On the heels of the end of the first week of trading in November, it appears that all hell is about to break loose in the gold and silver markets.

Calm before the storm

November 3 (King World News) – Alasdair Macleod: The writing of this market report was at a time of great volatility, due to it coinciding with the speech of the Hezbollah leader, Hassan Nasrallah. The drift of it appears to be that Hezbollah will support Hamas. If so, it means an intensification of the Palestinian crisis, which would presumably drive gold and silver prices higher. This market report should be read in this context.

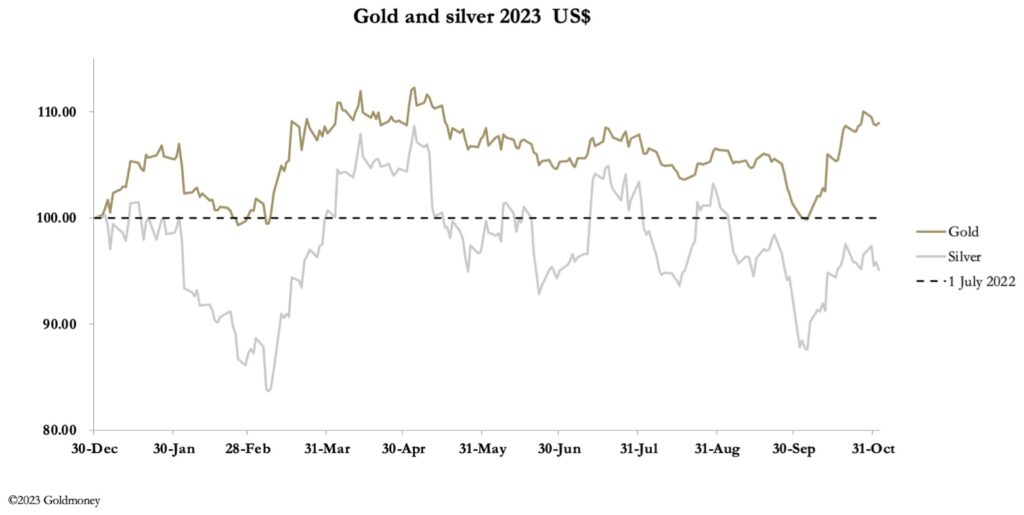

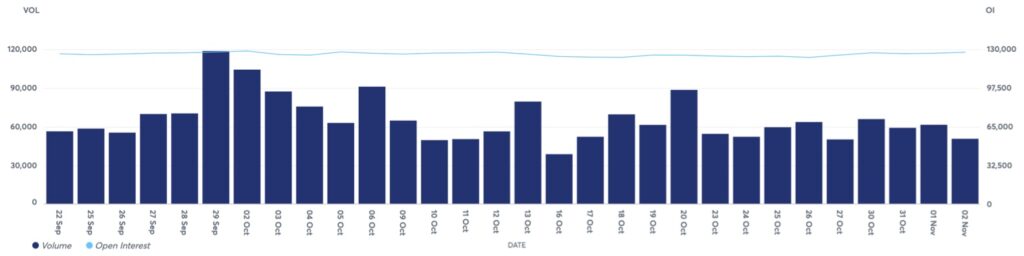

Gold and silver continued to consolidate their bullish moves of last month, with gold trading at $1997 in lunchtime European trade, down $9 from last Friday’s close, and silver was $23.25, up 15 cents on the same timescale. Gold’s turnover on Comex has been moderating, though Open Interest (the thin line in the chart below) continued to recover.

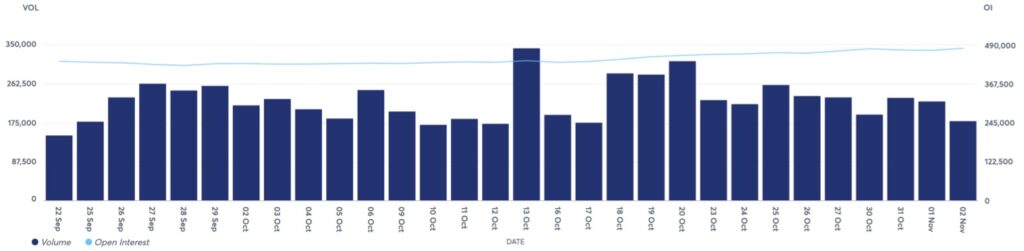

In silver, Comex volumes reflected a lack of interest, and Open Interest is only 12,000 contracts above the lowest levels of recent years.

Having briefly challenged the $2000 level, gold is now consolidating in the upper $1900s. Traders will be assessing the importance of the $2000 barrier. How much work will the price have to do to go through it convincingly, or does it mark the top for the immediate future? They will be studying their charts, which look encouraging for the bulls, as our next chart demonstrates.

A Powerfully Bullish Chart Pattern

While these indicators are not infallible, to have the 55-day moving average turning up above the 12-month MA underneath the price is a powerfully bullish chart pattern. Anecdotally, sentiment supports this bullish reading, with the investing selling ETFs. According to the World Gold Council, “September saw continued net outflows from global gold ETFs, extending their losing streak to four months”. And from WGC figures we see that in 2023 to September, ex-Asia net sales of ETFs were 203 tonnes.

Clearly, the global public got bored with gold, seeing it decline while bond yields rise. Therefore, it was hardly surprising that the price exploded upwards when the Israel-Hamas situation suddenly escalated. Indeed, that looks far from being resolved and it is a fair bet that the troubles will spread, threatening an escalation of hostilities from Hezbollah — there are already some minor skirmishes taking place…

This silver explorer recently did a huge transaction with a $4.5 billion market cap producer CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

Despite these prospects, this week has seen a lull in developments, other than predictable attacks on Gaza by Israel. That could change later today (after this report is released) because Hassan Nasrallah, cleric and leader of the Iran-backed, militant group Hezbollah will break his silence on the war between Israel and Hamas. This is bound to be critical, because as Iran’s proxy, Nasrallah will undoubtedly be defining Iran’s position. Will it be actually war, or the threat of war? In either case, it looks like leading to an escalation of tensions.

It is hard to see why Hezbollah/Iran will butt out and merely reiterate demands for peace. Meanwhile, everything is on hold. Bond yields have declined as speculators lock in profits, as the chart of the US 10-year Treasury Note shows.

Unfortunately for markets, this chart strongly suggests that the decline in yield is a normal reaction in a powerful underlying trend, implying that US bond yields are heading significantly higher. This is entirely consistent with contracting bank credit, soaring government budget deficits, and a deteriorating geopolitical outlook. These are also the conditions which drive gold prices higher.

How high one may ask. The answer is probably found in the very poor investment sentiment in gold, which is yet to correct. To listen to Alasdair Macleod’s just released audio interview discussing major surprises happening around the world that are set to ignite gold and silver prices higher and much more CLICK HERE OR ON THE IMAGE BELOW.

© 2023 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.