Today the price of silver futures surged aggressively back above $39 near the recent high leaving shorts running for cover.

Silver Panic Draws Near

July 21 (King World News) – The silver market continues to surprise traders with today’s surge near recent highs. $40 is now firmly in sight as shorts begin to question whether the price of silver may quickly accelerate this upside move to all-time highs. This could be the great short squeeze long-term holders of silver have been waiting for.

KING WORLD NEWS NOTE: The Monthly Chart Shows The Price Of Silver’s Upside Move May Now Accelerate To All-Time Highs Above $50

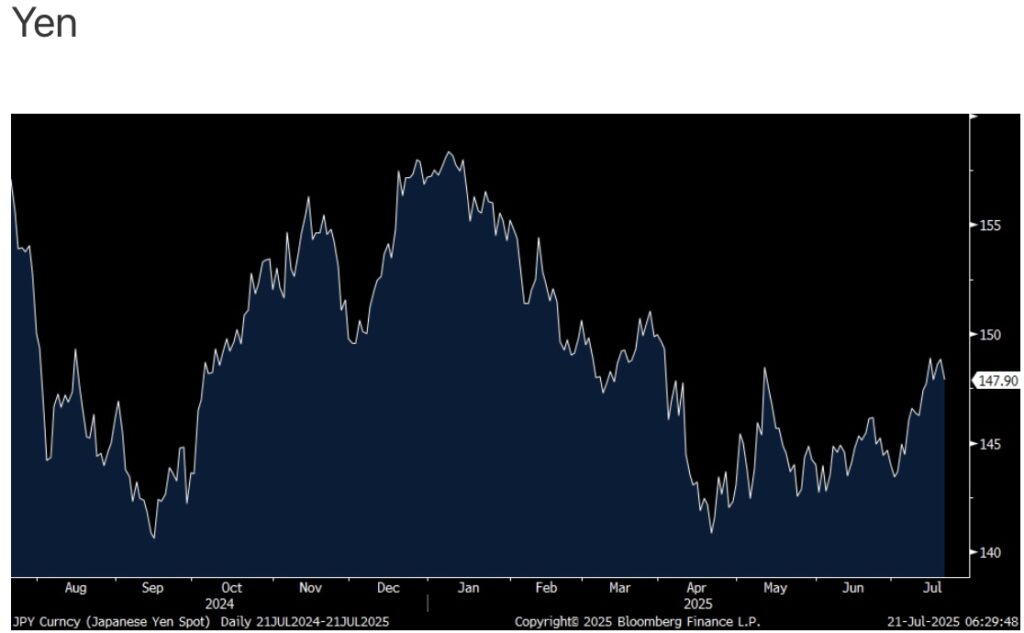

Japanese, Like Others, Despise High Inflation

Peter Boockvar: As most of us expected, Japanese Prime Minister Shigeru Ishiba lost his governing majority in the upper house election yesterday, securing just 47 LDP seats vs the 50 he needed but it could have been worse based on estimates I saw. Either way, he said he’s not resigning but without the majority in the lower house too, he’s essentially a lame duck at this point. As the yen has weakened over the last few weeks ahead of the election, they are bouncing even with the uncertainty of what fiscal policy might come of this.

JGB futures though did trade lower while the cash market and equities didn’t trade because of a national holiday.

The most important message to take is that we were reminded again that what a populace hates the most is inflation, especially when one’s income doesn’t keep up. We saw it in the US, and we’ve seen it throughout history, particularly the protests in France in 2018 known as the Yellow Vest protests when Macron tried to raise energy taxes. The BoJ hoped for years that they would achieve higher inflation and now that they did, no one is happy about it except them, and they don’t seem to be doing anything about it with an overnight rate of just .50%. That has now cost Ishiba his leadership support.

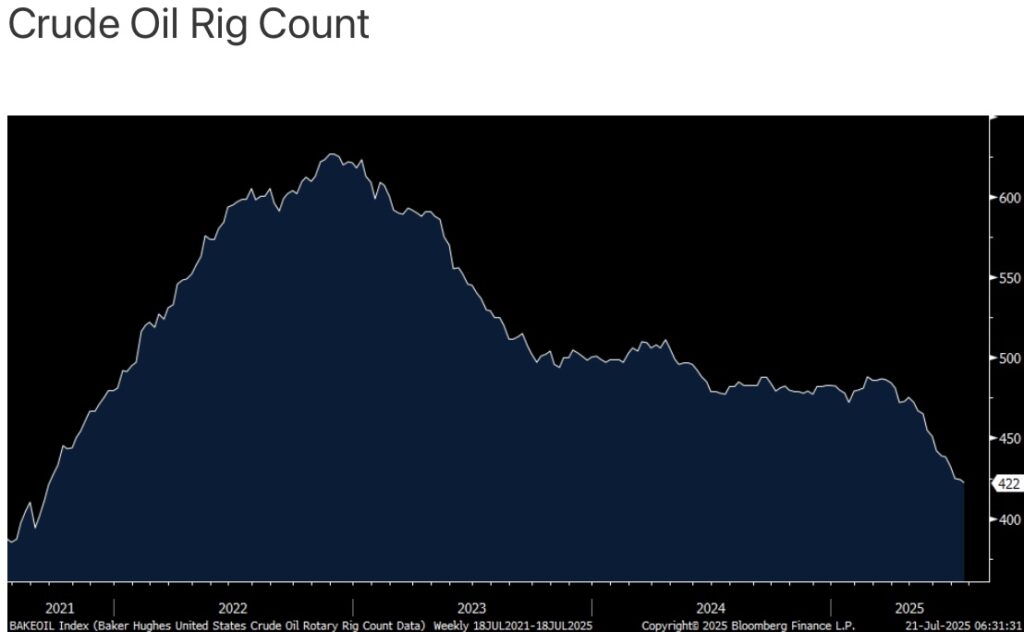

Crude Oil Prices Are Bottoming

I’ll continue to argue for a bottoming process taking place with crude oil prices. The US crude oil rig count as of 7/18 fell for the 12th straight week and by another 2 to 422 and has fallen by 53 over these three weeks. That’s the least since September 2021.

From American Express whose stock fell 2.4% Friday:

“Total card member spending was up 7%, which was consistent with the pattern we’ve seen this year, while spend in some of the travel categories, like airlines and lodging, was softer overall. Spending was a quarterly record.”

More on this, “We live in uncertain times, but I think people are continuing to live their lives. And what we’re seeing right now is very consistent spending. You’re seeing a little bit of a slowdown in airline, not necessarily front of the cabin. You’re seeing a little bit of a slowdown in lodging, but again, not necessarily on the high transactions, which are up. But goods and services continue to be resilient and our GenZs and our millennial’s continue to be consistent.” I’ll add to the latter, a lot of the growth here is just the less use of cash and more and more transactions take place using digital/credit.

They said “restaurant spending continued to be very strong, up 8% FX adjusted.”

“Our fastest growing cohorts kept up their momentum. In the US consumer business, millennial spend was up 10% and GenZ spend was growing around 40%, though starting from a smaller base. And our international business continued to grow in double digits, up 12% FX adjusted in the quarter.”

“Transaction growth up 9% is another indicator of strong customer engagement and is largely consistent with what we’ve been seeing over the past few quarters.”

AmEx was a bit more cautious on their small and medium-sized business customers. “I think SMBs are a little bit more circumspect, I think, than the consumers are right now. And so not buying maybe as much inventory and maybe not spending as much. And so I think they’re going to need probably a little bit more assurance from and economic perspective longer term for that to get going.”

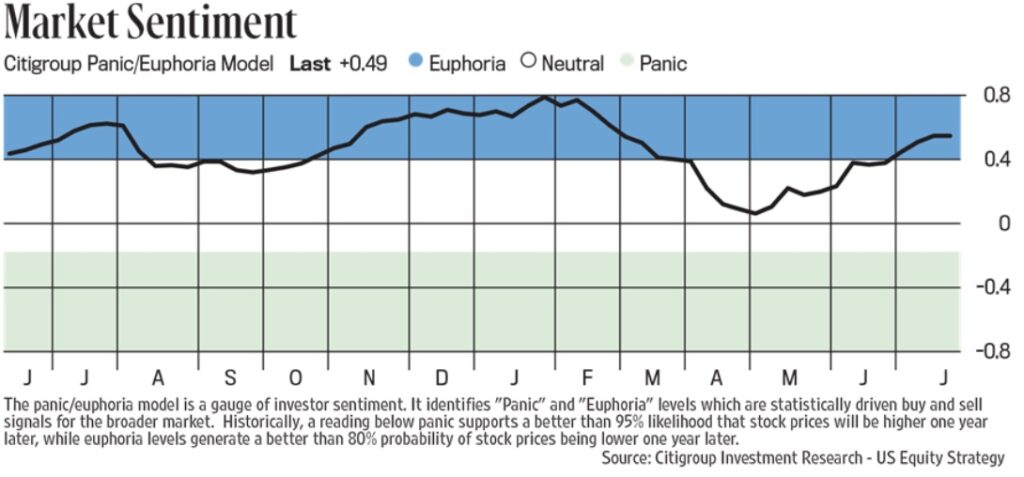

Euphoria?

Finally, on stock market sentiment. The Citi Panic/Euphoria index moved further into Euphoria at .49, the highest since early March.

Last week the Investors Intelligence got further stretched with a Bull/Bear spread now at 33.9 with Bulls at 54.7 vs 53.8 in the week before while Bears slipped to 20.8 from 21.2. I consider a spread of 40 to be extreme. The AAII retail investor survey continues to be more neutral with Bulls at 39.3 vs Bears at 39. The CNN Fear/Greed index is at 75, right on the dividing line between ‘Greed’ and ‘Extreme Greed.’ The NAAIM Exposure Index was 83.7 last week, off its nearly 100 print of a few weeks ago but elevated.

Bottom line, nothing alarming from a contrarian standpoint in terms of extremities in sentiment but still take note of the Citi survey and the near 40 pt Bull/Bear spread in II.

US May Begin Stockpiling Silver As Strategic Reserve

To continue listening to Nomi Prins discuss why this would make the price of silver skyrocket as well as her thoughts on gold, uranium, and the mining stocks CLICK HERE OR ON THE IMAGE BELOW.

JUST RELEASED!

To listen to Alasdair Macleod discuss what to expect next in the gold, silver and mining share markets and much more CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.