Look at who just warned that we need to expect higher inflation in 2026.

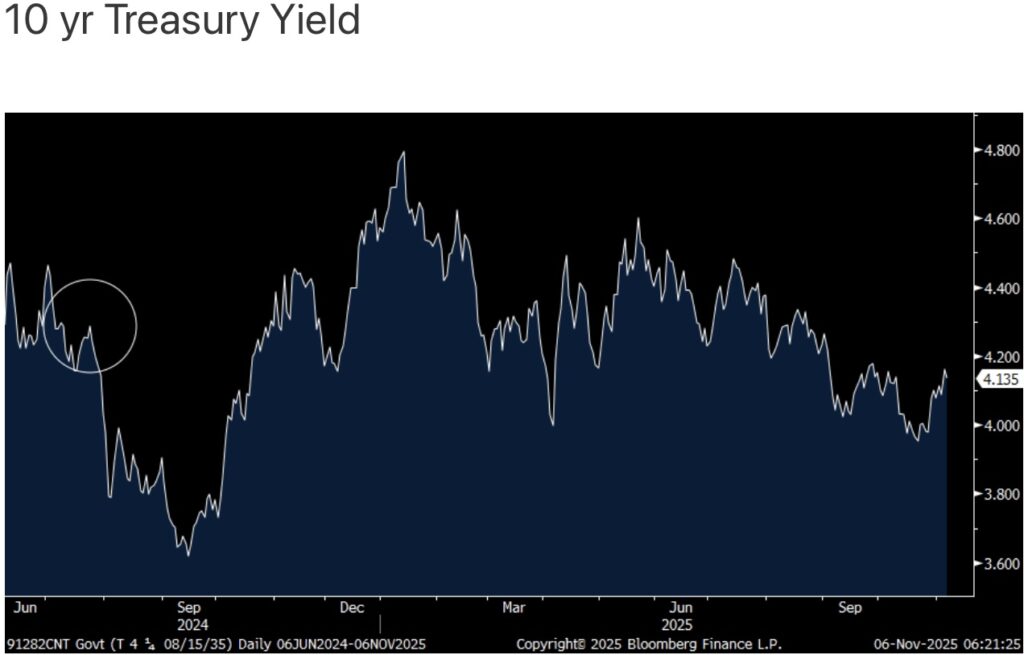

November 6 (King World News) – Peter Boockvar: So the Federal Reserve cuts rates by 150 bps over the past 14 months and all we got was a stinking 15 bps drop in the 10 yr Treasury yield? Of course I can pick any starting point but I’ll pick July 24th 2024, because it was right before the 10 yr yield took a big leg lower into the September 2024 lows at 3.6%, see spot circled below. On that date in July the 10 yr yield was 4.29% vs today’s level of 4.14%. I still believe we’re in a bond duration bear market and long term rates are going to stay higher for a while. The Fed cuts and the calls for more are just not having the intended impact on the long end of the curve where the long end doesn’t want an easy Fed because of its distaste for inflation.

Strictly from a stock market sentiment standpoint I believe the stage is now set for a pullback because the two figures I believe have statistical significance now show extreme bullishness. I reflected Monday the off the chart Euphoric read in the weekly Citi index. Seen yesterday was the Investors Intelligence survey which already had a Bull/Bear spread above 40 but now you have the level of Bulls kissing 60 at 59.3, up from 57.7 last week. Off the lowest level since January 2018, Bears ticked up to 14.8 from 13.5. That spread of 44.5 from 44.2 last week is dangerously wide. I want to emphasize that any stock market digestion that this leads to would just be a short term reset as that is only what sentiment indicators are relevant for.

Without jobless claims today and payrolls tomorrow but after getting ADP yesterday, Challenger today said employers cut 153,074 jobs in October, up 175% y/o/y and higher by 183% from September. They said, “October’s pace of job cutting was much higher than average for the month. Some industries are correcting after the hiring boom of the pandemic, but this comes as AI adoption, softening consumer and corporate spending, and rising costs drive belt-tightening and hiring freezes. Those laid off now are finding it harder to quickly secure new roles, which could further loosen the labor market.”

With respect to hiring, Challenger said that US employers have reduced the pace by 35% y/o/y and we’re on track for the lowest year-to-date pace since 2011.

From McDonald’s whose stock traded up but slightly missed estimates and they confirm what we keep hearing:

“In the US, we continue to see a bifurcated consumer base with QSR traffic from lower income consumers declining nearly double digits in the third quarter, a trend that’s persisted for nearly two years. In contrast, QSR traffic growth among higher income consumers remains strong, increasing nearly double digits in the quarter.”

“We continue to remain cautious about the health of the consumer in the US and our top international markets and believe the pressures will continue well into 2026.”

On the cadence, “I think we saw that in the US, kind of got a little bit worse through Q3 and into the start of Q4. I’m talking about from an external perspective.”

On inflation, “we’re expecting to see there’s going to be above average inflation next year. You’ve heard others referencing what’s going on with beef prices. Certainly we’re seeing very high inflation around beef prices versus what we’re used to historically. And so I think all of that just keeps putting pressure on the industry.”

ALSO JUST RELEASED: Bank Crisis: Banks Are In Trouble…Again CLICK HERE.

ALSO JUST RELEASED: The US Economy Is Beginning To Implode CLICK HERE.

ALSO JUST RELEASED: AI, Massive Layoffs And The Coming Stock Market Crash CLICK HERE.

ALSO JUST RELEASED: Silver & Gold: Do Not Get Beat Down By The Declines CLICK HERE.

ALSO JUST RELEASED: The Devil’s Box And The Gold Market CLICK HERE.

ALSO JUST RELEASED: Fear Index Reaching Levels Last Seen Prior To 2008 Global Collapse CLICK HERE.

ALSO JUST RELEASED: John Ing: When It Comes To Gold “We Haven’t Seen Anything Yet” CLICK HERE.

GOLD, SILVER, MINERS: John Ing’s Must Listen Audio Interview!

John Ing is a man of great wisdom, and he discusses exactly what his contacts are sharing with him as well as where the price of gold, silver and the miners are headed and you can listen to it now by CLICKING HERE OR ON THE IMAGE BELOW.

To listen to Alasdair Macleod discuss what is happening with gold, and especially silver and the mining stocks CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.