Here is a look at gold, interest rates and young male virginity on the rise.

Gold

August 14 (King World News) – Ole Hansen, Head of Commodity Strategy at Saxo Bank: Gold initially traded lower after a stronger-than-expected US PPI print, on speculation it may dampen rate cut expectations by pointing to a potential upside in July’s Core PCE inflation, likely keeping the Fed cautious. Rising producer input costs risk either squeezing company margins or being passed through to consumers, adding upward pressure on CPI. However, the data does not change our long-held bullish view on gold, as the FOMC will ultimately have to balance inflation control with economic support.

For now, however, gold remains well and truly stuck midrange.

KING WORLD NEWS NOTE: Gold Remains Range Bound

In A Normal Market…

Otavio Costa: In a normal market, this setup would lead me to expect short-term rates to rise.

But in today’s environment—marked by an urgent push for fiscal dominance — I’d rather have a constructive view on hard assets.

The combination of rising inflation and suppressed interest rates is one of the most powerful drivers for hard assets, in my opinion.

KING WORLD NEWS NOTE: No One Is Expecting Higher Interest Rates

Another Big Bull Market

Sven Henrich: I knew it!

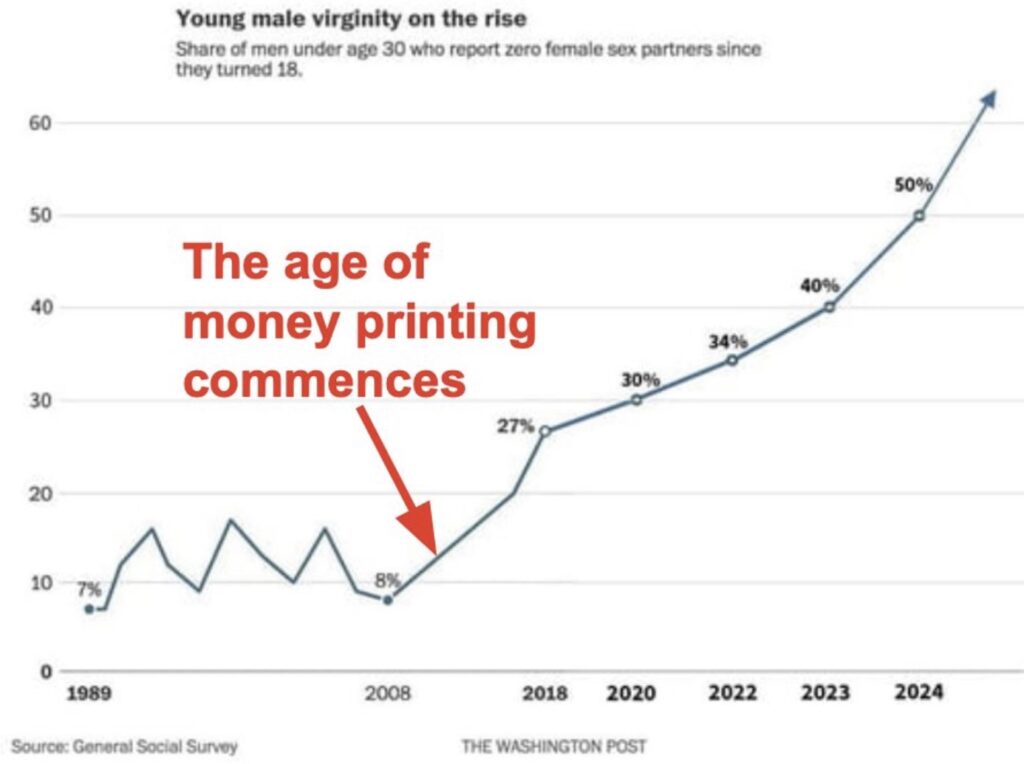

KING WORLD NEWS NOTE: Young Male Virginity On The Rise!

Tsunami Of Crypto Money Will Flow Into Gold Market!

Billionaire Pierre Lassonde shares with King World News listeners around the world many of his top stock picks in this remarkable audio interview and you can listen to it by CLICKING HERE OR ON THE IMAGE BELOW.

To continue listening to Alasdair Macleod discuss the short squeeze that is beginning to unfold in the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.