It’s game on for silver as the world moves closer to a catastrophic meltdown.

Silver Launch

October 1 (King World News) – Otavio Costa: It’s official.

Silver just reached its highest quarterly close in history.

Game on.

KING WORLD NEWS NOTE: The Silver Upside Slingshot Is Now At Hand As $50 All-Time High Is Within Striking Distance

All Paths Are Leading To A Catastrophic Meltdown

Gregory Mannarino, writing for the Trends Journal: Debt + fragile credit = meltdown path. Below I have broken down TEN red flags, with each one feeding off the other.

Let’s break it all down…

Leverage ACROSS THE BOARD is compounding, but most dangerously in the debt/credit markets.

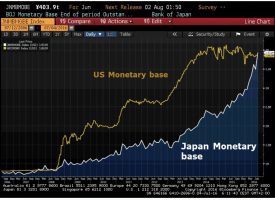

Funding… despite the Fed and US Treasury buying it all, THIS WILL NOT BE ENOUGH to support/prop up the system at one point. The facts are this.. The economy is right now already feeling the effect of Hyper-Debt. And with the current economic policies of currency devaluation, artificially suppressed rates, and therefore more debt—things will worsen from here.

This mechanism, as I outlined above, DESPITE THE PROPAGANDA, is wiping out the economy, the middle class, US industry, and US small businesses.

Let’s do a further breakdown…

Right now, there are “10 red flags,” which I am watching closely

- Labor reality check (recent revision). The BLS says job growth from Mar 24 to Mar 25 was overstated by 911k. Moreover, yesterday’s propaganda jobs headlines are attempting to trick the public by not counting continuing claims, which are rising. Even American workers with jobs, are earning less “real income” via losses of dollar purchasing power. Moreover, with less people working = softer tax receipts = bigger deficits. And another death loop.

- Main Street is dying. Only 32% of small business firms had unfilled openings in Aug, this is the lowest since July 2020. Small biz is half of the US job engine, and closures are rising.

- Corporate stress is also rising…. 2025 is pacing for the fastest bankruptcy year since 2010. 71 large filings in July alone (after 63 in June). By their numbers.

- Banks still carry MASSIVE losses on their books. Unrealized losses on bank securities over $400 billion. (According to the numbers they are allowing us to know).

- More banks are tapping the Feds Standing Repo Facility. This raises further issues/questions regarding system liquidity. (The system is bankrupt).

- Deficits are structural. The Congressional Budget Office, CBO, states that FY2025 deficits are near $2 trillion with no end in sight.

- US Treasury. The Treasury expects to borrow even more moving forward. As of now, every 90 days another $1.1+ trillion.

- Interest cost is eating the budget. Net interest is set to take 18% of revenues this year, according to their numbers. (The reality is of course much worse).

- Soft “real” economy under propaganda headlines. Big data revisions/fakery/propaganda, should tell us all that the truth is way worse than they are allowing us to know. (This Is End Game Politics). Lie, deceive, distract.

- Refinancing + tighter credit = feedback loop. More bankruptcies across the board, with rising bank losses mean tighter lending. This mechanism slows growth and “forces” more policy “intervention.”

Expect MORE easy money policy which will further inflate the debt, debase the dollar, and “force” even lower rates. Hyper-debt is policy-made, NO COMEDY OF ERRORS GOT US HERE…

More debt, more intervention, less truth. Expect it.

Silver Preparing To Explode Above $50

To listen to James Turk discuss his price targets for silver as it prepares to explode above $50 as well as what to expect from gold and mining stocks CLICK HERE OR ON THE IMAGE BELOW.

JUST RELEASED!

To listen to Alasdair Macleod discuss silver approaching the $50 all-time high set in 1980 as well as gold’s surge along with the mining and exploration stocks CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.