Here is a look at the terrifying reason global interest rates are rising, and what it means for the world.

January 9 (King World News) – Peter Boockvar: Having very close friends in LA who left their home yesterday not knowing if it would be there when they came back, my heart and prayers go out to those living in the area, especially those who lost their houses.

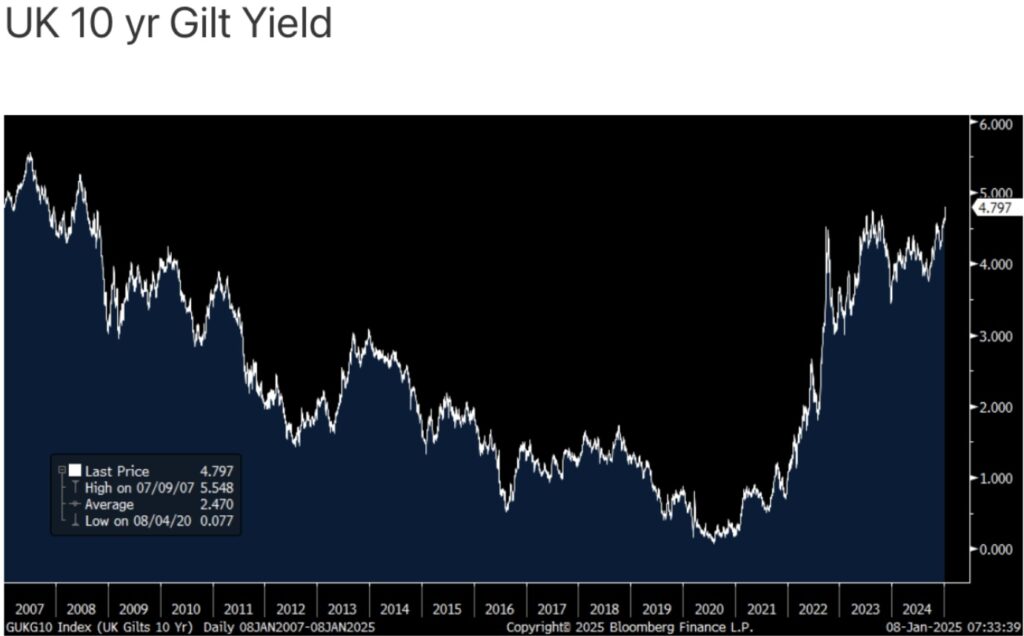

With market interest rates continuing to rise in many parts of the world with today seeing another jump in UK gilt yields in particular with its 10 yr jumping by 12 bps to 4.80%, the highest since 2008, everyone has their own theory and/or questions on why this is happening.

Terrifying Reason Global Interest Rates Are Rising

I think it’s all of the above in that rates are rising because the world is now flooded with too much sovereign bond supply and that the laws of supply and demand now matter for those countries that have excessive debt, which means many. Rates are now rising because we’re seeing the unwind of the largest financial bubble in the history of bubbles that took place in sovereign bonds that culminated in $18 trillion dollars of negative yielding securities in December 2020. Rates are rising because maybe central banks (outside of the BoJ) are likely going to slow the pace of rate cuts from here because of still inflation above their targets.

Liquidity Spigot Turning Down Big Time

I will again also point to the Japanese, the BoJ and the JGB market as a reason for the rise in rates there and elsewhere. I believe it was the BoJ ending yield curve control in July 2024 as the catalyst for the rise in the US 10 yr yield to 5%. Now, we have a likely rate hike this month from the BoJ and each and every quarter stretching out to Q1 of 2026, the BoJ is slowing its bond buying by 400 billion yen per quarter and will eventually cut in half the amount they are buying by then. That liquidity spigot is turning down big time.

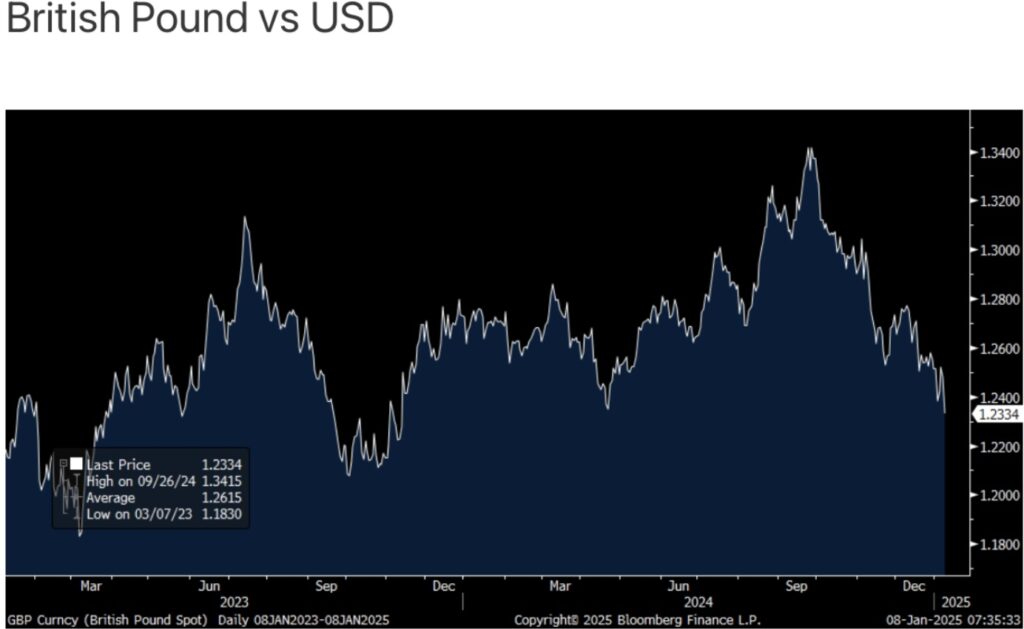

By the way, back to the UK, even with the continued rise in yields, the pound continues to weaken and this market response is something you usually see historically in emerging markets. It’s also a big thumbs down on the new Starmer government.

Mortgage Applications Plunge

With the continued rise in mortgage rates, purchase applications fell sharply for the 3rd straight week, by 6.6% and now down 15% y/o/y. That said, at the end and beginning of the year, the holidays always seasonally skew this data and I’d rather wait until next week for a cleaner read. Refi’s stabilized after falling off a cliff in the last two weeks of 2024. Again, seasonally distorted.

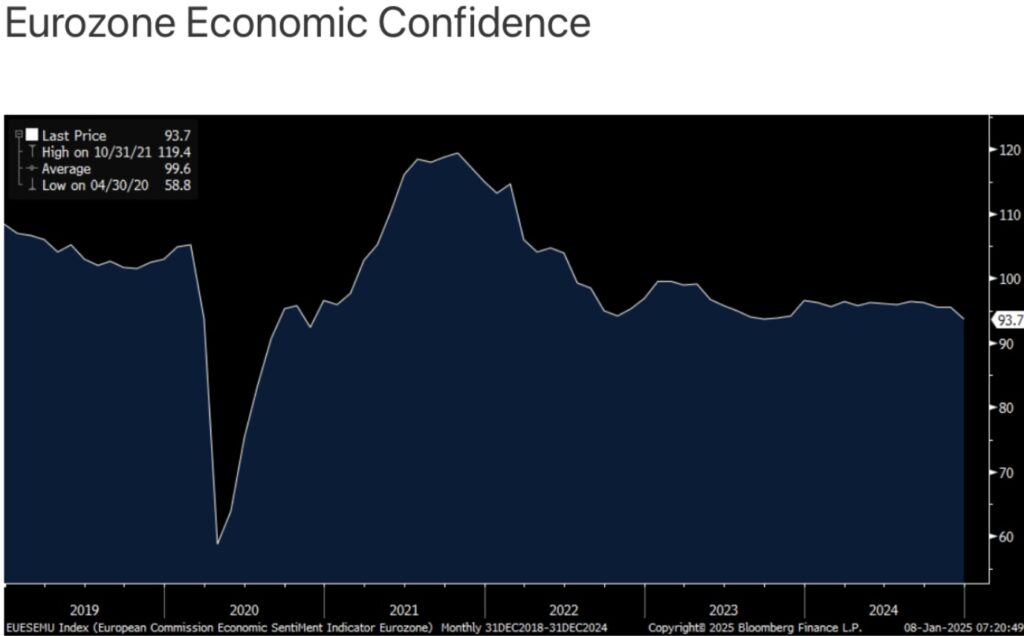

Economic confidence in the Eurozone in December weakened further to 93.7 from 95.6 and the estimate was for no change. That matches the lowest since November 2020.

Manufacturing confidence led the decline, only partly offset by a gain in services confidence. Consumer confidence fell to the lowest since February and retail and construction were little changed. Bottom line, Europe’s economy is barely growing and with the weak euro too, it will be very interesting to hear what Corporate America says during earnings season about their business in this region.

German factory orders dropped by 5.4% m/o/m, well worse than the estimate of a .2% decline. Weakness in big ticket items were the main culprit. Retail sales in Germany fell for a 2nd straight month in November.

Turk Just Warned Financial Crisis Set To Erupt In Early 2025!

To listen to what this financial crisis that is set to erupt in 2025 will look like and how you can safely navigate your way through the coming global shockwaves CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.