The price of gold is surging toward the $4,000 level as the welfare state is bankrupt and global debt soars.

The Welfare State Is Bankrupt – Global Debt Soars

October 6 (King World News) – Daniel Lacalle: The Welfare State Is Bankrupt – Global Debt Soars.

Higher taxes and soaring spending have made public accounts in developed nations unsustainable.

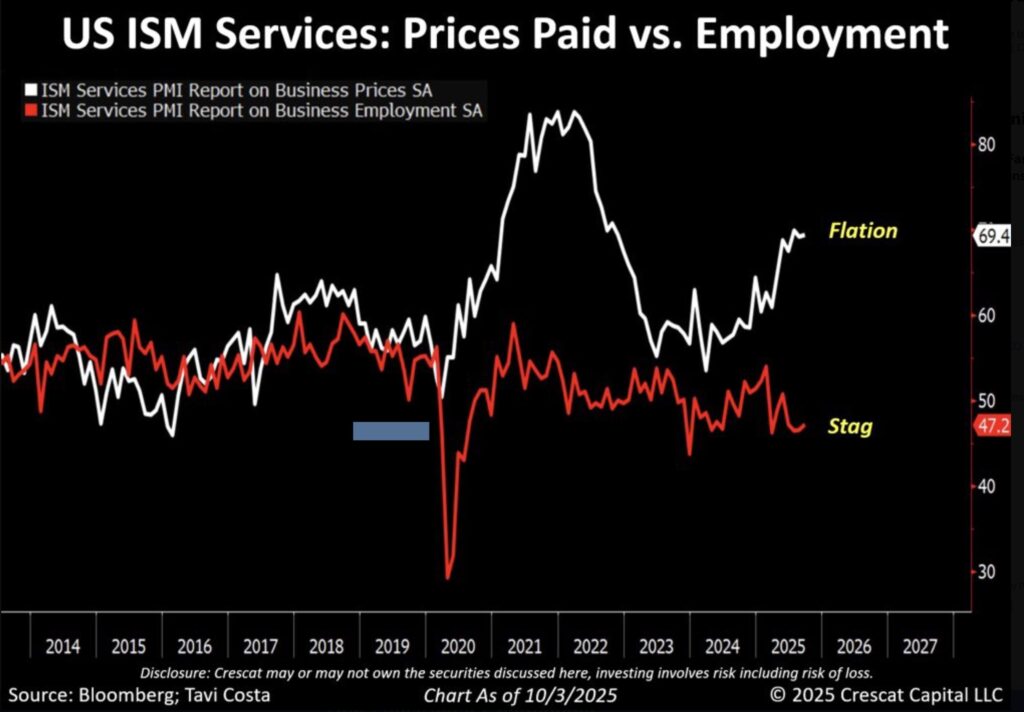

Serious Stagflation

Otavio Costa: Deeply stagflationary.

The latest ISM Services report was a clear display of the Fed’s predicament.

KING WORLD NEWS NOTE: Like The 1970s, We Are In A Period Of Serious Stagflation. Gold Soared 25.5x And Silver 38x In The ’70s.

The prices paid component is now pushing toward the 70 handle, while employment has dropped well below 50.

And remember, this reflects services, not goods.

On the goods side — which commodity prices help illustrate — inflationary pressures continue to build and accelerate.

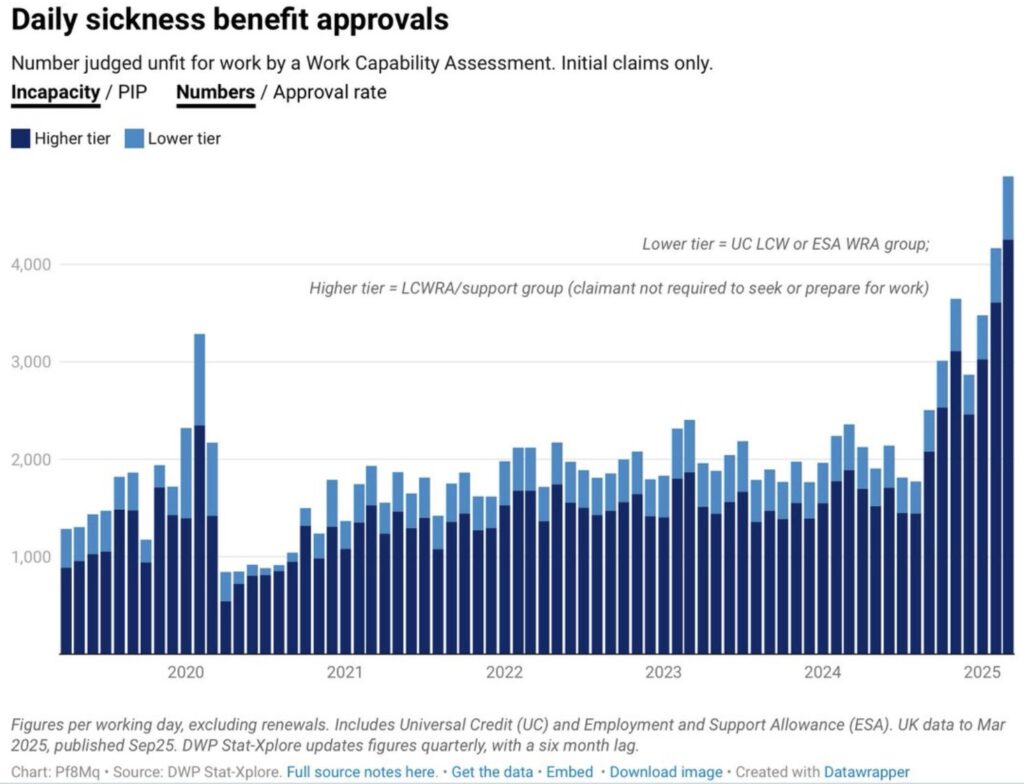

Trouble In The UK

Albert Edwards, Former Global Strategist at Société Générale: The UK provides an astonishing example of fiscal incontinence- sickness benefit has surged over the last two years. Once on it, there is little likelihood of ever re-entering the workforce. It’s not just bond vigilantes who should take note, but taxpayers.

KING WORLD NEWS NOTE: Sickness Benefits Have Soared In The UK

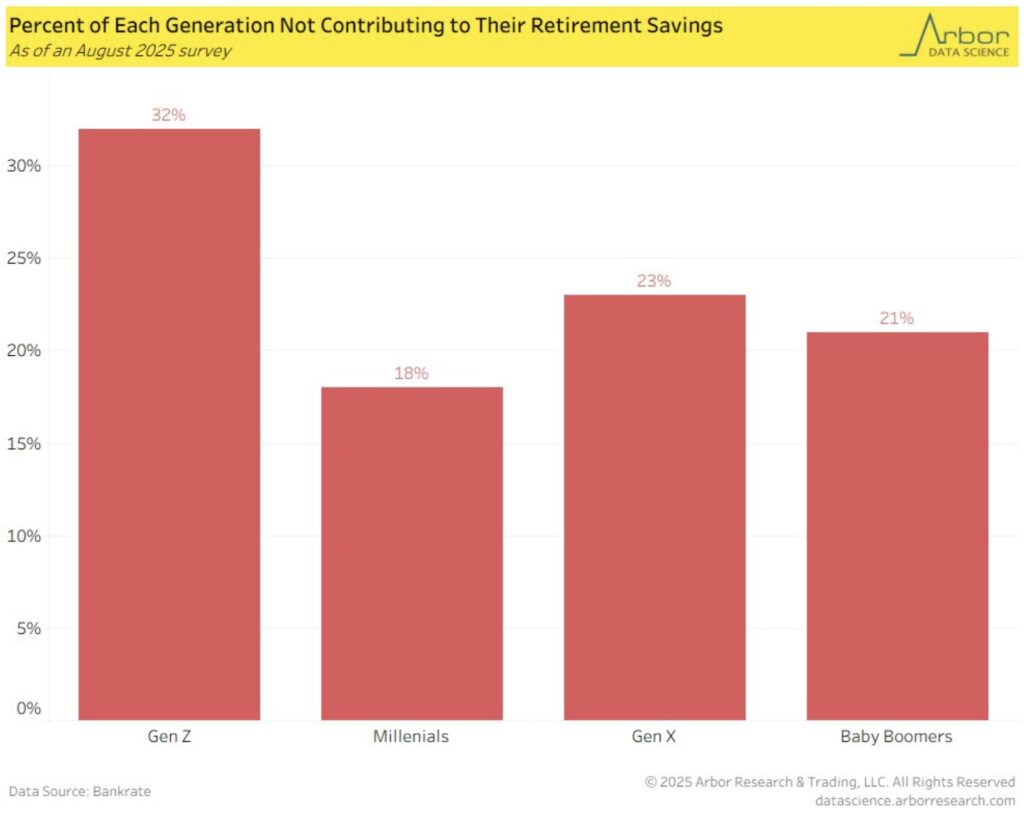

Gen Z Staring At Retirement Problems

Liz Ann Sanders at Charles Schwab: Per August survey from Bankrate, 32% of Gen Z reported they are not contributing to retirement savings … compares to 18% of Millennials, 23% of Gen X, and 21% of Baby Boomers.

KING WORLD NEWS NOTE: 32% Of Gen Z Not Saving For The Future

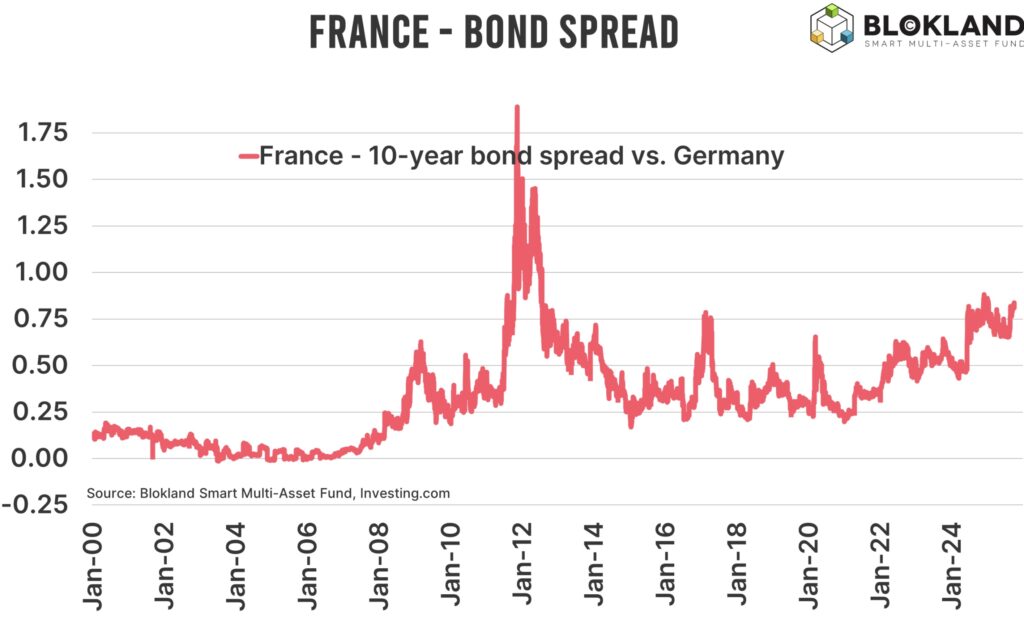

Problems In France

Jeroen Blokland: The new French cabinet (which looks a lot like the old one) is already facing political backlash. Hence, the odds of France delivering a healthy fiscal budget are slim.

- The French government spends tremendous amounts on social security

- – The French economy has potential GDP growth of 1% at best.

- – Technically, France does not have its own currency; it shares one with many other countries.

The lack of fiscal discipline, economic growth, and (officially direct) backing of a central bank is a recipe for political turmoil.

As a result, in practice, the ECB must aim its monetary policy at the weakest link.

KING WORLD NEWS NOTE: Bond Vigilantes May Soon Look To Attack The French Bond Market

Oil Is Cheap

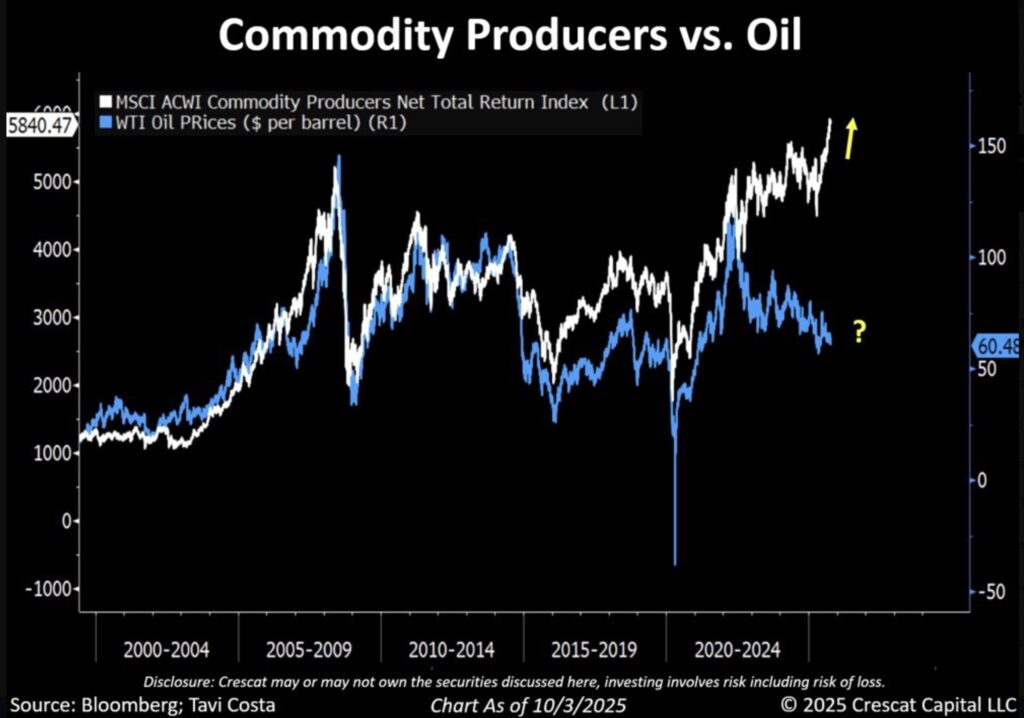

Otavio Costa: Hard to ignore how cheap oil has become relative to a diversified basket of commodity producers that historically move in close correlation.

KING WORLD NEWS NOTE: Oil Extremely Cheap vs Commodities

Commodities rarely diverge for long, and this disconnect suggests oil is among the most undervalued resources today, in my view.

All of this while US oil inventories sit near record lows and the Permian Basin has seen nearly a 30% drop in drilling rigs over the past three years.

More importantly:

Keep in mind that oil is also facing one of the most extreme speculative short positions in history.

Gold & Silver!

To listen to Alasdair Macleod discuss the massive gold deliveries from Comex as well as the price of silver surging toward an all-time high CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.