As the price of silver closes in on $40, it appears this could unleash the price of silver hundreds of dollars higher.

July 24 (King World News) – This is a portion of a fantastic report from Jesse Colombo: Now let’s take a look at silver’s long-term monthly chart to identify past resistance clusters that are likely to serve as price targets during this new bull run. These resistance zones were formed during periods of price congestion, most notably during silver’s surge and peak in 2011 and 2012. The two most prominent levels that stand out to me are the $42–$44 zone and, ultimately, the $48–$50 zone. There is a strong probability that silver will aim for the most obvious target — $50 — during this rally. And while it will likely pause to consolidate once it gets there, there’s no reason it has to stop at that level.

KING WORLD NEWS NOTE: Here Are The Silver Resistance Zones On The Way To All-Time Highs

Even more exciting is the fact that silver’s logarithmic chart, dating back to the 1960s, reveals a cup-and-handle pattern, indicating the potential for silver to reach several hundred dollars per ounce during this bull market. In order to confirm this particular scenario, silver needs to close decisively above the $50 resistance level.

KING WORLD NEWS NOTE: Multi-Decade Cup & Handle Formation Could Unleash The Silver Price Hundreds Of Dollars Higher

Adjusting silver’s price for inflation further highlights how undervalued it is by historical standards. During the Hunt brothers-induced spike in 1980, silver reached an inflation-adjusted price of $197. In the 2011 bull market, driven by quantitative easing, it hit $71. Currently trading at just $38.40, silver has significant room to rise if it’s to catch up with these previous inflation-adjusted peaks.

KING WORLD NEWS NOTE: The Illustration Below Shows The 1980 Price Of Silver Inflation-Adjusted Is $197. It Is Also Worth Noting That ShadowStates Inflation-Adjusted 1980 Silver High Is Probably Closer To $1,000

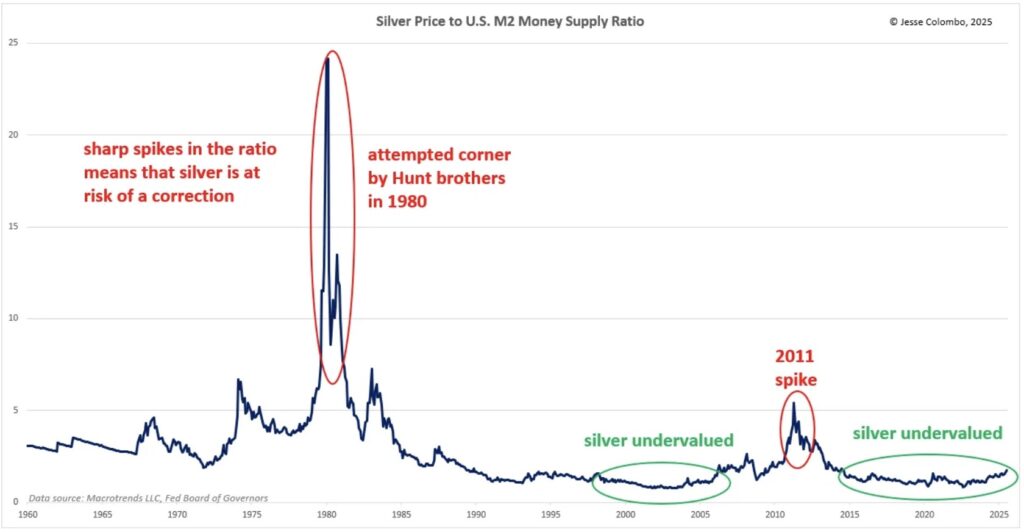

Another way to assess whether silver is undervalued or overvalued is by comparing it to various money supply measures. The chart below shows the ratio of silver’s price to the U.S. M2 money supply, providing insight into whether silver is keeping pace with, outpacing, or lagging behind money supply growth.

If silver’s price significantly outpaces money supply growth, the likelihood of a strong correction increases. Conversely, if silver lags behind money supply growth, it suggests a potential period of strength ahead. Since the mid-2010s, silver has slightly lagged behind M2 growth, which, combined with other factors discussed in this piece, position it for a strong rally.

KING WORLD NEWS NOTE: Continue To Use Any Weakness To Accumulate Physical Silver While It Is The Cheapest Hard Asset In The World

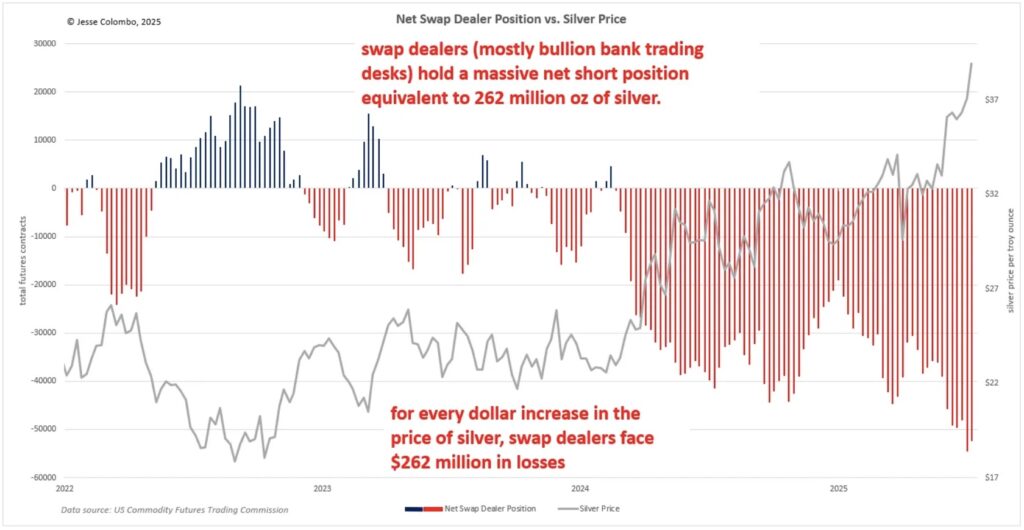

One of the key factors keeping silver’s price suppressed over the past year, even as gold surged, has been the heavy short-selling of COMEX silver futures by swap dealers—primarily the trading desks of bullion banks such as JPMorgan and UBS. This was a deliberate effort to cap silver’s price (read my detailed report to learn more about this kind of manipulation). In the process, they amassed a massive net short position of 52,324 futures contracts, equivalent to 262 million ounces of silver—nearly one-third of the annual global silver production. This staggering figure highlights the immense downward pressure exerted on the silver market.

What’s even more astonishing is how much of this short position in silver futures is naked, meaning it isn’t backed by physical silver. It’s merely “paper” silver being dumped onto the market to suppress prices. However, as silver’s bull market heats up, it could trigger a wave of short-covering—when traders who bet against an asset through short-selling are forced to buy it back as prices rise to limit their losses. As the price climbs, these traders become increasingly desperate to close their positions, further fueling the rally.

If the buying pressure is intense enough, it could even lead to a short squeeze, dramatically amplifying silver’s upward momentum. Given the size of their short position, bullion banks stand to lose approximately $262 million for every $1 increase in the price of silver—a setup for a major price surge. Now, just imagine what will happen as silver climbs by $5, $10, $20, and beyond from this point.

KING WORLD NEWS NOTE: Fascinating Setup In The Silver Market As Swap Dealers Have The Highest Silver Short Position In History.

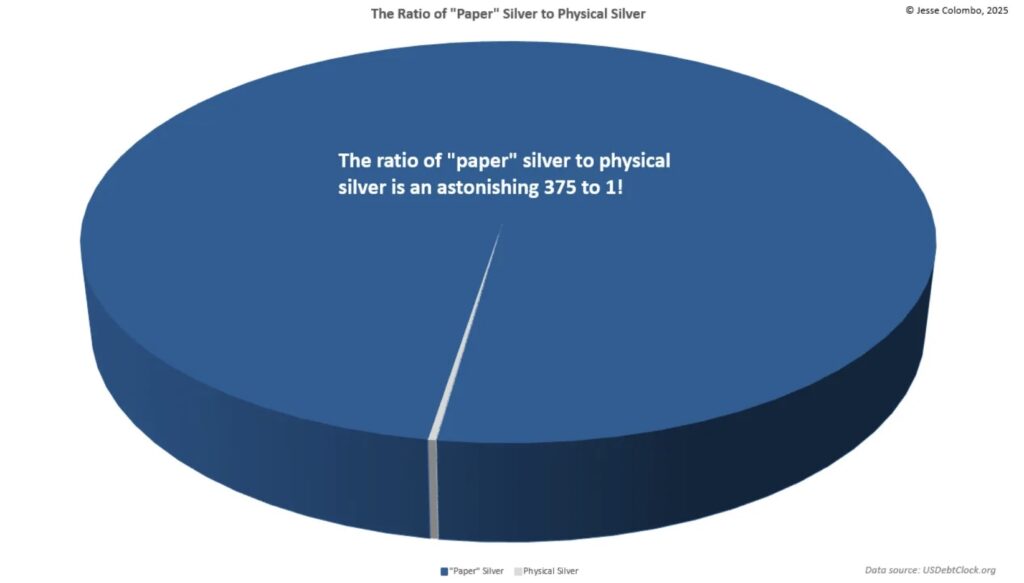

The risk of an explosive silver short squeeze is further amplified by the astonishing ratio of 375 ounces of “paper” silver—ETFs, futures, and other derivatives—for every single ounce of physical silver. In a violent short squeeze, holders of “paper” silver could be forced to scramble for the extremely scarce physical silver to fulfill their contractual obligations.

This would cause the price of “paper” silver products to collapse, while physical silver prices would skyrocket to jaw-dropping levels, potentially reaching several hundred dollars per ounce (this event is what may fulfill the price target implied by the cup and handle pattern I showed earlier).

KING WORLD NEWS NOTE: The Illustration Below Exposes The Ratio Of “Paper” Silver Claims To Physical Silver Is An Astonishing 375:1!

The Coming Mania

King World News note: Yes, continue to use any weakness to accumulate physical silver while it is the cheapest hard asset in the world. When it comes to the high-quality mining and exploration stocks, also use weakness to accumulate shares because the bull market will eventually culminate in a mania.

US May Begin Stockpiling Silver As Strategic Reserve

To continue listening to Nomi Prins discuss why this would make the price of silver skyrocket as well as her thoughts on gold, uranium, and the mining stocks CLICK HERE OR ON THE IMAGE BELOW.

JUST RELEASED!

To listen to Alasdair Macleod discuss what to expect next in the gold, silver and mining share markets and much more CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.