This is a look at how the Red rate cut will impact gold and the US dollar.

August 27 (King World News) – Gerald Celente: Speaking on 22 August at the global central bankers’ retreat in Wyoming, Jerome Powell, chair of the U.S. Federal Reserve, indicated the Fed will probably cut its key interest rate next month.

Powell acknowledged a “shifting balance of risks [that] may warrant adjusting our policy stance.” However, he also emphasized that inflation’s risk to consumer prices is “now clearly visible,” and “the upward pressure on prices from tariffs could spur a more lasting inflation dynamic.”

At the same time, “downside risks to employment are rising,” he said. “If those risks materialize, they can do so quickly in the form of sharply higher unemployment.”

The Fed has a dual mandate: controlling inflation and supporting the labor market. Inflation remains subdued while the labor market appeared to crater in the second quarter. Powell seemed to indicate that the policy urgency is no longer keeping interest rates up to rein back inflation, but instead to cut rates to boost business conditions and spark hiring.

Fed officials on the central bank’s rate-setting committee are divided, according to Steven Stanley, chief U.S. economist at Santander U.S. Capital Markets.

Some committee members want to cut rates more than once yet this year, he said. Others want to freeze rates, anticipating that Donald Trump’s trade war is going to spike prices. Still others are probably willing to cut the bank’s policy rate by a quarter point in September and then see what happens, a scenario that Stanley sees as most likely.

Powell’s comments pulled U.S. equity markets out of a slump after a heavy tech-sector sell-off early last week. Bond prices also firmed up.

“As you think about the fact that there are two-sided risks and that there are very divergent views on the committee, I think the easiest path ahead is for a slow path of rate cuts,” Matthew Luzzetti, Deutsche Bank’s chief U.S. economist, told Bloomberg. He sees a rate cut in September “with further action being more data-dependent beyond that.”

The Fed cut its key rate by a full point last fall but has made no changes this year as officials have waited to gauge the impact of Trump’s tariffs on prices. U.S. inflation was pegged at 2.7 percent last month, well above the central bank’s 2-percent target and gradually moving further from it.

Rising prices and a teetering labor market are pulling Fed officials in different directions.

Michelle Bowman and Christopher Waller, members of the central bank’s governing board, have urged lower rates now.

Beth Hammack, president of the Federal Reserve Bank of Cleveland, said last week that she would not favor a rate cut if the rates committee were meeting now. Jeffrey Schmid, president of the Kansas City Fed, told Bloomberg he would not be surprised if the central bank’s policy rate increased instead of decreasing.

A centrist group is willing to consider reducing the rate next month, then waiting on fresh data before committing to further action. “My strategic approach would be ‘move and wait,’” Raphael Bostic, the Atlanta Fed’s president, commented earlier this month.

“If the best of all the options is we make some adjustments and then we have to pause, or even then we have to reverse course, that might be better than just sitting here on hold until we get clarity on tariffs,” Minneapolis Fed resident Neel Kashkari also told reporters earlier this month.

“Investors should not underestimate the current tension within the dual mandate of price stability and maximum sustainable employment,” Joe Brusuelas, chief economist at RSM US LLP, wrote in a note. He sees the likelihood of a “one-and-done” rate-cut scenario for the rest of this year.

TREND FORECAST:

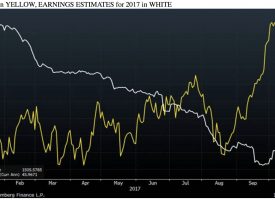

Remember, the lower interest rates go, the deeper the dollar will fall. And the deeper the dollar falls, the higher gold prices will rise. Gold is dollar-based, therefore as the U.S. dollar declines it is cheaper to buy gold in nations whose currencies are rising.

Also, current Fed-Head Jerome Powell’s term will expire next May. Between now and then, President Trump will push Powell to keep lowering interest rates to prop up the equity markets… as he did back in 2018 when Trump was President and the Dow had its worst December since the Great Depression. And we forecast that President Trump’s new pick for Fed-Head will be an obedient member of the Trump team and do what he is told… which means low interest rates.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.