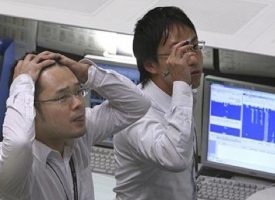

For those who are wondering what is ahead, a whole lot of pain is coming.

By Bill Fleckenstein President Of Fleckenstein Capital

March 14 (King World News) – Today’s headline refers to the fact that, really for the first time since the Trump rally began, it actually feels like the market may have achieved exhaustion. I am aware that I have noted a couple of potential island reversals (which ended up not mattering); however, today I am just describing how the market feels to me. Of course, I could easily be wrong, but I thought I would at least bring up the point because if I’m right we will see some weakness, followed by a failing rally, followed by a whole lot of pain…

IMPORTANT:

To hear which legend just spoke with KWN about $8,000 gold and the coming mania in the

gold, silver, and mining shares markets CLICK HERE OR ON THE IMAGE BELOW.

QE Fumes May Prove Flammable

For the last group of years I have discussed my view that any downside that gathered even the slightest bit of momentum could accelerate into a dislocation quickly. When I say “quickly” I don’t mean that as soon as the peak is seen the market will collapse. I mean that if we gather momentum to the downside, between the paid-to-play crowd, ETFs, the public that has piled in, and whatever negative impact derivatives may have, I don’t think you could have created a more combustible mix if you had set out to do so.

Then again, there is the budding problem with world bond markets, which may have seen their 35-year bull market end last summer, and when all that is mixed together, along with geopolitical issues and Trump’s governing style, you really have the recipe for a volatile combination if the collective mindset of the world’s investors starts to change.

I don’t want to get too far ahead of myself, but I haven’t had much to talk about from a strategic standpoint for a while so I thought I would bring all that to everyone’s attention.

Absence of “Why” Catches the Eye

As for today’s action, the market bolted lower right out of the blocks and within a couple of hours the indices were roughly 0.75% lower, for no particular reason (which is exactly what I found interesting). But then they started to rally in the afternoon and were down less than 0.5% with a couple hours to go, when I had to leave.

Away from stocks, green paper was higher, oil lost another couple of percent, fixed income was a bit firmer, and the metals were flattish.

Let’s Get Straight To the Points

We get the Fed announcement tomorrow and in the wake of that it should be very interesting to see how all these markets trade, especially if a turn in the tide is at hand.

Included below are two questions and answers from the Q&A’s with Bill Fleckenstein.

Bonus Q&A

Question: Bill: The debt ceiling was last mentioned here on Dec 15 (I ran the search). It’s now coming up this Wednesday, 3 months since we last discussed it (and then only very briefly). Obviously we’ll have to wait and see what transpires, but my impression of Republican Party dynamics is that the Tea Party caucus members actually really care about absolute levels of debt (as do most of us here). That is, how are these fiscally-conservative Republicans going to green-light $54 billion for defense, troops rolling into Syria, a border wall, a 10-year trillion dollar infrastructure program, an Obamacare replacement that cuts very few costs and keeps funding the health cartels, more police and prison guards everywhere, etc.? Given that his policies haven’t exactly been unitary with the Democrats, do you see any chance that the Donald can get a majority to pass a raised debt ceiling? If so, how do you think he could pull it off?

Answer from Fleck: “I don’t have any idea how the debt ceiling circus will play out, except that it will be raised. The concept of a debt ceiling is a farce. The law was passed in 1989 when the national debt was about $2.8 trillion. Today it is $20 trillion. It is a bad joke, and so I pay little attention to the nonsense about “maybe they won’t raise it.” I’ve seen that silly movie too many times.”

Question: Fleck, Here is a vid of Jim Grant on bubble vision, and he is talking about this new MIT study that states that inflation is actually running at 3.6 percent, and he states “that if it was a stock you would want to own it.” The dismay of the anchors is hilarious, Kernan says something to the effect that he never thought he would have to worry about inflation again…priceless. Watch inflation data: Jim Grant

Answer from Fleck: “Thanks. Inflation will be a problem again that they will not be able to fight. They are trapped.”

***To subscribe to Bill Fleckenstein’s fascinating Daily Thoughts CLICK HERE.

***KWN has now released the remarkable audio interview with legendary James Dines and you can listen to it by CLICKING HERE OR ON THE IMAGE BELOW.

***ALSO JUST RELEASED: Here’s What You Need To Know Ahead Of Tomorrow’s Fed Rate Hike CLICK HERE.

© 2017 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.