Difficult economic times are coming but gold will soar.

Rough Times Are Coming

July 9 (King World News) – Graddhy out of Sweden: Been saying that the inflationary 70’s will repeat, and most probably be dwarfed hugely.

Shared this chart 3 years ago when price was at bottom of the right shoulder. Then posted the chart at pink breakout and backtest. It is now up right against the 45-year blue inverse head and shoulders neckline.

This chart means rough times are coming, and that gold will soar.

KING WORLD NEWS NOTE: Is Gold Poised For A Historic Upside Breakout vs Copper?

More Inflation Is Coming

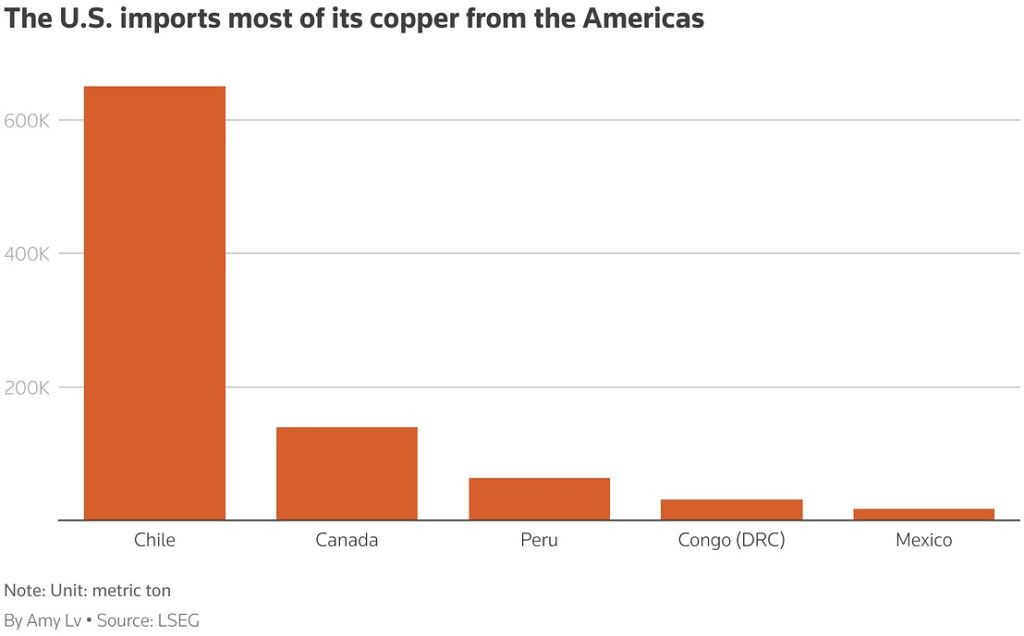

Peter Boockvar: As copper is now the subject of substantial tariffs, it’s important to understand that this is probably the most important industrial metal in the world in terms of its breadth of use. According to the US Geological Survey, “Electrical uses of copper, including power transmission and generation, building wiring, telecommunication, and electrical and electronic products, account for about three quarters of total copper use. Building construction is the single largest market, followed by electronics and electronic products, transportation, industrial machinery, and consumer and general products.” https://www.usgs.gov/centers/national-minerals-information-center/copper-statistics-and-information

The US produces about half of the refined copper it needs every year with about 2/3rds made in Arizona. Most of the balance of copper that we import comes from Chile (just over 600k metric tons) with much smaller amounts from Canada (about 175k) and Peru (less than 100k). These countries make up around 90% of refined copper imports to the US.

My worry, again, is while it is laudable to want the US to build more manufacturing plants in the US, the cost of physically building these factories and filling them with machinery and electrical equipment is getting more and more expensive because of the tariffs on all the crucial things that is needed for construction and build out.

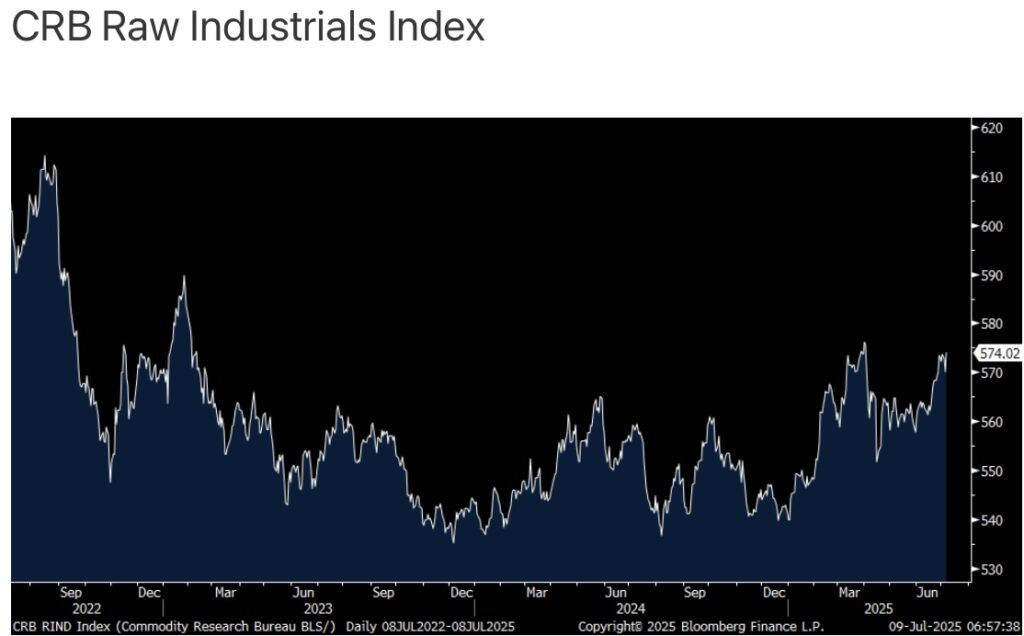

The copper rally yesterday sent the CRB raw industrials index up by almost 1% to just 2 pts from the highest level since February 2023.

I’m no technician but that’s a good looking chart below in terms of a bottoming process. We remain bullish and long commodity stocks.

Shifting to crude oil for a second, you’ve heard me make the bull case and the move higher this week in the face of a bigger than expected OPEC quota increase is further evidence of what is a tight inventory market. And, there hasn’t been much of an inventory boost in response to the OPEC quota rise. The long time experience with markets is that something that doesn’t go down on perceived bad news means that it’s most likely bottoming just as a stock that doesn’t rally on good news is most likely at a top.

Gold & Silver

To listen to Alasdair Macleod discuss gold, silver, mining stocks, the wild trading this week and much more CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.