Here is a look at the US dollar, gold, market sentiment, credit card and auto delinquencies.

November 14 (King World News) – Peter Boockvar: Was it Issac Newton who said “for every reaction there is an equal and opposite reaction”? I believe so and that is what we are seeing in the currency market in that if foreigners are going to get hit by our tariffs on their imports, their weaker currency is in the process of offsetting any potential pain for them. The Chinese offshore yuan in particular is at the weakest level vs the US dollar since late July.

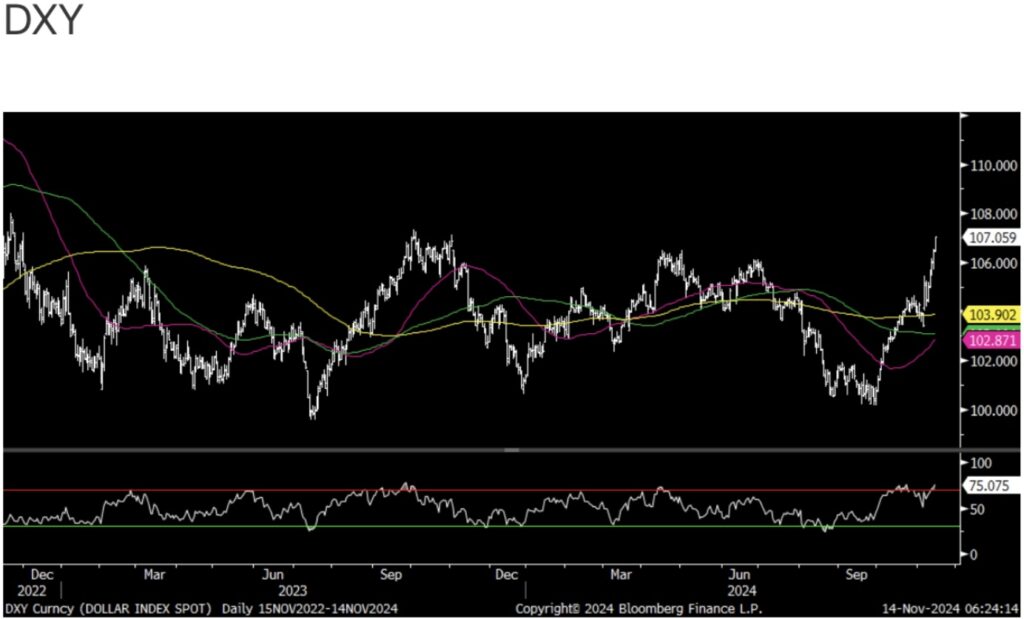

The dollar rally though is getting stretched short term as the 14 day Relative Strength Index in the DXY is at the highest level since September 2023 at 75.

In turn, gold is now the most oversold since October 2023 which we remain bullish and long of.

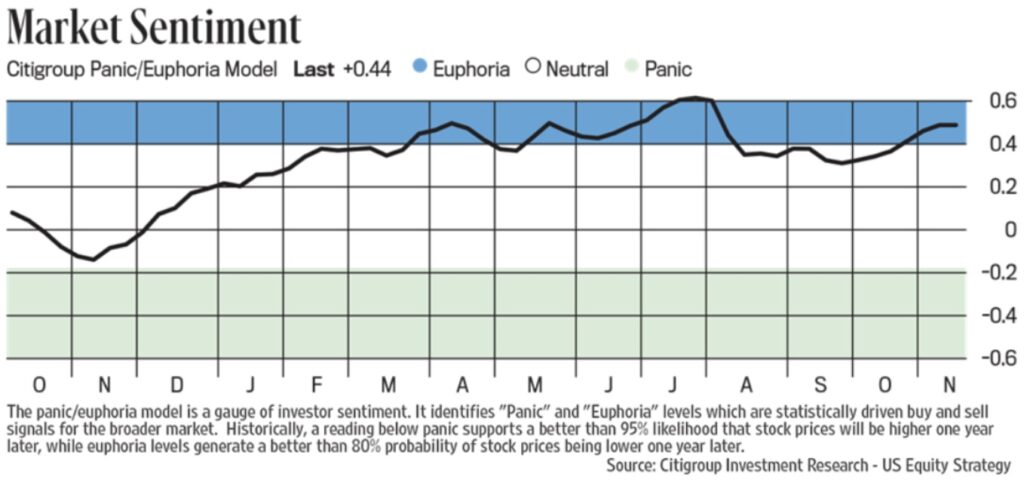

Post election, bullish stock market sentiment according to Investors Intelligence is back to extreme with the Bull/Bear exceeding 40.

Bulls rose to 60.3 from 56.7, a level rarely seen while Bears fell to 19 from 21.6. The Bulls are at the highest level since July 2024 while Bears are at the least since August 2024. This follows the Citi/Panic Euphoria index that got more Euphoric w/o/w. Also in today’s AAII, Bulls rose by 8.3 pts to 49.8, the highest since mid September when it was above 50. All of them though went to the Neutral side as Bears ticked up by .7 pts to 28.3, though the spread between the two is also high. The CNN Fear/Greed index at 67 is right in the middle of the ‘Greed’ category but not yet near ‘Extreme Greed.’

Bottom line, these sentiment gauges only matter for the short term but we should still take note when things get extreme and the II and Citi metrics are now such on the Bull side.

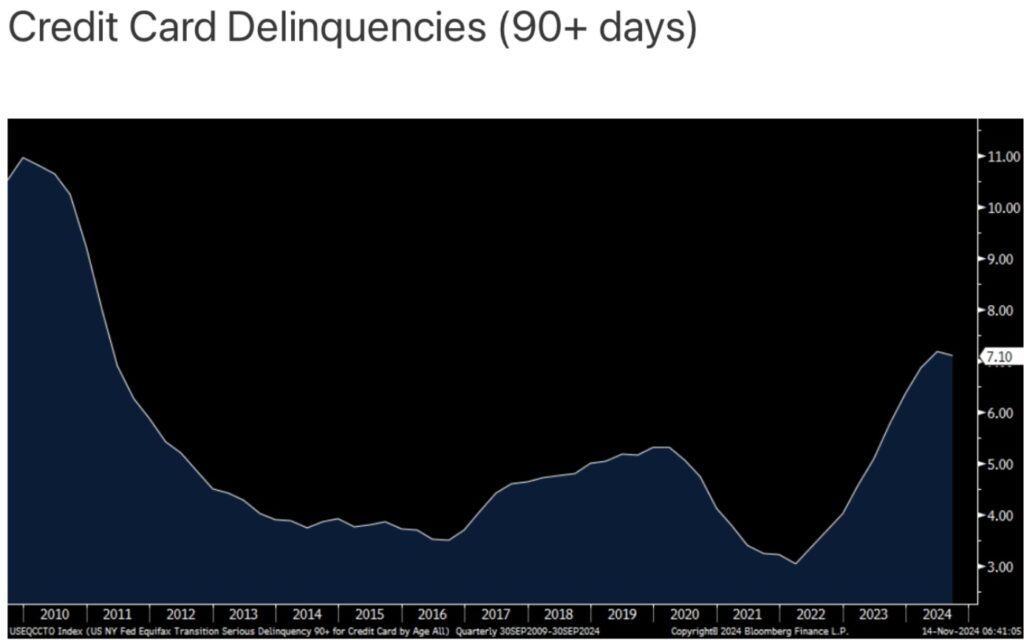

The NY Fed released yesterday its quarterly report on Household Debt and Credit and it’s important to not just look at the absolute debt level but compare it to income. “Although household balances continue to rise in nominal terms, growth in income has outpaced debt.” The growing issue though is this, “Still, elevated delinquency rates reveal stress for many households, even amid some moderation in delinquency trends this quarter.”

Further on delinquencies, “Credit card delinquency rates improved, with 8.8% of balances transitioning to delinquency compared to 9.1% in the previous quarter.

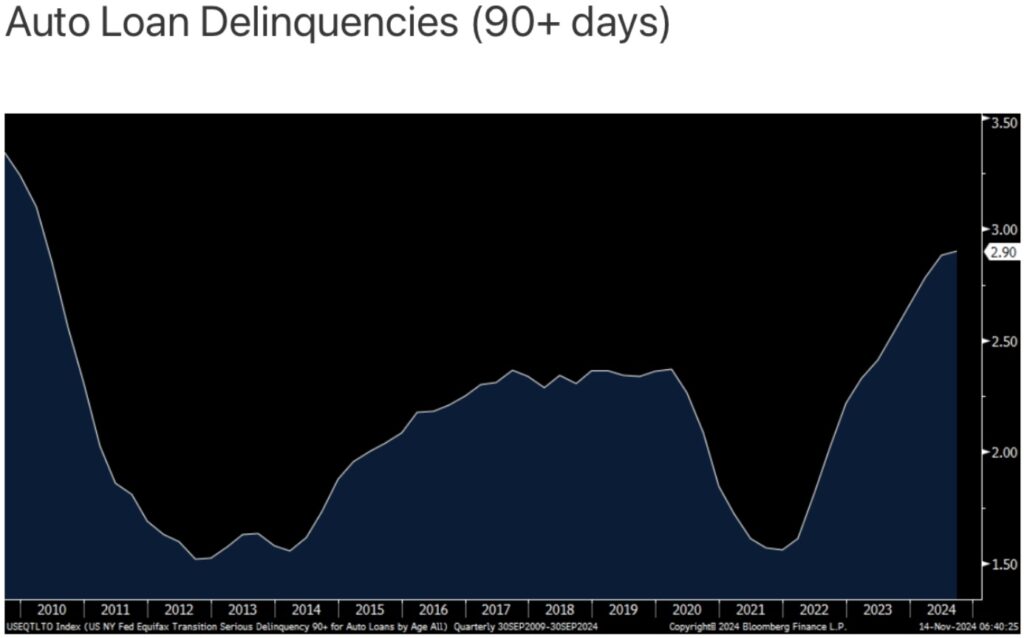

Early delinquency transitions for auto loans and mortgages worsened slightly, rising by .2 and .3 percentage points respectively.” Both though are up a lot y/o/y. Credit card delinquencies (90+ days) are now at 7.1% from 5.78% y/o/y…

…and auto loan delinquencies are at 2.90% vs 2.53% in the year ago period.

Bottom line, I’ll say again that we can’t paint the US economy and the US consumer with one brush. We have a fast lane part of growth and a slow lane right next to it and the lower and middle income consumer is in the slow lane relative to the upper end that remains in the fast lane.

JUST RELEASED!

To listen to Rob Arnott discuss how investors around the world can prepare themselves for the turbulence in global markets that lies ahead CLICK HERE OR ON THE IMAGE BELOW.

To listen to the jaw-dropping gold and silver price predictions that Nomi Prins just made CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.