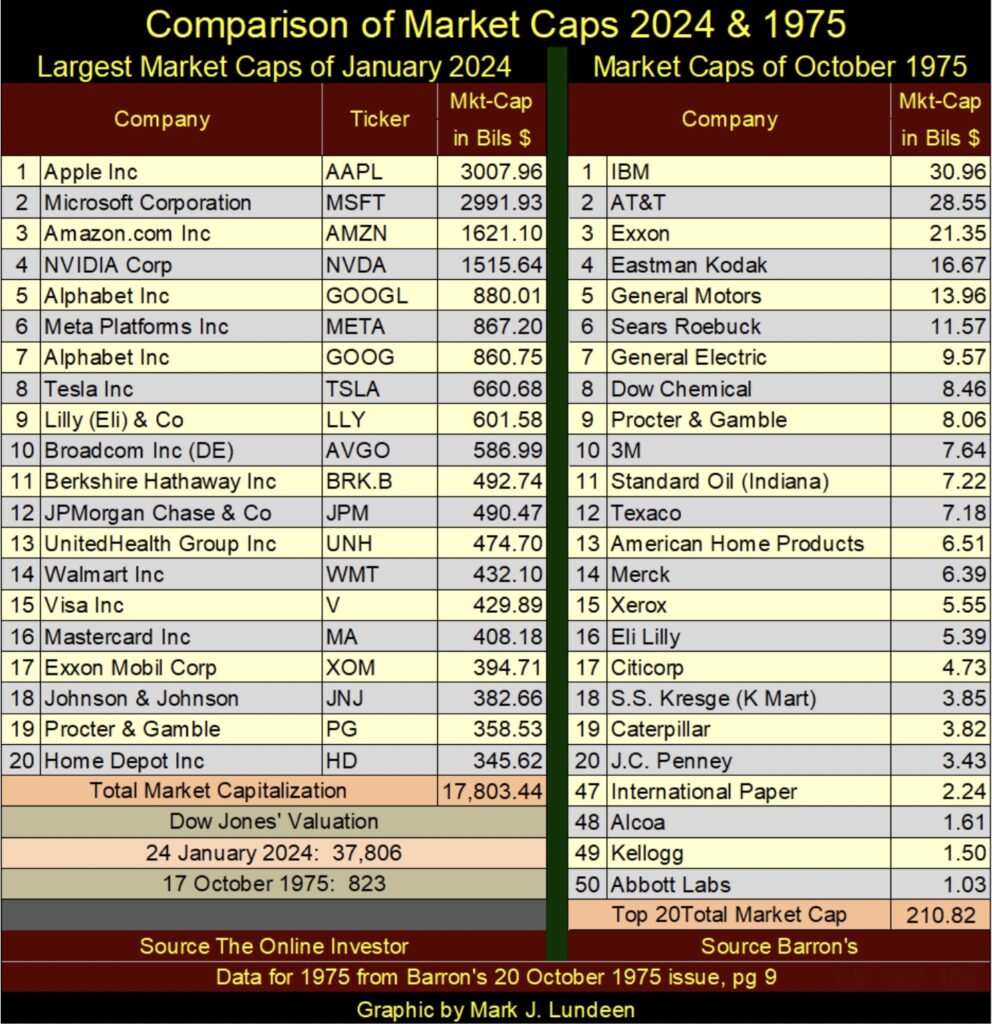

January 29 (King World News) – Mark Lundeen: … in 1975, there was only one financial company that made the top 20 list; #17 Citicorp.

Looking at the top 20 list for 1975, the economy, as traded daily in the stock market was much more diverse than it is today. Number 3 on the list; Eastman Kodak was a manufacturer of photographic film. Today, one has to look hard to even find 35MM film in a store, as digital photography has come to dominate the market. In the top twenty of a half century ago, we see retailers, oil companies, consumer goods, drug companies, a manufacturer of bathroom fixtures, automotive and heavy-equipment manufacturers, in the top 20.

As we are looking at market caps, let’s look at them. In October 1975, only four years after the US Treasury broke the dollar’s link to the Bretton Woods $35 gold peg, IBM (#1) had an enormous market cap of $30.96 billion dollars. Way back in October 1975, when the US national debt was only $551.6 billion dollars, a $30.96 billion dollar market cap was HUGE!

On the right side of the table, I also included the last four of the fifty companies listed in Barron’s article from its 20 October 1975 issue. Number fifty; Abbot Labs had a market cap of $1.03 billion. In October 1975, about 1,800 issues traded daily at the NYSE. If #50’s market cap on this list barely broke above $1 billion dollars, there must have been many companies trading at the NYSE, significant companies whose market caps were below $100 million.

Reviewing the top 20 market-caps for 2024, the market-caps are much larger, but concentrated in high-tech and finance. Retail and consumer goods still have a presence in today’s top 20. But the list has shifted towards what I believe to be a propensity of Soviet-light, high-tech snoops whose real business is to know all about you. Companies willing to use their customer base’s personal data to maximize their companies’ profit potential.

I take no joy in saying this. But I’m not stupid, so I can see it for what it is. If you use a cell phone or computer, these companies make money selling your personal information to anyone willing to buy it. All without your permission, knowledge or returning a dime to you in the selling of your life on the internet.

Wait a minute! That isn’t correct; as every user accepted these companies’ take it or leave it “TERMS OF SERVICE” before they logged on to their “services.” People should begin squawking about this digital high-tech abuse to their Congressmen and Senators, because this should not be.

There is a notable exception to that; Elon Musk’s Tesla (#8), which purchased Twitter, now X, to oppose the WEF’s New World Order…

Listen to the greatest Egon von Greyerz audio interview ever

by CLICKING HERE OR ON THE IMAGE BELOW.

I realize people read material, such as mine for insight into matters of finance. But in 2024, keeping finance separate from power politics is not only impossible, but imprudent if someone believes they can separate the two. There are people in high places, who have nothing but contempt for the world’s “little people.” The illuminated elite, who gather annually at Davos to make plans for our future, plans that you and I aren’t going to like if they are successful. It’s important they know they no longer work in the dark, by shining a light on them.

Okay, I got that out of my system, so now let’s look at the market-caps for 2024. Apple, a company that didn’t trade in the stock market in 1975, tops the list at $3,007.96 billion dollars. That is about 100 times larger than IBM’s market-cap of $30.96 billion in 1975.

However, back in October 1975, the US national debt was only $551.6 billion dollars. In January 2024 the national debt is $34,069.9 billion dollars, an increase by a factor of 61.76. As I see it, most of the gains in market-caps, and national debt from 1975 to 2024 couldn’t have happened, if the “monetary authorities” weren’t inflating the money supply.

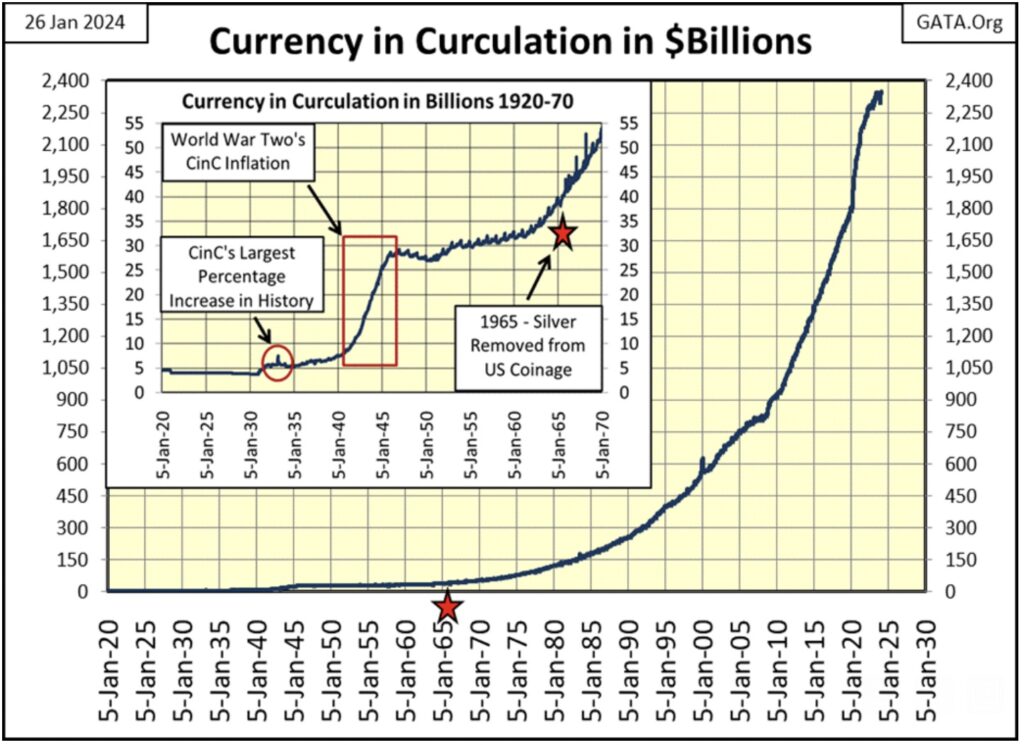

In 1920, the US national debt was only $27.39 billion dollars. CinC (paper dollars in circulation) in the chart below was only $5 billion in 1920. 104 Years later, CinC has increased to $2,332 billion in January 2024.

The chart below points out the fact the Federal Reserve was * NEVER * an “inflation fighter.” Rather, the Federal Reserve was always the GREAT ENGINE OF INFLATION, inflating bubble valuations in the stock market, real estate, costs in education, and everything else, unless it is the valuations for gold, silver, and for share prices in precious metal mining companies.

You Must Own Gold!

For your information, below is the table for market caps I first used on this topic way back in June 2017. The companies seen in it mirror most, but not all of the same companies seen above in 2024. The market caps from seven years ago were remarkably smaller than those seen today; no trillion-dollar market caps in 2017.

Why might that be? I believe FOMC’s primate idiot, Jerome Powell’s Not QE#4 of 2020, was the source of the $10,000, billion-dollar valuation inflation seen above.

Indication Of Remarkable Strength Below The Gold Market

It’s remarkable gold has been closing daily in scoring position since last mid-November. That by itself may be an indication of remarkable market strength just below the surface in gold market, that one day soon may break to the surface.

But I’m not holding my breadth waiting for this to happen, though I’m sure someday in the next year or two it will happen. Think of all those many trillions-of-dollars now circulating in the stock and bond markets, trying to squeeze into the gold and silver markets. What price would gold and silver be then, with gold and silver mining companies seeing rivers of earnings and dividend payouts gush forth from their operations!

I’ve seen where people smarter than me have considered this idea of a massive flow of funds from the financial markets into gold, silver, and the commodity markets in general. Being precious metal bulls, they’ve concluded they’d like to see this happen, but doubt it ever would as it would be a catastrophic market event. And they are 100% right.

An Agent Of Chaos Will Unleash Hell

But these are the ruminations of logical people, living in rational times. When Mr Bear returns, he is going to try to turn everything upside down. Being an agent-of-chaos, Mr Bear is going to do his best to make our lives chaotic, and markets irrational. To the degree the United States and NATO are successful in destabilizing the global-geopolitical situation, with their irrational, and ever-expanding conflict with Russia over Ukraine, Mr Bear may be more successful than even I would like him to be.

If the worse thing Mr Bear could do is create a catastrophic flow of funds from the financial markets into gold, silver and the commodity markets, at the bottom of the pending bear market, that may be exactly what we’ll see happen.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.