Here is a bit picture look at the silver market while the metal remains below $40.

Silver

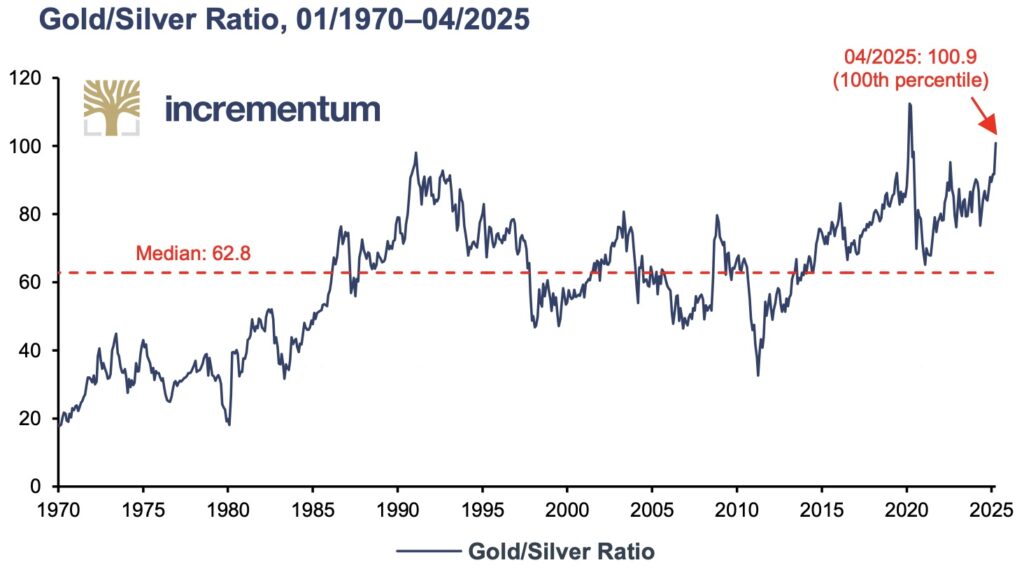

July 29 (King World News) – Ronnie Stoeferle at Incrementum: The gold/silver ratio stood at 100.9 at the end of April, putting it in the 100th percentile, a level that was otherwise only reached at the beginning of the Covid-19 pandemic. The long-term median since 1970 is 62.8, which further underlines the striking current divergence. In the past, similarly extreme conditions have been followed by an outperformance of silver.

Fundamentally, everything seems to be in place for gold’s little brother: Silver recorded a supply deficit for the fourth time in a row in 2024. Demand exceeded supply by 148.9 million ounces (Moz). In the period from 2021 to 2024, the cumulative deficit amounted to 678 Moz, which is the equivalent of ten months of global mine production. For 2025 , the Silver Institute is forecasting a further supply deficit of 117.6 Moz.

This shortage is primarily caused by the ongoing boom in photovoltaic applications. This key sector of the energy transition, which is dominated by China, is now the second largest demand driver for silver after jewelry and was responsible for a demand of 197.6 Moz in 2024.

In addition, silver has outperformed gold in 6 of the last 7 bull markets since 1967. Nevertheless, the price performance of the white metal has so far remained below the historical average, which opens up an attractive investment opportunity, provided that silver finally succeeds in realizing its potential as performance gold.

Investment demand could become the primary driver of silver’s price in 2025. The explosive growth of Indian ETP holdings – with 40% of private investment inflows and 70 Moz net investment – currently points to a change in market dynamics.

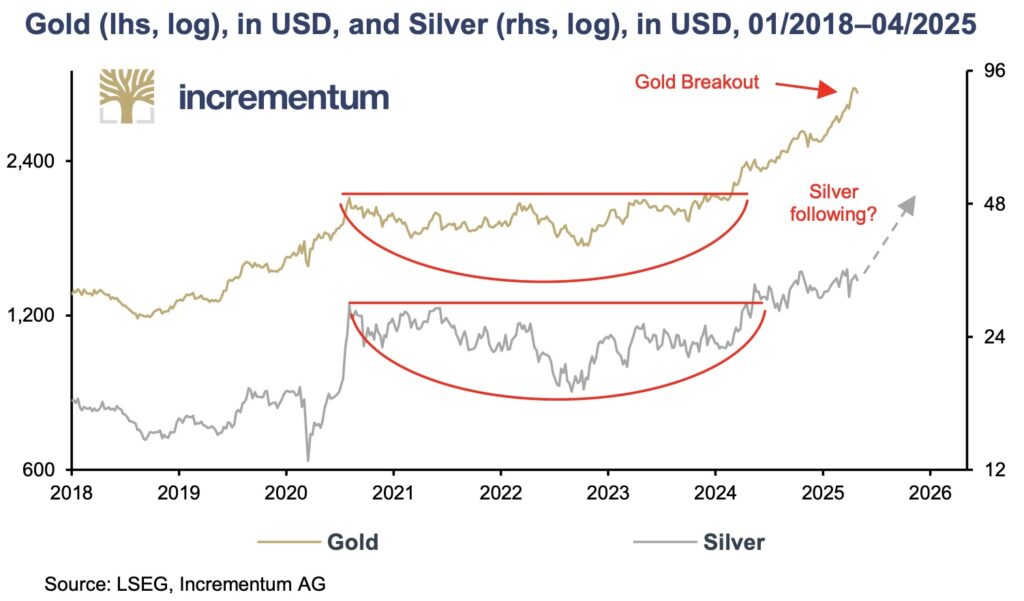

King World News note: Continue to use weakness in the price of silver to accumulate the metal as silver remains the most undervalued hard asset in the world. Expect new all-time highs this year as the massive 45-year cup & handle breakout unfolds.

Wild Card For 2025, Gold And More

To listen Gerald Celente discuss the Wild Card for 2025, what to expect for gold, and much more CLICK HERE OR ON THE IMAGE BELOW.

Gold Is Coiling To Surge $1,000!

To listen to Alasdair Macleod discuss the coming $1,000 surge in the gold market as well as what to expect from silver and the mining stocks CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.