Gold is rebounding “with $4,000 fading in the rearview mirror.”

$4,000 In The Rearview Mirror

October 23 (King World News) – Ole Hansen, Head of Commodity Strategy at SaxoBank: Gold trades tentatively higher, with $4,000 fading in the rearview mirror. The first notable resistance level is around $4,148, while a break above $4,236 would be needed to confirm renewed upside momentum.

Silver’s 10.6% correction on a closing basis means it must reclaim the $50 level to establish a firmer footing, with $51.83 the key level to break to attract momentum-focused traders back in.

Pullbacks In A Bull Market

Graddhy out of Sweden: All bull markets go through periods of small and larger pullbacks, no matter how bullish fundamentals look. This because short/intermediate term, the market is not ruled mainly by the very bullish big picture fundamentals, but mostly by short/intermediate term sentiment.

Gold

Peter Schiff: Gold is back above $4,150. The low of the correction was $4,016. That looks like a successful test of a new support level at $4,000. Gold stock investors should not be scared off by the sharp price decline from $4,378 but emboldened by a new $4,000 floor on the price of gold.

Gold

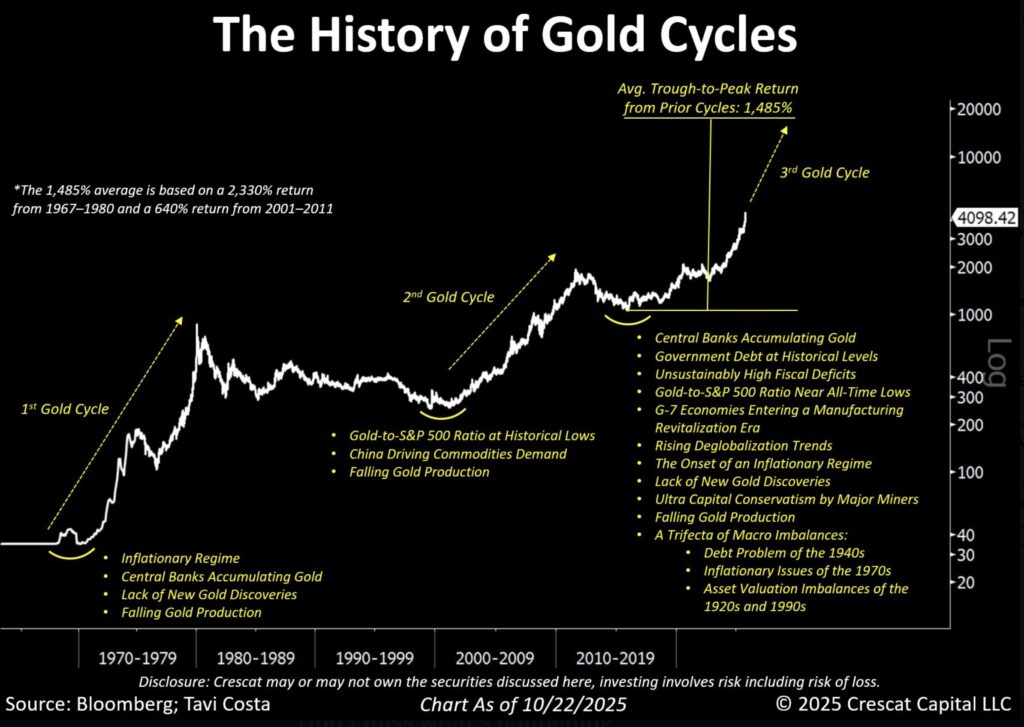

Otavio Costa: Major reversal in gold … holding strong above the $4,000/oz mark.

Gold bull cycles don’t typically peak with the gold-to-silver ratio as high as 85.

For perspective:

In 1980, the ratio fell below 20.

In 2011, it dropped to 30 before gold peaked a few months later.

Given the scale of today’s economic imbalances, a sharp contraction in the gold-to-silver ratio toward historic lows is highly likely, in my view.

However, brace for volatility.

The road ahead won’t be a straight line, but for those with conviction in hard assets, I believe this may turn out to be a highly rewarding cycle — especially in what could be one of the most fiscally and monetarily undisciplined periods in modern history.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.