Below is a shocking note from Stephanie Pomboy, plus a look at what is happening with car sales and rent.

After 15 Years Of Zero Interest Rates

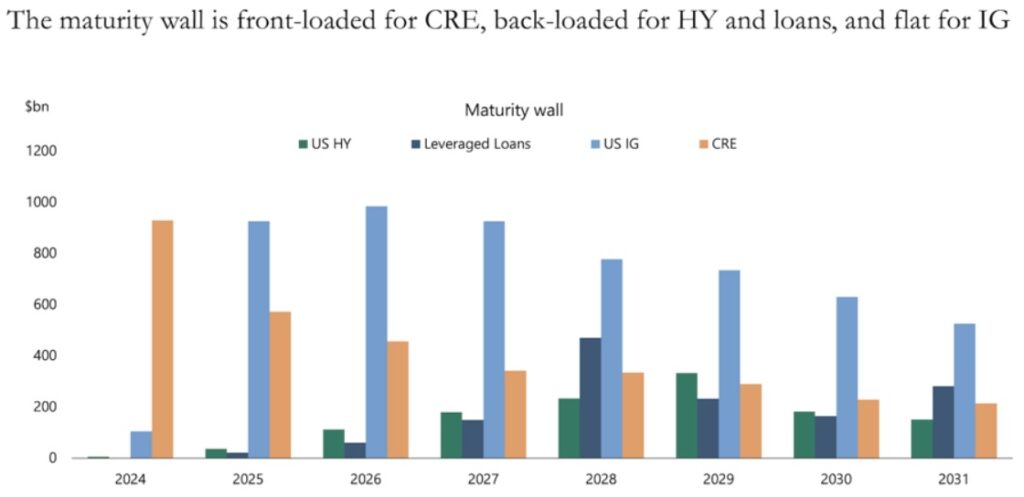

January 8 (King World News) – Peter Boockvar: ‘Long and variable lags’ when it comes to the impact of monetary policy on the economy is something we’ve heard all about for years with the only debate being how long and how variable. After 15 years of essentially zero interest rates preceding the 2022 rise in them, I still believe the impact will be very long and very variable as long as interest rates still stay higher for longer, which I believe they will. Below is a chart from my friend Torsten Slok back in October that he put out in his daily writings quantifying the maturity wall in coming years in high yield, leveraged loans, investment grade and commercial real estate. As seen, the biggest jump over the coming years is from investment grade companies.

Now we don’t have to worry about the credit quality of these IG names but I do want to point out that the interest rate this debt will refi into will be a few hundred basis points above the rate on the maturing loan which was most likely priced pre 2022. Keep in mind that one of the key factors in the notable rise in corporate profit margins over the past 20 years has been artificially low interest expense. That along with the lower corporate tax rate and low labor costs.

Stephanie Pomboy Weighs In

With respect to the US government’s maturity wall this year, my friend Stephanie Pomboy in a recent note mentioned the $10 trillion of maturing US debt this year with about $6 trillion being bills and $4 trillion being longer term notes. Those notes will likely refi also about 200 bps above the maturing rate. On $4 trillion, that’s an added $80 billion of interest expense and doesn’t include the about $2 trillion extra of debt the US government needs to sell just to finance the budget deficit. By the way, the US Treasury is issuing $119b of new debt just this week.

As for private equity and what higher for longer rates mean for them, this was an interesting tidbit I read over the weekend in the FT ‘Long View’ column from John Plender. He cites this from McKinsey, “that roughly two-thirds of the total return for buyout deals entered in 2010 or later and exited in 2021 or before can be attributed to broader moves in market valuation multiples and leverage, rather than improved operating efficiency.” In other words, much of private equity’s success during that time period was due to easy money and a low cost of funding deals.

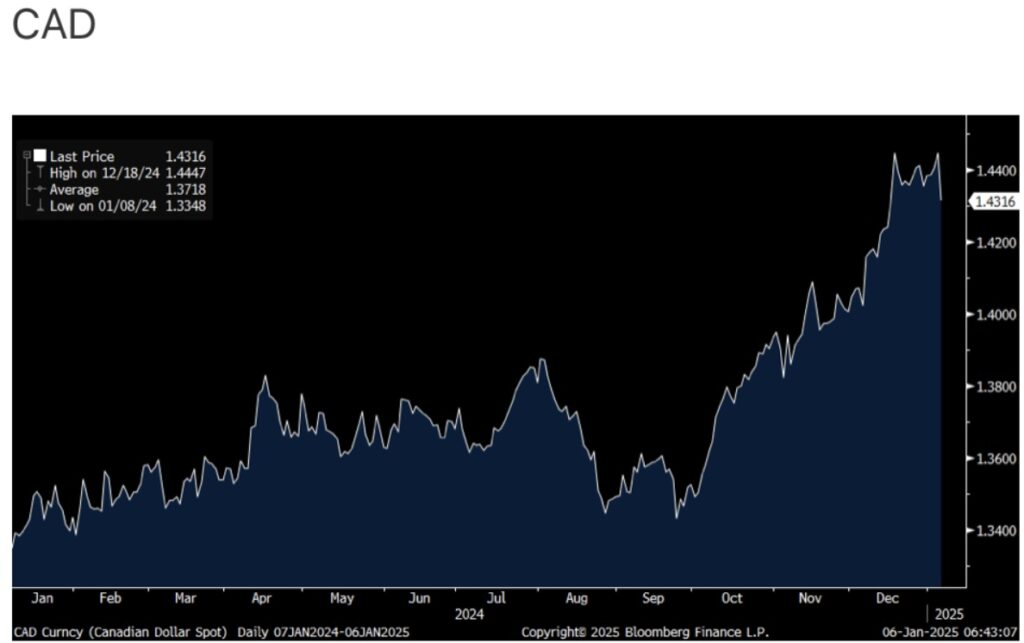

O Canada

… Justin Trudeau resigns, the Canadian$ is rallying almost 1% and should rally further from here after really getting beaten up last year. It’s like a stock rallying after an unliked CEO leaves.

Justin Trudeau Resignation Sends Canadian Dollar Higher

In case you didn’t see, the Washington Post is reporting that “President-elect Donald Trump’s aides are exploring tariff plans that would be applied to every country but only cover critical imports, three people familiar with the matter said…If implemented, the emerging plans would pare back the most sweeping elements of Trump’s campaign plans but still would be likely to upend global trade and carry major consequences for the US economy and consumers.” This more targeted approach that this article is implying should be much more tolerable by the economy and markets rather than my concern of another scattershot repeat of 2017 and 2018. That said, there is no free lunch and will raise the cost of a variety of things. https://www.washingtonpost.com/business/2025/01/06/trump-tariff-economy-trade/

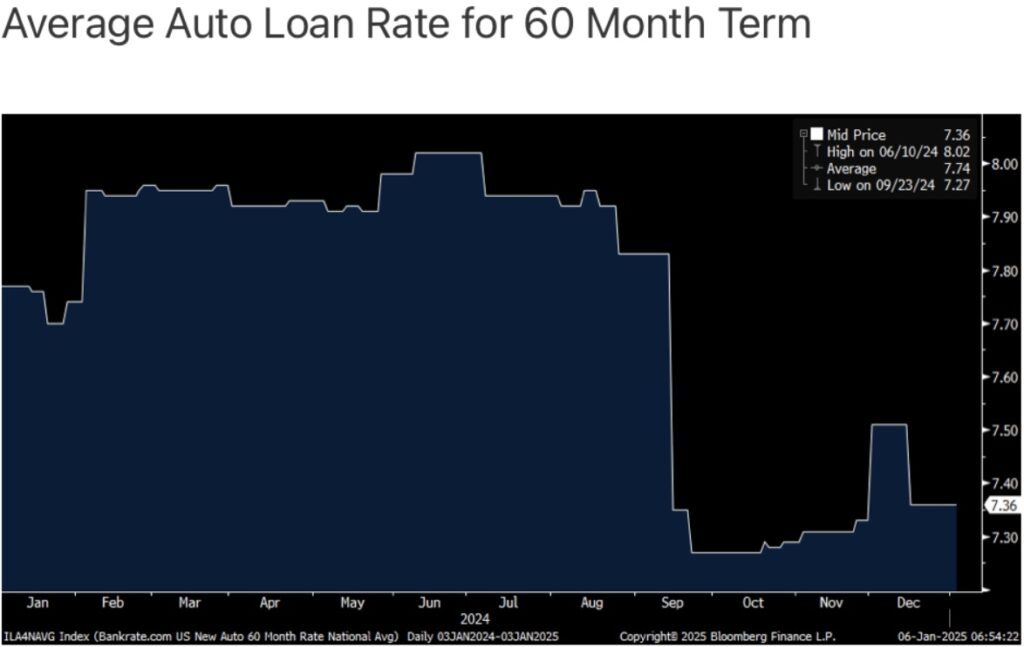

Increased Retail Incentives Helps Car Sales

December vehicle sales seen Friday beat expectations with a count of 16.8mm seasonally adjusted annualized rate (SAAR) vs the estimate of 16.5mm. That compares with 15.83mm in December 2023 and 16.7mm in December 2019. Ward’s said “The return to growth was aided by rising inventory, increased retail incentives and lower interest rates, while pull-ahead volume of electric vehicles from expectations of cuts in government incentives could have played a part.”

On the interest rate side, the rate for a 60 month auto loan on average was about 7.40% in December vs the average in 2024 of 7.74%. They fell with the lower fed funds rate.

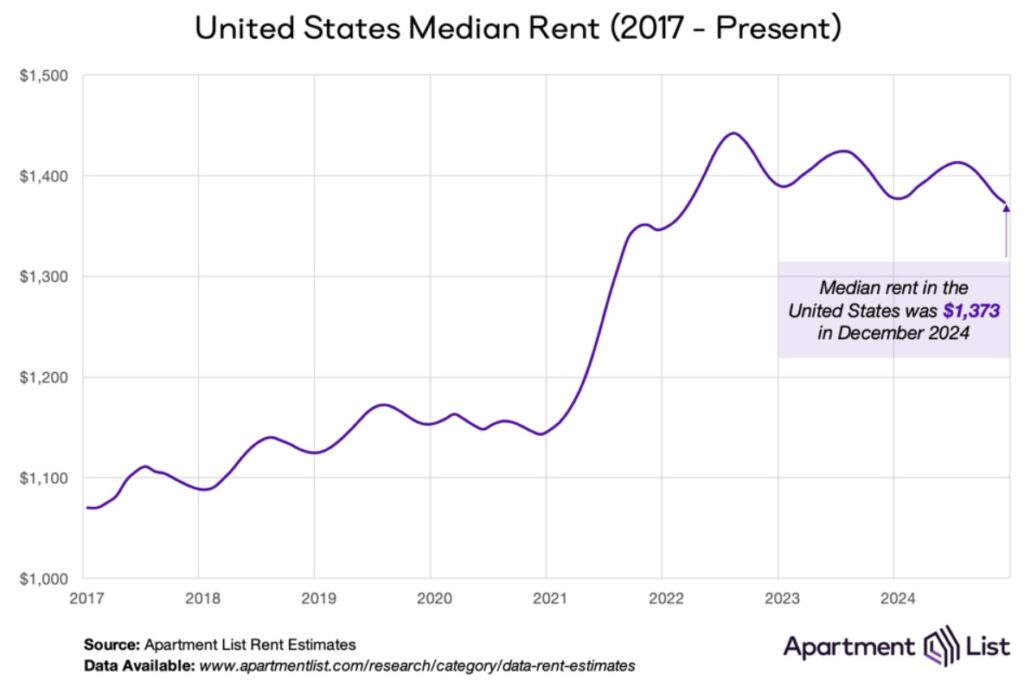

Apartment Vacancy Rates Creep Even Higher

Apartment List on Friday released its December new lease national report and reflected a .6% m/o/m drop, which typically happens this time of the year. The y/o/y decline was also .6%. The vacancy rate continues to creep up slowly, now at 6.8%, up one tenth as a lot of supply mostly in the sunbelt gets absorbed. Apartment List said “2024 saw the most new apartment completions since the mid-1980s, and with nearly 800 thousand units still in the construction pipeline, the supply boom has runway to continue into 2025.” That said, the pace of new multi family starts is slowing sharply. The sunbelt markets of Austin, Raleigh, and Jacksonville saw the deepest declines. Seasonally, overall new rents should rebound in the spring.

From what I saw from the publicly traded REITS, the renewal rates are rising about 2-3% in contrast.

“Rent (Still) Too Damn High” But Falling

Turk Just Warned Financial Crisis Set To Erupt In Early 2025!

To listen to what this financial crisis that is set to erupt in 2025 will look like and how you can safely navigate your way through the coming global shockwaves CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.