Today the short squeeze in the silver market continued with shortages of physical metal being seen across the world.

King World News has just released Alasdair Macleod’s latest audio interview (link below). But first…

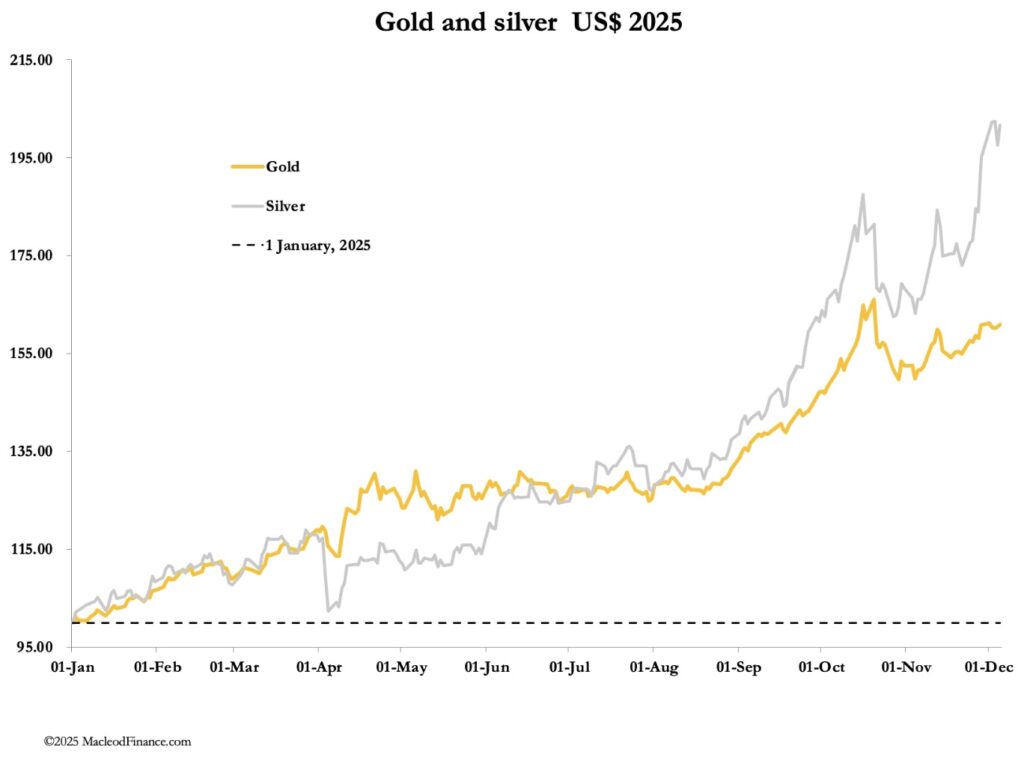

Silver tests new highs

December 5 (King World News) – Alasdair Macleod: While silver bullion stocks are improving in SGE/SHFE vaults, shortages persist in London and Comex deliveries are soaring. Meanwhile a global bond market crisis will drive gold higher.

With China protecting her own silver supplies, the silver squeeze is set to continue, particularly as India continues to ramp up her demand. Meanwhile, developments in global bond markets increasingly point to a funding crisis for the US government which can only be resolved through massive QE, debasing the dollar in 2026.

In European trade this morning, gold was $4224, barely changed on the week, while silver at $58.20 was up $1.60 from last Friday’s close. Silver spent most days establishing new highs before a brief selloff yesterday (Thursday).

It was definitely silver’s week, despite appearing to cool slightly in China. Metal in the SGE/SHFE vaults increased above the 600-tonne level to 688 tonnes, suggesting panic over. But China is imposing a strict licensing criteria to restrict exports from January to protect domestic supplies. More on this follows.

Meanwhile, the silver squeeze continues in London and Comex, with liquidity continuing to be tight. Comex stand for deliveries associated with the December contract expiry total 1,570 tonnes so far bringing the total for 2025 to 14,404 tonnes, proving that Comex is the largest single source of silver in the world, driven entirely by industrial demand.

Much of that demand is from a new source — India. India’s economy is growing rapidly, enjoying an economic transformation similar to that which propelled China in recent decades. Investment in manufacturing is soaring, nowhere more than in photovoltaics. And where do the large Indian conglomerates go for their silver, when the refiners are already busy and giving long wait times? Comex of course.

With China dominating over half of global refined supply and restricting exports to protect its industries, there can only be one outcome — the most vicious squeeze on industrial supplies has only just started. This is just beginning to be understood by investors in Asia. In a tweet this morning, BullionStar in Singapore reported silver demand surging, selling three times more silver than gold by value.

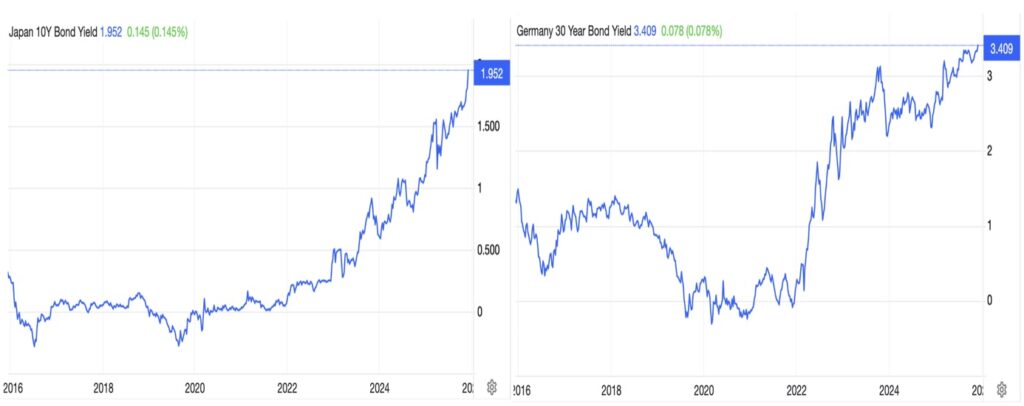

With this attention focusing on silver, it is perhaps understandable that gold is flying under the radar. But there are major developments which are increasingly destabilising the global monetary system. At a time when the Fed is abandoning inflation targeting in favour of monetary easing, bond yields elsewhere are rising sharply. The charts below should be ringing alarm bells.

Global carry trades are based on low interest rates and bond yields in yen and euros. Yet bond yields in JGBs and German bunds are rising steeply, a trend which looks like accelerating. Meanwhile US jobless figures are beginning to rise, and the Fed is moving from QT to QE. With the carry trade set to collapse and recession threatening to increase US funding requirements, there is only one way in which this dilemma can be resolved: QE by the Fed on an unimaginable scale.

The dollar’s debasement in 2026 will be substantial, driving gold significantly higher — not because gold is rising but because the dollar’s purchasing power will be destroyed by the only policy a Trump appointee to replace Jay Powell at the Fed can follow.

We finish with a technical chart on the gold/silver ratio, which is plummeting:

Just Released!

To listen to Alasdair Macleod discuss silver approaching $60 and the surprising reasons why it surged to new all-time highs CLICK HERE OR ON THE IMAGE BELOW.

ALSO JUST RELEASED: Yes, Gold, Silver, Copper, But Take A Look At This Metal CLICK HERE.

ALSO JUST RELEASED: They Have Lost Control, Plus Another Gold & Silver Bull Catalyst CLICK HERE.

ALSO JUST RELEASED: Greyerz – This Man’s Predictions For The World Are Absolutely Terrifying CLICK HERE.

ALSO JUST RELEASED: 2026 WARNING: Expect More Interventions And A Scorched Economy CLICK HERE.

ALSO JUST RELEASED: We Are Headed Toward Crisis And The Destruction Of Fiat Currencies CLICK HERE.

ALSO JUST RELEASED: Besides Silver, Take A Look At This Metal CLICK HERE.

ALSO JUST RELEASED: Silver Futures Near $60 As Gold, Copper & Oil Markets Heat Up CLICK HERE.

ALSO JUST RELEASED: More Metal Shortages Plus The Road To $10,000 Gold CLICK HERE.

ALSO JUST RELEASED: Friday’s Comex Shutdown And The Wild Trading In Silver After It Reopened CLICK HERE.

ALSO JUST RELEASED: COMEX Shutdown Sparks Wild Stories About A Meltdown In The Silver Market CLICK HERE.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.