Mark Lundeen responds to Eric King at King World News.

October 29 (King World News) – The King World News webmaster, Bryan, sent this email to Mark Lundeen that contained a note from Eric King: Mark, another excellent piece.

Mr. King just wanted to share some points with you:

Communication from Eric King to Mark Lundeen:

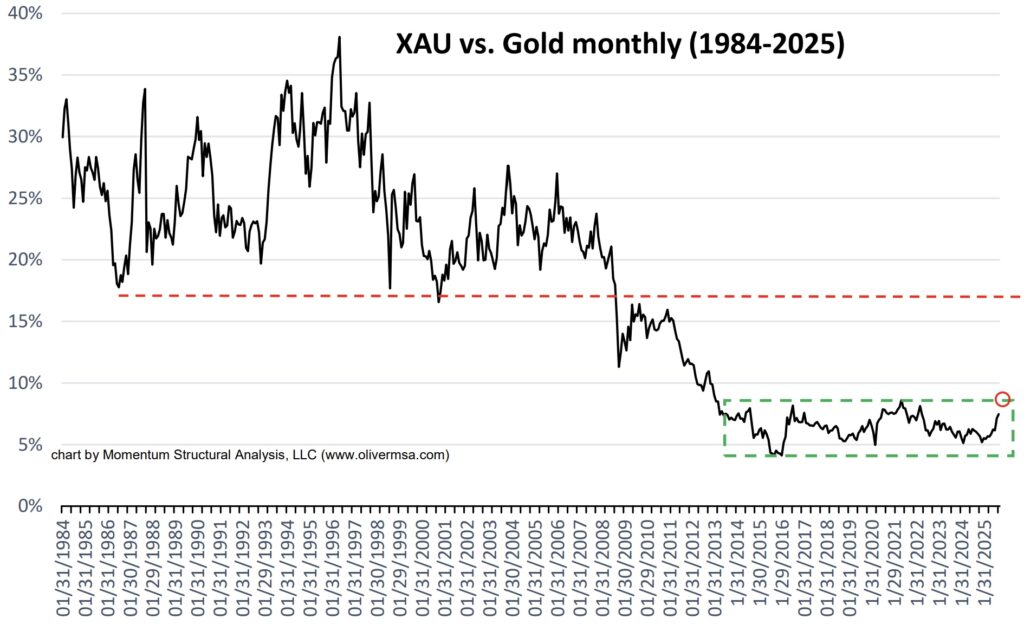

Mark, King World News has been featuring the attached image over and over again of the XAU vs Gold. Because when you look at the XAU chart, it appears that gold stocks have had some type of incredible run, which is patently false when measured vs Gold (see attached chart). Yes, they have risen, in some cases quite dramatically, but vs Gold, the entire complex remains at the most historically undervalued level or range ever seen in history.

Also, the HUI closed Friday at 589.91, almost 40 points below the record 638.58 high that was set, at the time, in 2011, even with the price of gold trading well above $4,000.

Back to the XAU, when compared to Gold it is quite clear that the miners have been dragged higher kicking and screaming as they have been and still remain trapped inside what I call “the Devil’s Box” (featured in the green dotted portion of the chart) for the past 13 years. You can do the math to see what it will take to get the XAU to get back to the median point of 25-26% from the current ratio of 6.92%. And keep in mind that at the first sign of recent weakness in Gold, the XAU vs Gold ratio tumbled from 7.8% down to 6.92%. Meaning the miners outperformed Gold to the downside.

Valuation Matters

I am only sharing this information with you because you are an old pro who knows that valuation matters. You already know how undervalued mining stocks are vs Gold, but some people might see the XAU advance and be deceived into thinking they better sell before it collapses again, having been conditioned by the previous bear market in mining stocks, which was really a depression in terms of the price of mining stocks – XAU vs Gold.

No One Will Ring A Bell

I believe the XAU vs Gold ratio will go to all-time highs in the other direction, possibly above 40%, during the coming mania in mining stocks. What will precipitate the mining stocks breaking out of the Devil’s Box? I don’t think anyone will ring a bell. I believe that one day the mining stocks will simply begin a historic upside advance, breaking out of the Devil’s Box and continuing higher until the XAU vs Gold ratio hits all-time highs.

Mark, I am aware that you already know all of this information and share your views of much higher prices for gold, silver, and mining stocks with your readers, urging them to remain patient, but I just wanted to send this to you because many people are being deceived by what they perceive to be a manic run higher in mining stocks, which is, once again, patently false when compared to the price of Gold.

None Of The High-Quality Stocks Are A “Sell” Inside The Devil’s Box

I would also add that none of the high-quality mining and exploration stocks are a “sell” inside the Devil’s Box. Rather, all high-quality mining and exploration stocks are a “buy.” Will there be wild volatility? Yes. Jim Sinclair warned the volatility in gold would “light people’s hair on fire.” This volatility will include the mining stocks as well. So there will be huge pullbacks that will be tough for investors to endure. Richard Russell used to warn that most people cannot hold on for the duration of a bull market because they “cannot stomach the pullbacks.” But for those that can hang on for the entire bull market and keep their positions intact, the coming mania in the mining stocks will be one for the ages.

Best regards,

Eric King

Mark, thank you for your great articles and for sharing your faith and trust in Jesus Christ and God.

Bryan,

KWN Webmaster

Mark Lundeen Responds To King World News

Here is Mark Lundeen’s response: Hi Eric & Bryan

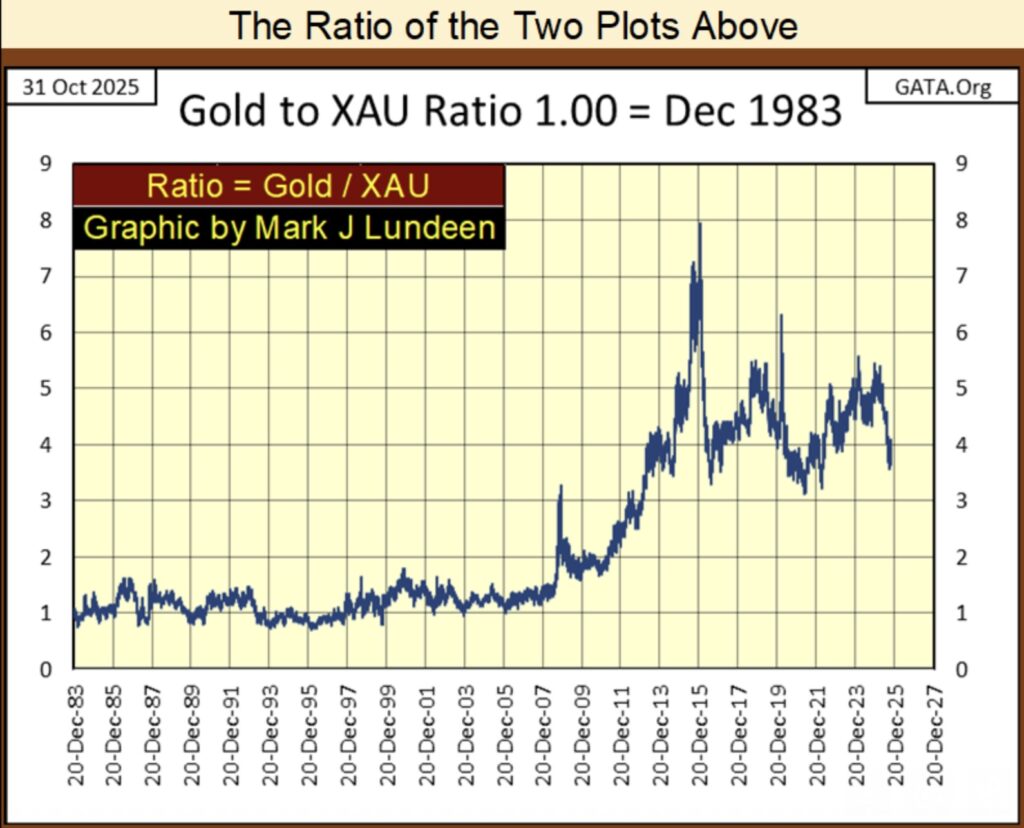

Eric got me thinking about a ratio of gold to the XAU, so I constructed some charts for gold and the XAU going back to December 1983. I thought you’d find them interesting.

First chart, gold and the XAU as published.

It’s after midnight, I’m tired, but it seems to me that the higher the ratio, the more undervalued is the XAU to the price of gold. I might be wrong on that, but I don’t think so.

The second chart is the index of the two data series. Same data, just used their indexed values. I like using indexes.

KING WORLD NEWS NOTE: The Gold vs XAU ratio started at 1.00 In 1983. Today, the Gold vs XAU ratio is above 4.00!

Meaning, to get back to the historic median, the XAU Gold Mining Index will have to skyrocket vs the price of gold!

Again, the higher the ratio, the more undervalued the XAU is to gold.

I’m going to use these charts, and other for the Barron’s Gold Mining Index, a weekly data series going back to 1920 for my article this week. Feel free to use these charts on KWN, but I’ll let Eric make the comments if he cares to do so. I’ll make mine later this week.

King World News note: Mark Lundeen has selflessly shared his work with readers around the world for a very long time. He is one of the few writers that has always focused on the big picture, even during the worst of times for gold, silver and the mining sector. Lundeen never let the noise impact his unshakeable belief, like Richard Russell, that the bull markets in gold, silver and the mining stocks would fully express themselves, and that no government or governments in the world could stop it from happening. His work is more important now than ever as we begin to enter periods of great volatility.

Tavi Costa On The Gold & Silver Volatility

To listen to Tavi Costa discuss exactly where we are after the recent pullback in gold, silver and mining stocks and what to expect going forward CLICK HERE OR ON THE IMAGE BELOW.

To listen to Alasdair Macleod discuss this week’s trading in gold and silver as well as what to expect next week CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.