Gold and silver rallied on Friday on fears that a US strike could unleash World War III.

King World News has just released Alasdair Macleod’s latest audio interview discussing a terrifying issue facing the world and how it will impact gold, silver, stock markets and more (Link at bottom of this article). But first…

February 21 (King World News) – Alasdair Macleod: In very low turnover on Comex, gold and silver begin to recover as geopolitical tensions rise. Evidence is increasing of a possible attack by the US on Iran in the coming days.

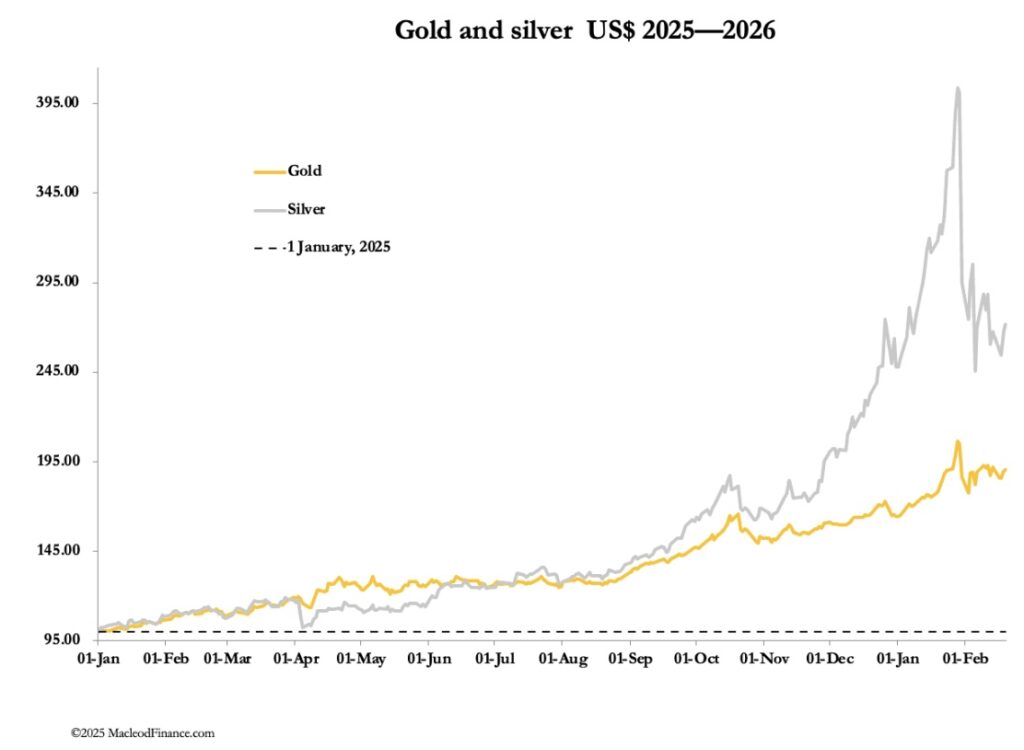

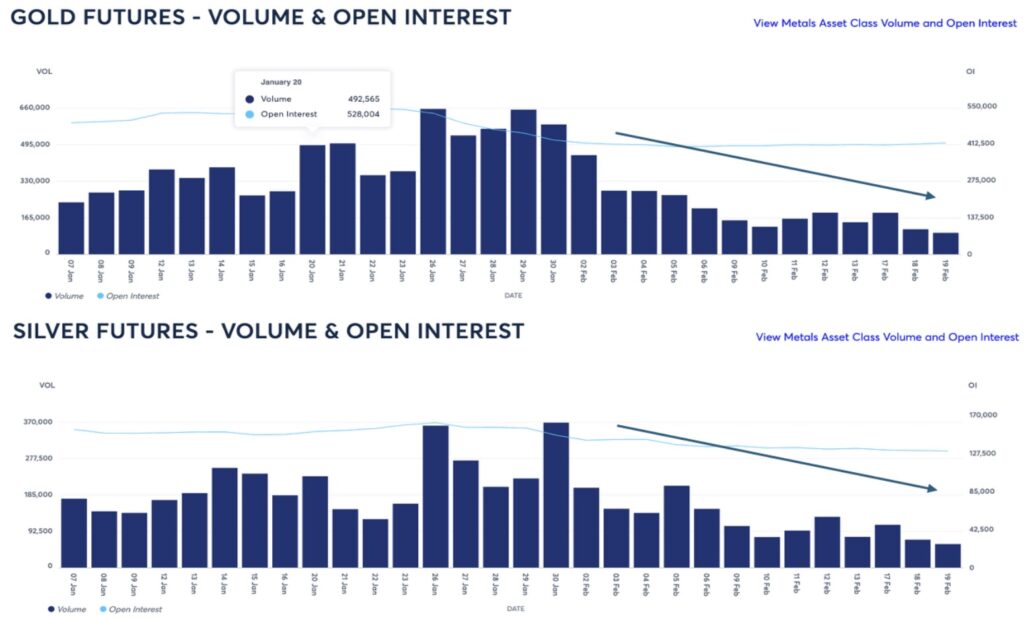

Gold and silver rallied this week in a firmer tone suggesting a gradual climb higher is in prospect. In Europe this morning, gold traded at $5025, up $105 from last Friday’s close, while silver at $80.50 was up $5.30 over the same timeframe. US markets were closed on Monday for Washington’s birthday, which may have contributed to pitifully low volumes on Comex, arrowed on the charts below:

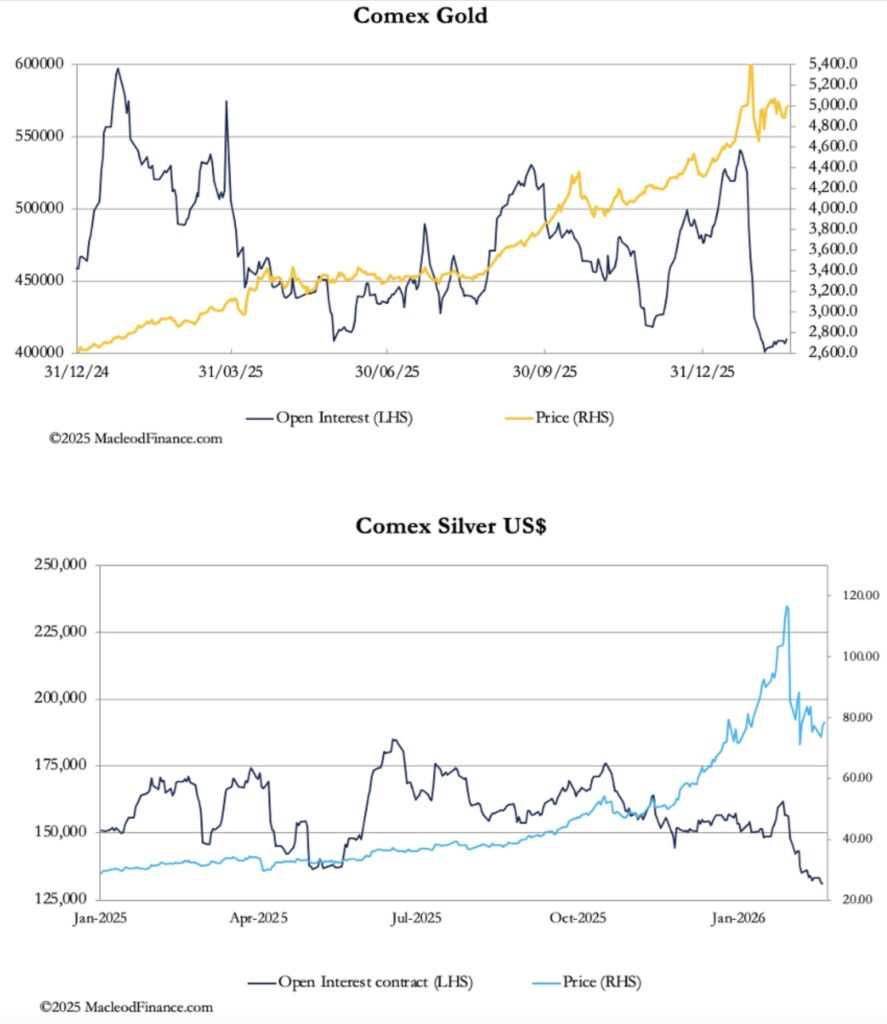

These turnover numbers are exceptionally low, even for holiday periods and reflect a futures market dying on its feet. Open interest in both contracts is also very low, but gold’s is showing some signs of recovery, illustrated next:

Clearly, speculative interest is virtually absent in both contracts, which is likely to be reflected in London’s forward market. If the point behind the recent shakeout was to rinse out flaky longs, then that process is completed.

There has been some uncertainty over price trends during China’s new year holiday, with Shanghai markets being closed for the entire week, reopening on Monday. The evidence is that this is where prices are being determined, particularly for silver with London and New York playing a secondary role. Therefore, the few speculators on the short side would be sensible to close their bears ahead of the weekend, which explains the feel of a firmer underlying tone for both metals from mid-week onwards.

Additionally, there is mounting speculation by informed sources that the US is preparing to mount an attack on Iran in the next few days. If so, then it could take place this weekend. It follows Bibi’s visit to Washington with his list of demands to be satisfied in current US—Iran negotiations, which are clearly unacceptable to the Iranians.

The UK is reported to have refused to allow the US to use the RAF’s Fairford airbase in Gloucestershire in an attack on Iran. If the report in Wednesday’s The Times is true, US plans to attack Iran are well advanced and are being frustrated by the UK’s interpretation of international law over the use of its airbases.

We can guess that the UK government will give way. But Iran has made it clear that if she is attacked, she will respond aggressively against US bases in the region and use her recently obtained Russian hypersonic missiles against Tel Aviv. Additionally, she will close the Straits of Hormuz, which Goldman Sachs believes could spike oil to $300. Furthermore, the 2026 comprehensive strategic pact between Iran, China, and Russia comes into the picture, potentially escalating a US-Iran conflict into a wider conflict which would almost certainly backfire badly on the US.

All this points to a US attack in the coming days being unlikely, with US tactics primarily intended to maximise pressure on Iran’s negotiators. They surely suspect this, expecting to force the US to back down, though tensions are likely to continue to exist.

In other news which might be distantly related to ongoing Middle East tensions, early this month China advised domestic investment institutions and banks holding US treasuries to reduce their exposure. This is the most public attack on US finances so far, a message sure to be noticed by other holders of US debt when as much as $10 trillion of it is due to be refinanced in 2026 in addition to funding the current budget deficit.

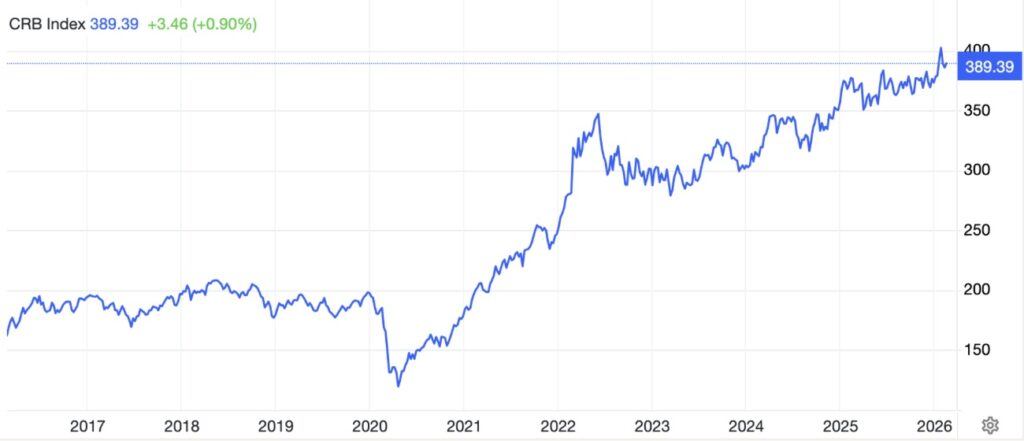

We shall see how it plays out. But for now, it should be noted that the dollar’s purchasing power is declining at an alarming rate, which is the message from the gold price rising sharply in recent months. And where gold goes, so do commodities in general, indicated by the chart of the CRB Index which is clearly heading higher:

This index comprises 19 commodities, including base metals, agriproducts and energy. It has tripled since 2020 and indicates commodity-driven inflation will continue to be a problem in 2026—2027.

This gives the Fed a headache when the US economy appears to be stalling and therefore requiring lower interest rates to lessen a recession. Domestic issues are bound to take precedence over preserving the purchasing power of the dollar, driving the dollar lower still, and therefore gold and commodity prices higher. To listen to Alasdair Macleod discuss a terrifying situation facing the world and how it would impact gold, silver, stock markets and more CLICK HERE OR ON THE IMAGE BELOW.

ALSO RELEASED!

Look At What Is Sending Bank Stocks Plunging And Gold Prices Higher CLICK HERE.

Friday’s Trading Could Be Absolutely Wild! CLICK HERE.

SPECIAL REPORT: AI Fears Grip Equity Markets CLICK HERE.

Gold Price Rebounds As Oil Price Surges Strongly CLICK HERE.

Look At This Once In A Lifetime Opportunity CLICK HERE.

Are We Seeing The End Of Derivatives In The Gold Market CLICK HERE.

Nomi Prins Says Despite Volatility Silver Price Will Hit $180 By The End Of 2026 CLICK HERE.

Here’s Why Gold & Silver Are Rallying After Thursday’s Takedown CLICK HERE.

Gold: The Anti-Bubble, Plus How Do I Keep My Money? CLICK HERE.

Is Another Gold & Silver Takedown About To Happen? Plus $369 Oil And Booming Commodities CLICK HERE.

Albert Edwards – Is The NASDAQ About To Crash? CLICK HERE.

People Are Being Deceived, The Gold Bull Market Is Not Finished CLICK HERE.

Michael Oliver – Gold Bull Market Nowhere Near Its Final Climax CLICK HERE.

Astonishing! The Super Wealthy Still Don’t Own Gold As Miners Near Blastoff CLICK HERE.

$10,000 Gold And The Vault Behind COMEX CLICK HERE.

Investing Legend Rob Arnott Says Silver vs Oil Ratio Reached Insane Levels CLICK HERE.

Michael Oliver – Historic Breakouts Will Now Send Gold & Silver Prices To Levels That Will Shock The World! CLICK HERE.

© 2026 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.