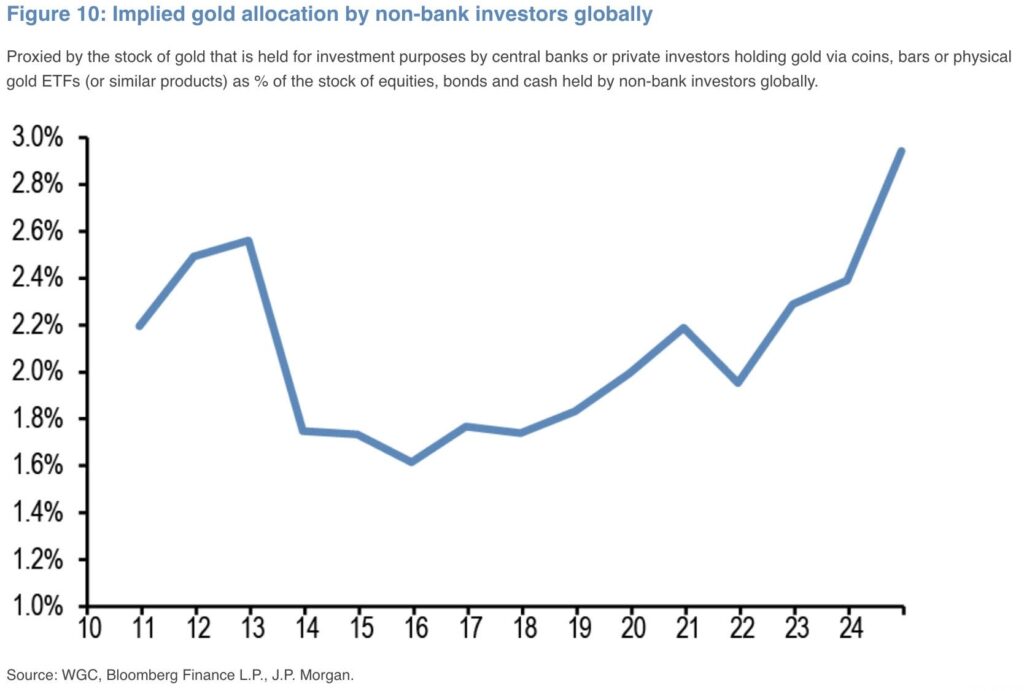

Global equities are now a jaw-dropping 33x the value of global gold holdings.

January 6 (King World News) – Email from KWN reader Kevin W: According to JPM global equities are now 33.0x the value of global private and public gold holdings. What you can see is just how expensive over all equities are globally and in US compared to gold but the trend is clearly a bullish ominous sign for gold over equities.

As a historical reference, I found an old Stanford Study a couple months ago. It indicated that as of March 1973 when gold was about $100, global equities were only worth 10x and US equities worth 6x what global private and central bank/treasury gold holdings were. By December 1974 when gold hit $200 the ratios were reduced to 5x for global equities and 3x for US equities. After which there was a 50% correction in gold back to $100 in 1976 before it made its $800 run by January 1980 bringing the global equity:gold ratio to 12.5x. Today global equities are 33.0x and US equities 10.7x the value of global private and public gold holdings. What you can see is just how expensive equities are globally which should indeed drive demand globally into gold. It would take a 62% correction in global equities with static gold price to reach that 12.5x ratio that it was in January 1980. Or an outstanding $12,500 gold with static equities to reach the January 1980 peak in gold.

Bitcoin soars on $78B inflow bringing market cap to $2.0T.

Whereas gold up 25% with a rolling four-quarter basis Central Bank net buying alone of 909 metric tonnes worth exactly $78B bringing private and public holdings to $5.3T.

Assuming that continues and private investors start getting into the act adding another $120B, gold could run up like a parabola too.

Turk Just Warned Financial Crisis Set To Erupt In Early 2025!

To listen to what this financial crisis that is set to erupt in 2025 will look like and how you can safely navigate your way through the coming global shockwaves CLICK HERE OR ON THE IMAGE BELOW.

© 2025 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.