Gold futures closed the week back above the $4,000 level, but investors are wondering what is next?

Game on!

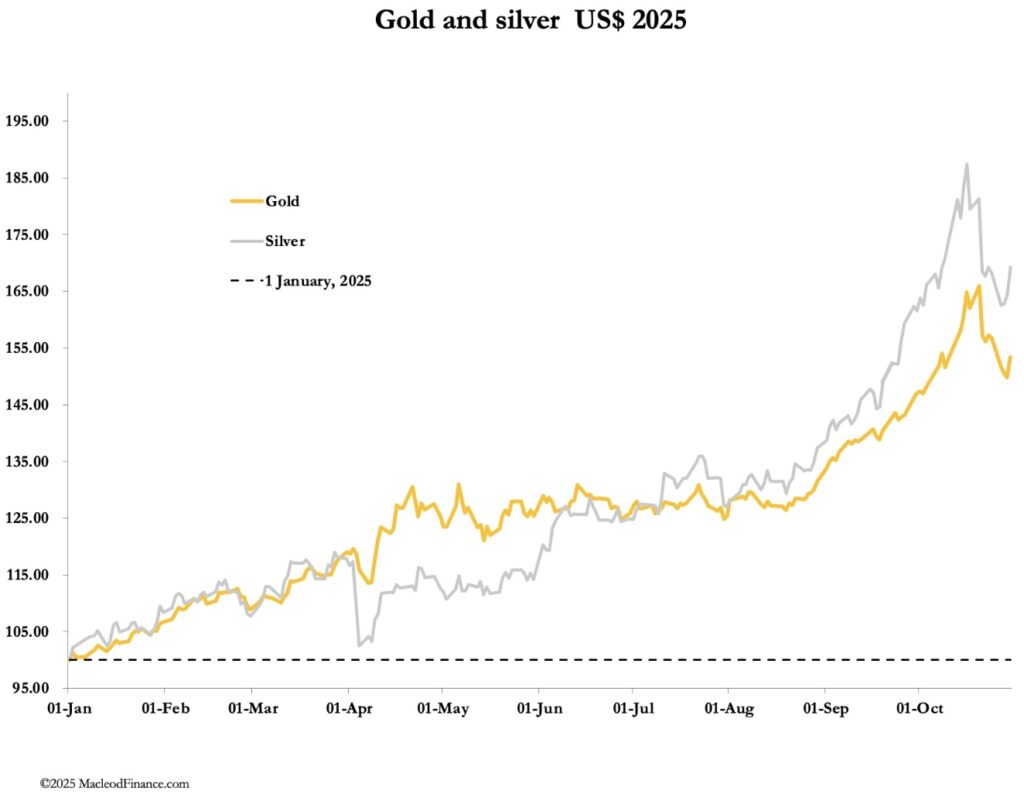

October 31 (King World News) – Alasdair Macleod: Despite recent weakness in gold and silver, the early indications are that the current consolidation phase is unlikely to last long before prices resume their uptrend.

It may be too early to conclude that after the shakeout of the last two weeks we have seen the bottom in gold and silver prices. But current physical liquidity constraints and the reasons for buying gold and silver have not gone away, suggesting that prices are being set up for another run higher.

Gold and silver steadied this week after retreating from all-time highs the previous week. In London trading this morning gold was $4010 after a low of $3887 on Tuesday, to close a net $100 lower from last Friday’s close. Silver was more resilient at $48.80 after a low of $45.60, for a net gain of 20 cents.

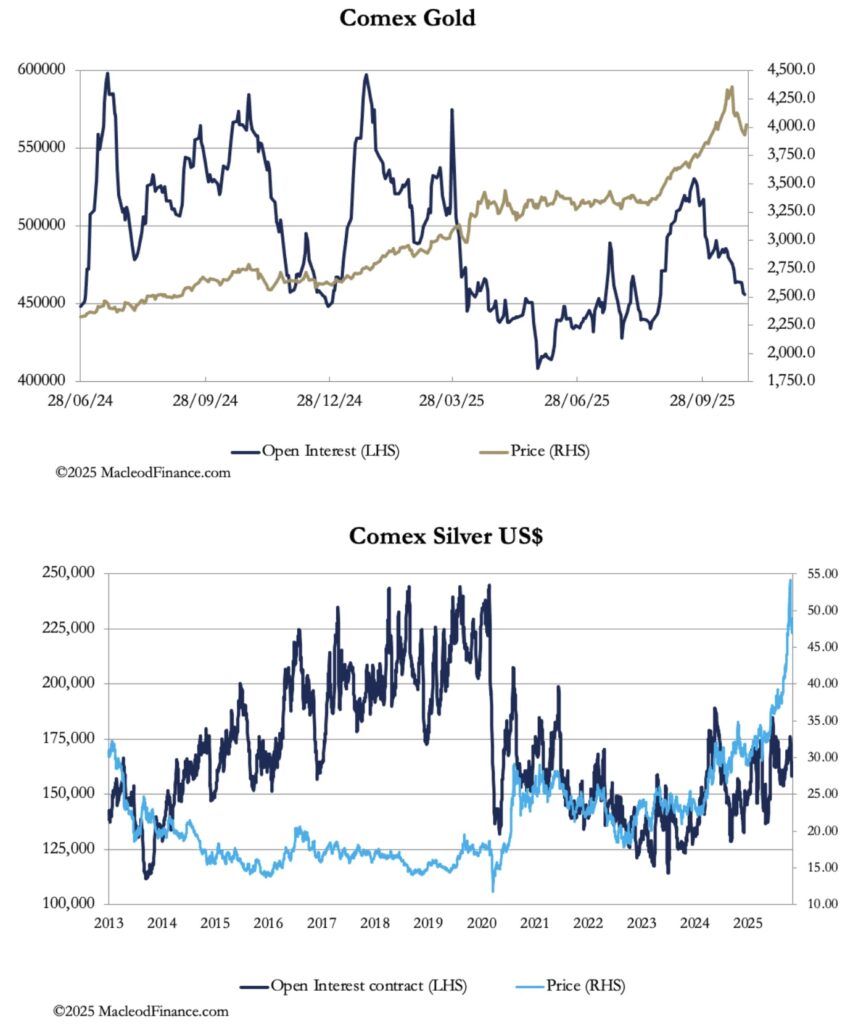

Referring to relative strength indicators, technical analysts told us that gold and silver had become massively overbought, so have formed a major top. If that was the case, then it would be reflected in open interest on Comex at all-time highs, because overbought conditions by definition exist when speculation becomes excessive. But that is not the case as the next charts for gold and silver clearly show:

At 456,000 contracts gold’s open interest indicates relatively subdued speculator interest. In silver’s case, there was minimal speculator buying when the price soared from $30 to $50+. The market evidence therefore negates the mechanical relative strength evidence pointing to a massive liquidity squeeze driving prices instead.

Traders are being whipsawed, again.

This week sees the end of November contracts and options — a time when the swaps like to shake out weak holders. Next week when it’s over, we can expect to see stand for deliveries accelerate, and liquidity issues in London coming to the fore. Silver is still in backwardation, but the condition has reduced to a just a few cents. Nevertheless, it indicates the liquidity squeeze is still on. It is less obvious in gold which remains in contango.

While the bullion banks are having difficulty in silver, they appear to be more balanced in gold, perhaps with paper longs in London balancing shorts in Comex futures. They will be aware of central bank demand, and crucially aware of central banks’ reluctant to renew lease contracts after the fiasco at the Bank of England earlier this year.

Readers will also be amused to know that security staff guarding the vaults at the Bank are threatening to strike for more pay.

Yesterday, the World Gold Council released its gold demand estimates for Q3, noting that it increased by 3% measured by tonnage driven by investment demand, despite higher prices. This is reflected in buying of ETFs, shown by the WGC’s chart:

The surge in September with no region being net sellers is consistent with investment funds and individuals awakening to an asset class to which they are underexposed.

Now is time for us to indulge in a little price speculation.

The recent selloff in gold is almost certainly being met with sighs of relief from fund managers fielding questions from their clients about why they haven’t invested in gold and gold mines despite gold outperforming all other asset classes. Almost certainly, they will be telling them (wrongly) that gold’s current performance shows the dangers of chasing a speculative bubble.

If it turns out that the selloff of the last two weeks ends up supporting yet higher prices as the supply squeeze continues, fund managers will be forced to reconsider their scepticism and scramble to buy before prices embarrass them again. The lack of available bullion could then push prices far higher.

The Fed’s interest rate policy

On Wednesday, the Fed reduced its funds rate by ¼% to 3 ¾% as widely expected. But Jay Powell cautioned that a further cut by the year-end was not a slam-dunk, causing bond yields to tick higher. But despite Powells reticence it is clear that the inflation target is being abandoned in favour of preventing recession and is a clear signal for dollar weakness and gold’s strength. To listen to Alasdair Macleod discuss what is happening with gold, and especially silver and the mining stocks CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.