Silver is threatening its historic 1980 record high as gold continues to surge toward the $4,000 level, but take a look these surprises…

Gold vs Bitcoin

September 26 (King World News) – Holger Zschaepitz: Does the growing divergence between Gold and “digital Gold” (Bitcoin) signal trouble ahead for crypto?

KING WORLD NEWS NOTE: Growing Divergence Between Gold (YELLOW LINE) vs Bitcoin (WHITE LINE) May Be Signaling Danger Ahead For Crypto

So Many Incorrect Calls On Gold

Otavio Costa: If we earned a dollar every time someone tried to time a correction in gold using technical analysis, we’d all be filthy rich by now.

Let’s call this what it is:

A gold rush.

I wouldn’t compare this cycle to the 1970s or 2000s.

The imbalances fueling central bank gold buying today are far more extreme.

If you follow that logic, then we really haven’t seen anything yet, in my view.

KING WORLD NEWS NOTE: Gold Price Has To More Than Triple Just To Reach 1980 High Adjusted For Money Supply

Mindblowing

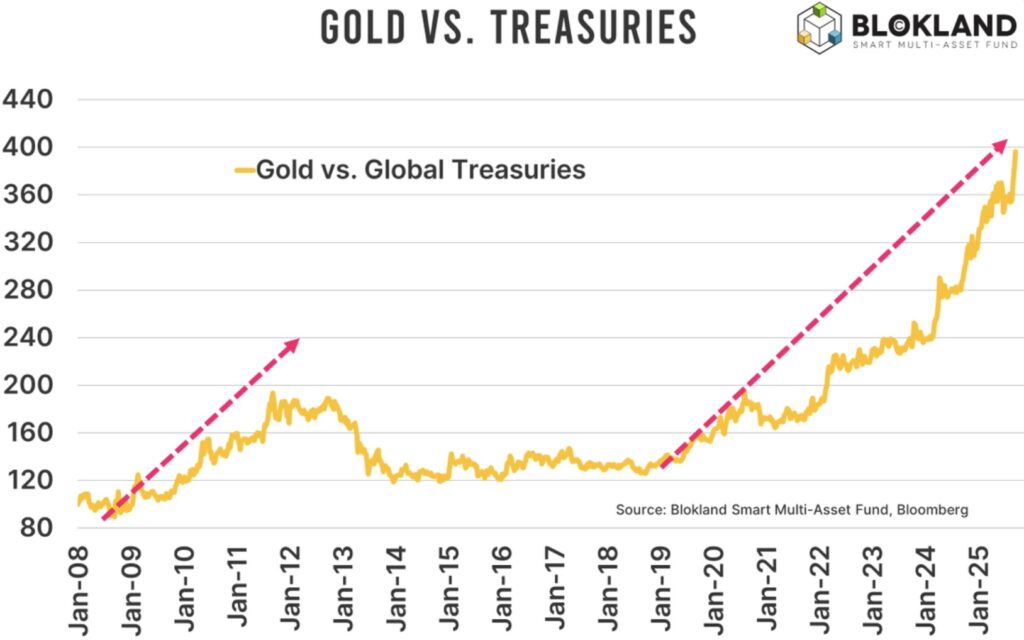

Jeroen Blokland: This chart is mindblowing!

Gold’s outperformance over Treasuries is just unreal.

KING WORLD NEWS NOTE: Gold’s Outperformance vs US Treasuries Has Been Nothing Short Of Jaw-Dropping

Make It Make Sense

Jim Bianco: Goolsbee says the Fed has to get inflation to 2%. PERIOD

But the inflation rate now is well above 2% and it’s trending higher.

So how does cutting rates 100 to 125 basis points lower the inflation rate to a target (2%) it hasn’t been to in an almost 6 years?

—-

Bloomberg headlines [from 3 days ago] …

FED’S GOOLSBEE: WE DID NOT MOVE INFLATION TARGET

FED’S GOOLSBEE: HAVE TO GET INFLATION 2%, PERIOD

FED’S GOOLSBEE: ANYONE SAYING WE’RE RAISING THE INFLATION TARGET, THAT’S DANGEROUS TALK

Why Cut Rates At All If You’re Worried About Inflation?

FED’S GOOLSBEE: NEUTRAL IS 100-125 BASIS POINTS BELOW CURRENT RATEFED’S GOOLSBEE: RIGHT NOW, I’M NOT THINKING ABOUT 50 BASIS-POINT CUTS

Fed Playing A Dangerous Game

Robin Brooks: Sentiment on US activity is turning more positive, with consensus scaling back its recession odds. If data bear this out, it’ll push up long-term bond yields globally and yield curves will steepen a lot more. Fed rate cuts into a strengthening economy can be a dangerous game…

Listen to the greatest Egon von Greyerz audio interview ever

by CLICKING HERE OR ON THE IMAGE BELOW.

Moving Into The Red

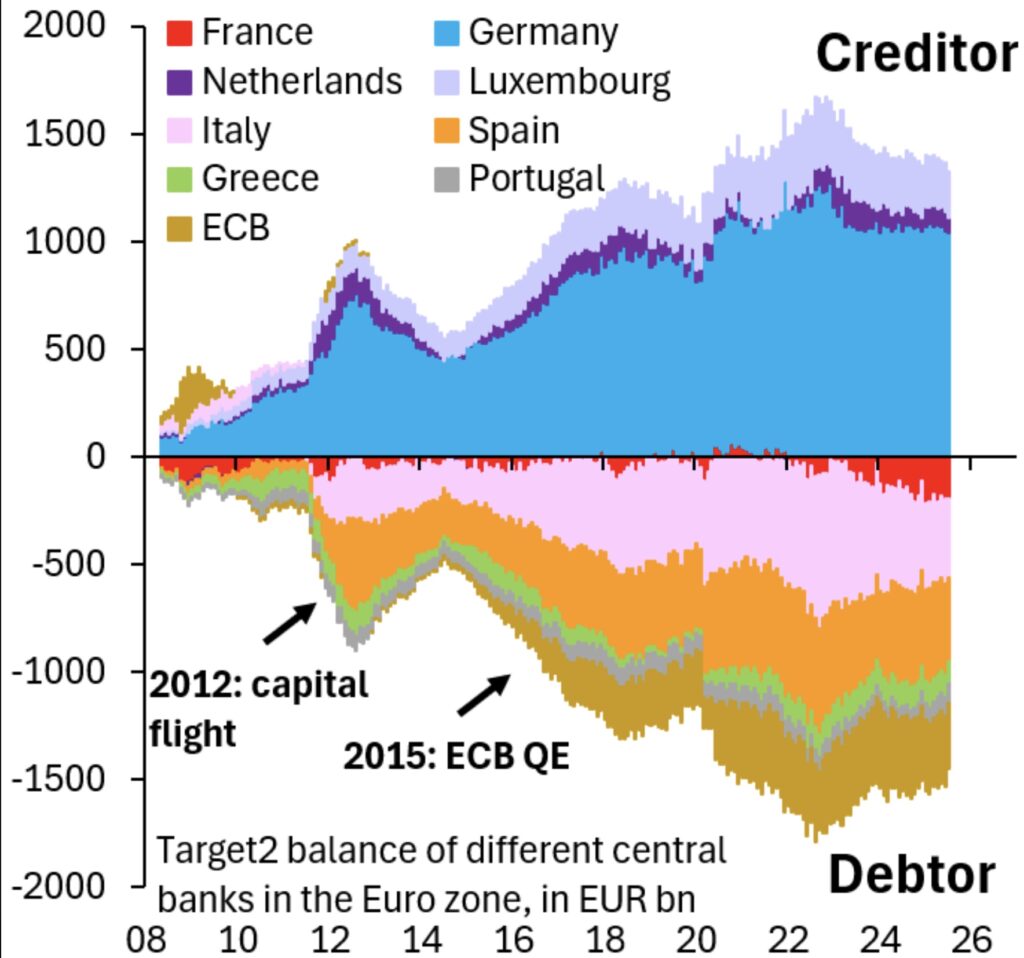

Robin Brooks: For the longest time, France (red) was a non-entity in the Euro zone’s TARGET2 balances. But that’s changed in recent years, with France becoming a debtor country. As a result, Germany’s creditor balance is unchanged, even as Italy has been able to reduce its debtor balance…

KING WORLD NEWS NOTE: France Is Now In The Early Stages Of A Serious Debt Problem (RED) That Could Unleash A Crisis

Unsustainable

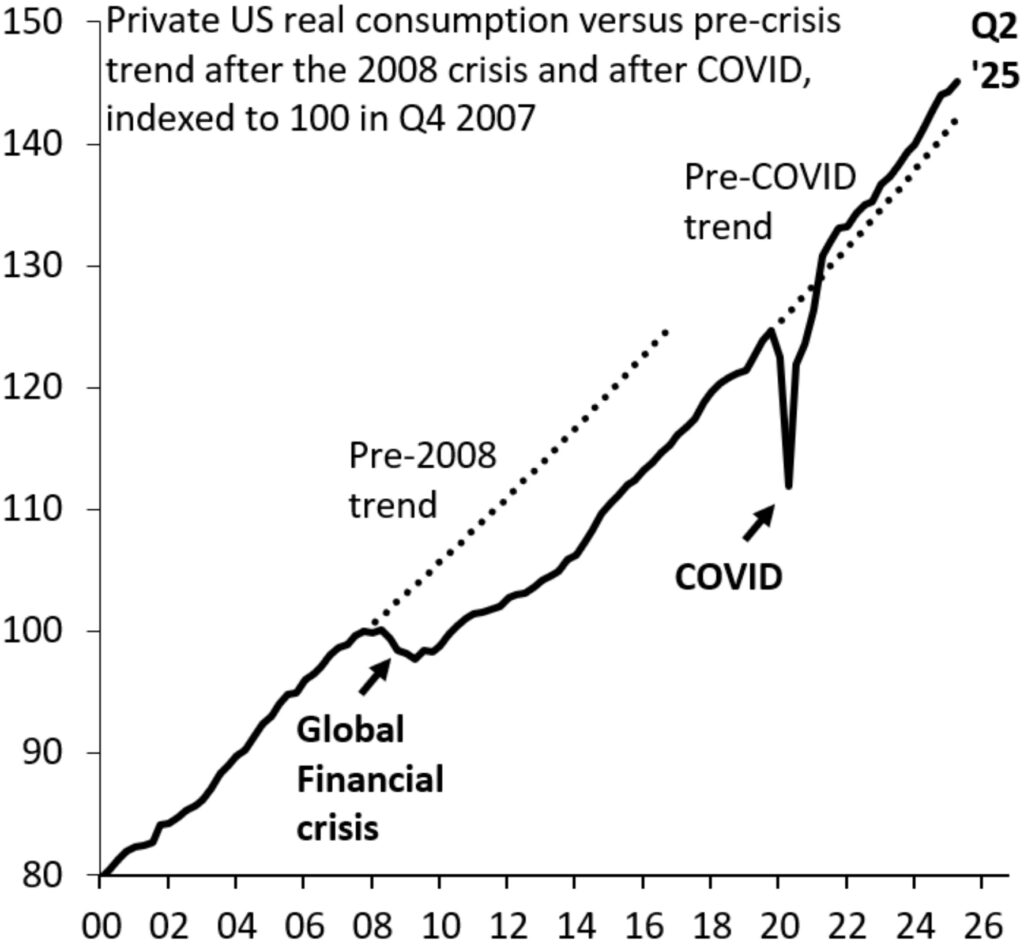

Robin Brooks: Private consumption remains firmly above its pre-COVID trend. There’s lots of anecdotes that consumption is becoming increasingly concentrated among high net worth and high income households, but the truth is that the strength of consumption in the face of tariffs is a puzzle…

KING WORLD NEWS NOTE: Skyrocketing US Consumption Now Being Fueled Exclusively By The Wealthy

Silver Threatening 1980 Record High

All of the issues noted above are fueling silver prices to threaten the historic 1980 record high as gold futures continue to surge toward the $4,000 level. Continue to accumulate physical silver while it remains cheap because time is running out to purchase it below $50.

As for the high-quality mining stocks they remain grotesquely undervalued. For example, the HUI Gold Mining Index at 590 remains more than 40 points below its 2011 high when the price of gold was only $1,920. Today the price of gold is twice that level and yet the HUI Gold Mining Index still trades below levels hit in 2011 as the gold bull market continues to “climb a wall of terror.”

Within hours King World News will be releasing two audio interviews discussing the wild trading in the gold and silver markets and much more.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.