Wild day unfolded as the Fed cut rates, but today’s trading was brutal. Take a look…

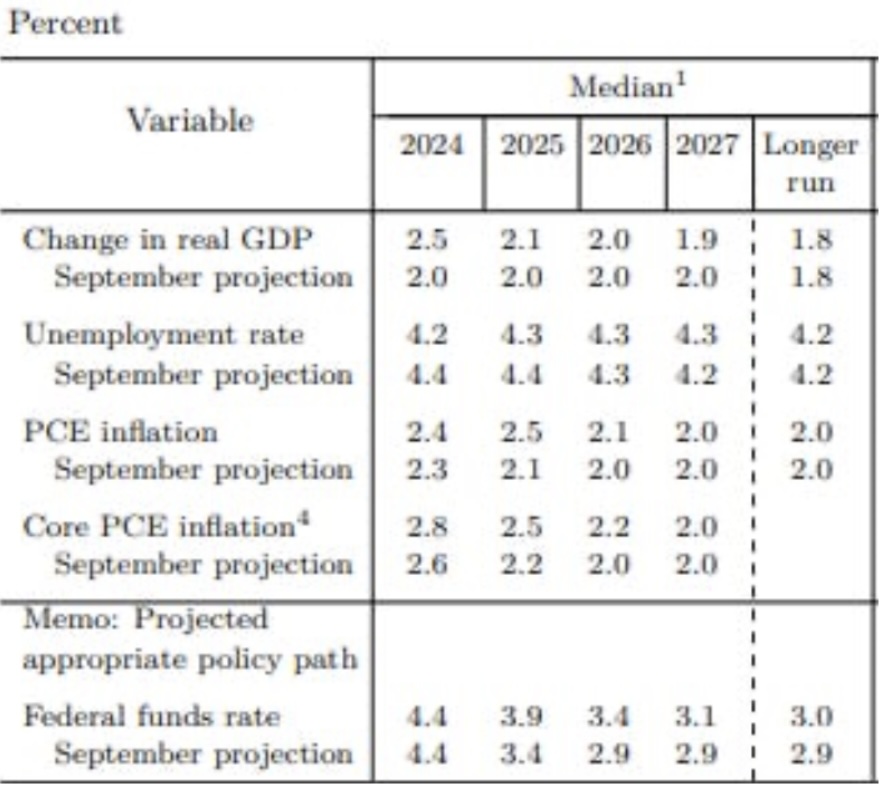

December 18 (King World News) – Peter Boockvar: The FOMC statement was about identical to what they said in November as they cut rates again even though they raised their 2024 GDP forecast to 2.5% from 2%, lowered their unemployment rate estimate to 4.2% from 4.4%, increased their headline PCE forecast to 2.4% from 2.3% and the core rate from 2.6% to 2.8%.

So, all their estimate changes should have pointed to a pause but they cut anyway and I guess Jay Powell at 2:30pm will help us better understand. Also of note for 2025, and we take with a grain of salt, they increased a touch their GDP forecast to 2.1% from 2%, lowered their unemployment rate estimate to 4.3% from 4.4% and raised their headline PCE guess to 2.5% from 2.1% and the core rate also to 2.5% from 2.2%. The 2025 median dot plot for the fed funds rate now stands at 3.9% from 3.4%. I’m not going to bother with the 2026 estimates as it’s too far out in time.

Finally of interest, Beth Hammack dissented and did not want a cut and I’m surprised that Bowman didn’t dissent either.

Bottom Line

Bottom line, as stated, Powell needs to reconcile the change in their economic forecasts with his desire to cut rates again. That said, the Fed’s median dot plot has now squared up with where the fed funds futures are pricing, that being just two more cuts in 2025 to 3.83%. At its most dovish pricing a few months ago, the December 2025 fed funds contract had a fed funds rate of about 2.80%, so the market and corroborated by Fed estimates, has taken back about 100 bps of cuts.

Rates are jumping in response, I’m guessing because of the upward economic forecasts and the Fed catching up to the markets by taking away some cuts. The 2 yr yield has jumped 10 bps in seconds to 4.32% and the 10 yr yield is at 4.45% from 4.40% right before.

Frustrating For Gold, Silver, Mining & Exploration Investors

King World News note: The action in the mining and exploration stocks as a whole has been dreadful, and incredibly frustrating for anyone invested in the sector. The key here remains patience. The mining sector went through a similar period of dread during the Dotcom bubble. However, in the years following the Dotcom bust, the mining and exploration stocks skyrocketed. As the stock market comes unglued that will translate into higher gold, silver and mining stocks. Again, all that remains now is for investors to remain patient. Our day is coming very soon.

To listen to Alasdair Macleod discuss the shocking events taking place behind the scenes in the gold and silver markets CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.