Ahead of the Fed Meeting here is the setup…

July 30 (King World News) – Peter Boockvar: I agree with the case for the Fed to cut rates tomorrow, a tweak as I’ve referred to it but understanding they will most likely go in September instead. I was ok with Alan Blinder’s argument in yesterday’s WSJ for most of his piece but then he lost me when he said if the Fed cut Wednesday, “I believe the markets would stand up and cheer.” He revealed the Fed’s unspoken 3rd mandate of trying to please the markets. The last time they did that we ended up with 9% inflation (and would have been in the double digits if home prices instead of rents were used).

Interestingly, in the same WSJ, ex Fed Governor Kevin Warsh wrote a piece mostly focused on the Fed’s balance sheet and said “Much of Wall Street applauds the Fed’s big balance sheet and monetary dominance in Washington. Households and businesses on Main Street have far less reason for enthusiasm” and that is because of the inflation the former has stoked. I would welcome Warsh as the next Fed chair if he was given the opportunity.

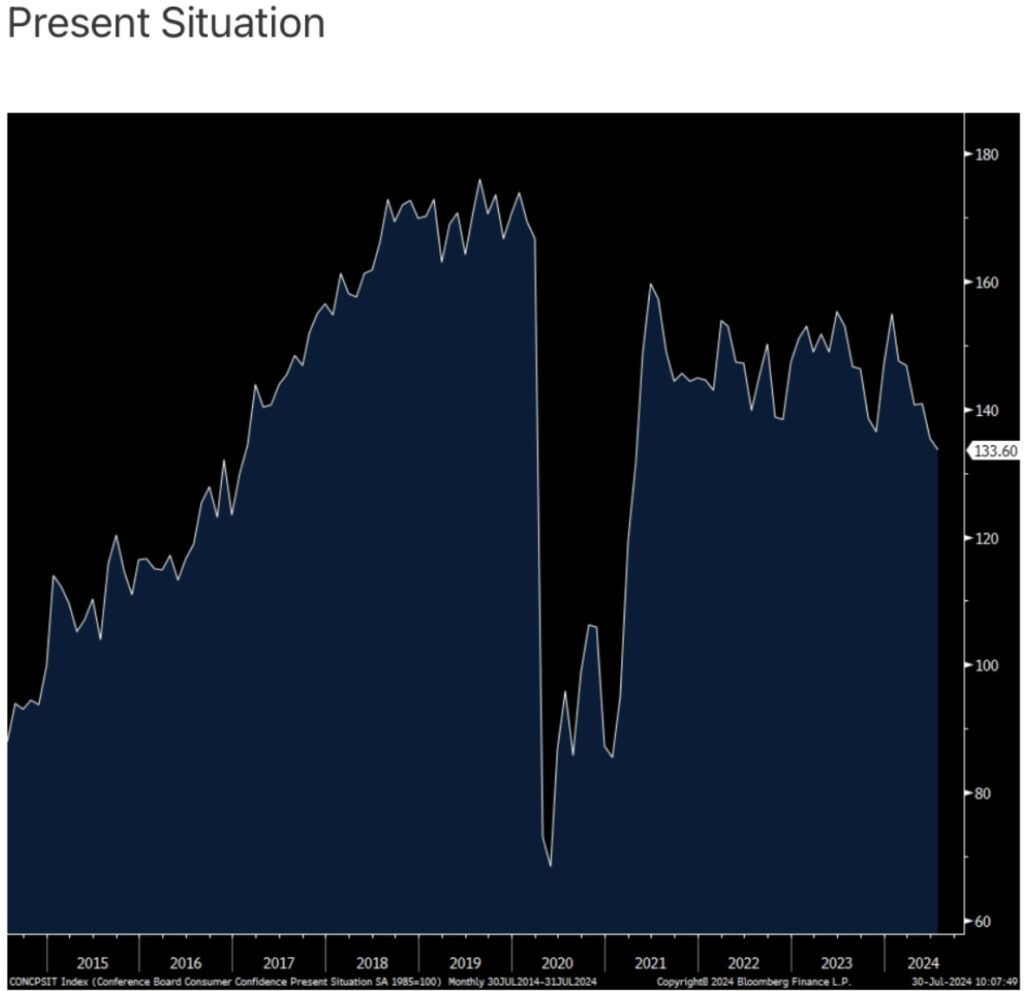

The July Consumer Confidence index from the Conference Board was 100.3, about in line with the estimate of 99.7 and compares with 97.8 in June (revised up from 100.4 initially) and 101.3 in May. There has been an interesting divergence with the two main components this year. The Present Situation has fallen to the lowest level since April 2021 and go back to January 2017, not including Covid, the last time it was lower.

On the flip side, while still pretty depressed, the Expectations component rose to the highest since January.

The differential can be explained by the labor market answers. People are more worried now but hopeful in the coming 6 months things will improve, albeit slightly.

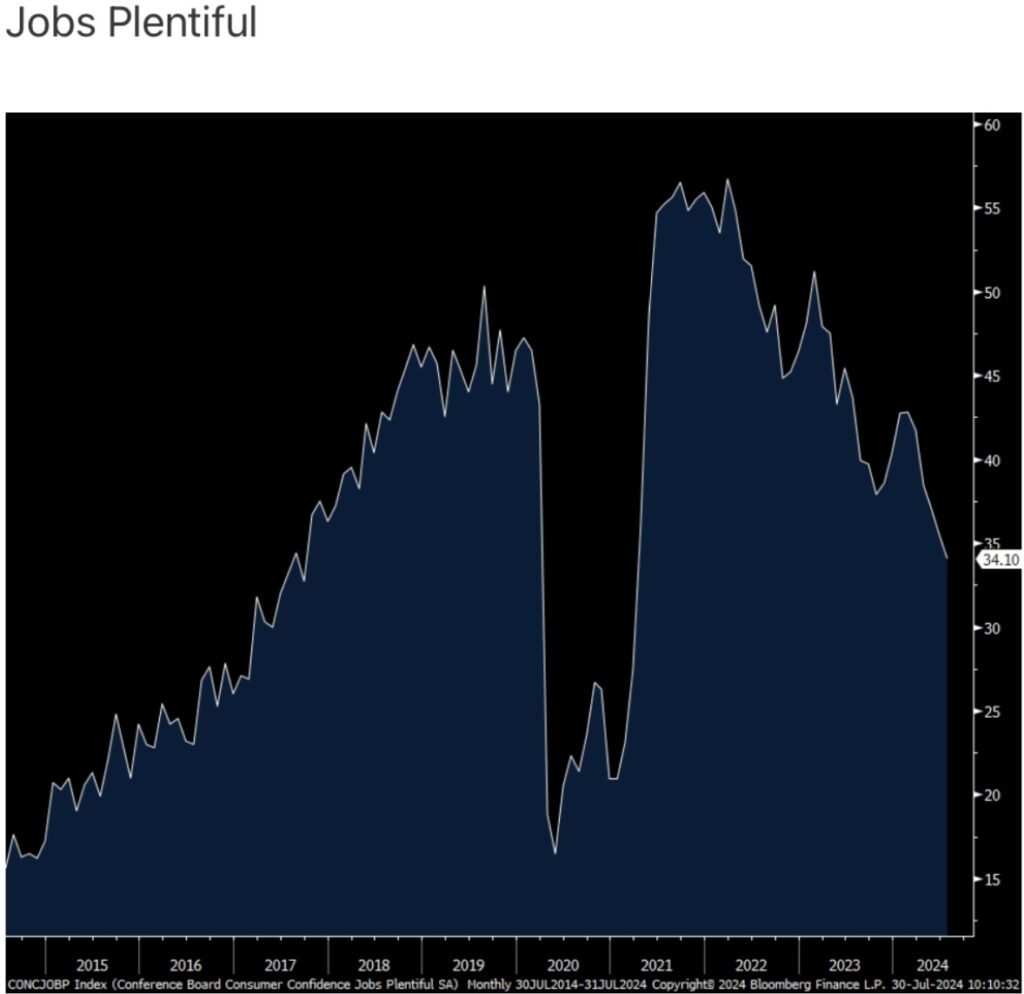

Those that said jobs were currently Plentiful fell to the lowest level since March 2021.

Jobs Hard to Get rose to the most since March 2021. On the other hand, those expecting ‘more jobs’ in 6 months rose to the highest since January, though still remaining very low.

Adding further to the unevenness, the 6 month outlook for ‘higher income’ fell to match the lowest since February 2023.

One yr inflation expectations held at 5.4% for a 3rd straight month and remaining in a tight range of 5.2%-5.4% this year.

Spending intentions continued to weaken. Expectations to buy a home fell almost 1 pt m/o/m to just 4.2, the least since 2013. Intentions to buy a car fell to the lowest since last October. Plans to buy a major appliance declined to a 3 month low.

In terms of demos, confidence rose to the highest of the year for those under the age of 35 but for those 35-54 yrs old fell to the lowest since November 2020. It rose to a 3 month high for those 55 and over…

This silver explorer recently did a huge transaction with a $4.5 billion market cap producer CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

Bottom Line

Bottom line, combine the data here and what we’ve heard from so many consumer touching businesses and we know all about the divergent state of the US consumer.

Somewhat dated, and with questions on some possible double and triple counting, job openings in June totaled 8.18mm, down slightly from the 8.23mm seen in May. That though is above the forecast of 8mm.

A factor keeping the figure above 8mm is the growing demand for workers from state and local governments. As for the private sector, job openings fell to 7.09mm and that is the 2nd lowest since early 2021 and nearing its pre Covid pace when we didn’t have work from home as a thing.

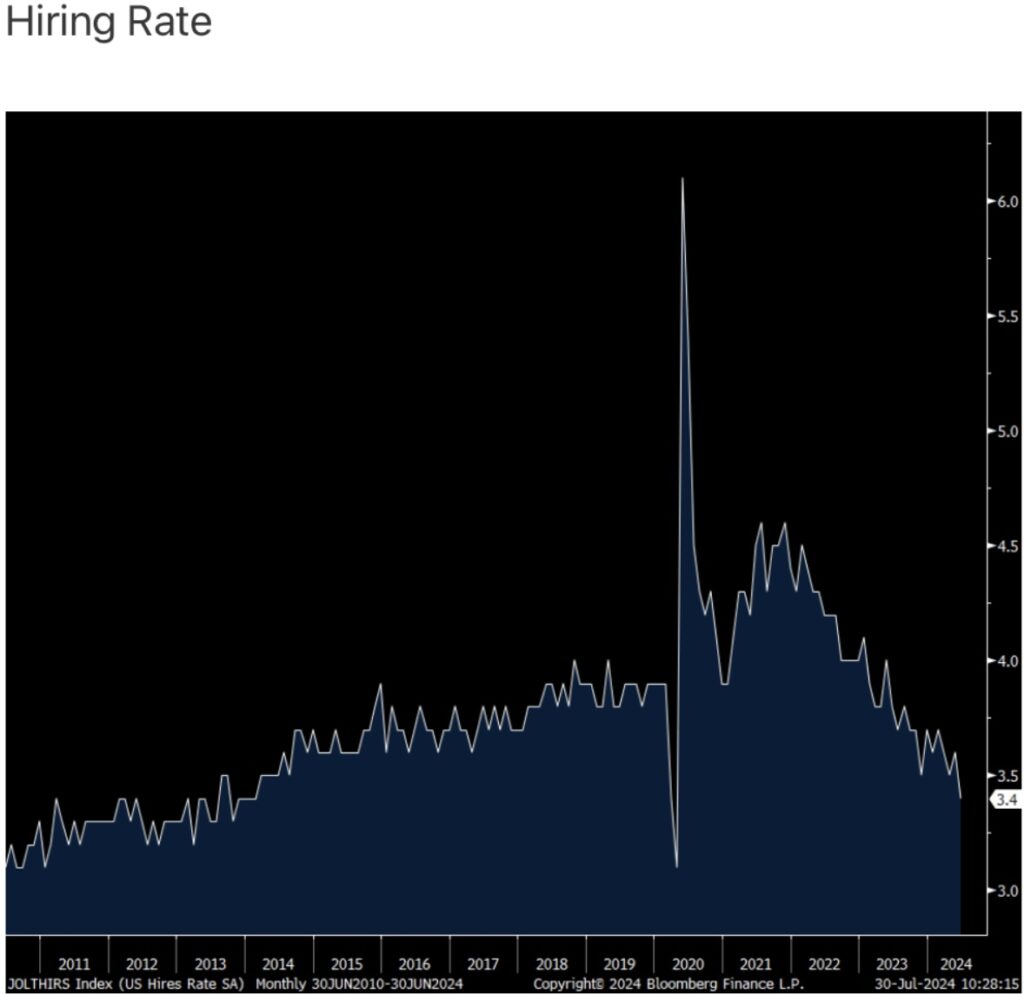

A growing issue too in the month was the hiring rate which fell to just 3.4% which is the slowest since 2013 not including Covid and not far from the Covid low of 3.1%.

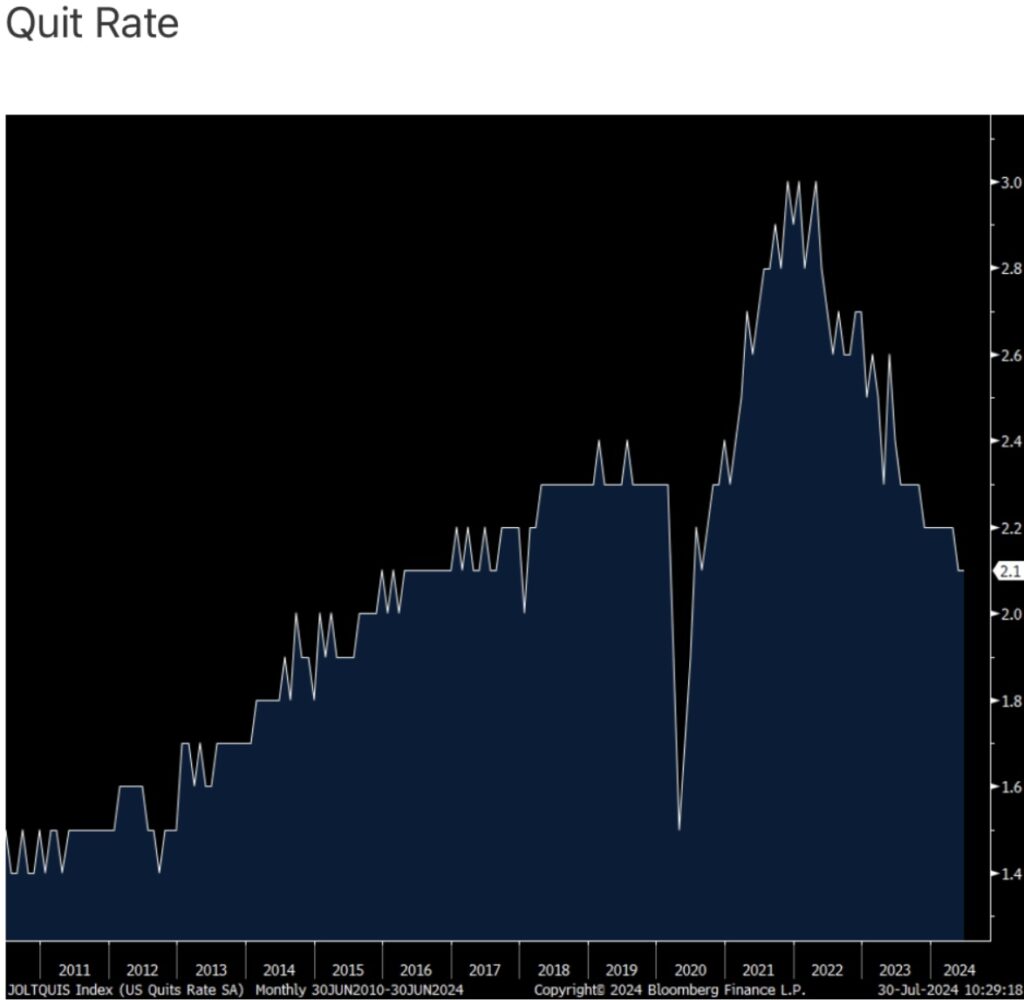

The quit rate at 2.1% is the lowest since 2018, also taking out Covid data.

Bottom line, the labor market is seeing a more muted demand for new workers at the same time we’re seeing a pick up in firing’s, albeit somewhat, as seen in the initial claims data.

Released!

To listen to Alasdair Macleod discuss the volatile trading in the gold and silver markets click here or on the image below.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.