Today Alasdair Macleod spoke with King World News about what people should expect to see from the gold and silver markets after next week’s election.

King World News has just released a timely and powerful audio interview with Michael Oliver!

For now, Alasdair Macleod’s King World News audio interview has just been released! (Link below).

Gold & Silver

November 2 (King World News) – Alasdair Macleod: Ahead of next week’s US presidential election, traders are naturally reducing their positions to wait-and-see.

Gold hit a new record high this week, while silver failed to challenge its recent high of $34.80 on 22 October before prices declined on profit taking. In European trade this morning, gold was $2751, up $65 from last Friday, and silver $32.80, down 90 cents on the same timescale. Comex volumes in gold were high, while in silver only slightly less so.

All eyes are on next week’s US presidential election, which according to opinion polls is too close to call. However, the betting odds which have been a more reliable indicator than polls in the past have Trump favourite at 8/13 odds-on, while Harris is 8/5 odds-against. This event could induce some significant volatility into all markets…

This silver explorer did a transaction with a $4.5 billion market cap producer CLICK HERE OR ON THE IMAGE BELOW TO LEARN MORE.

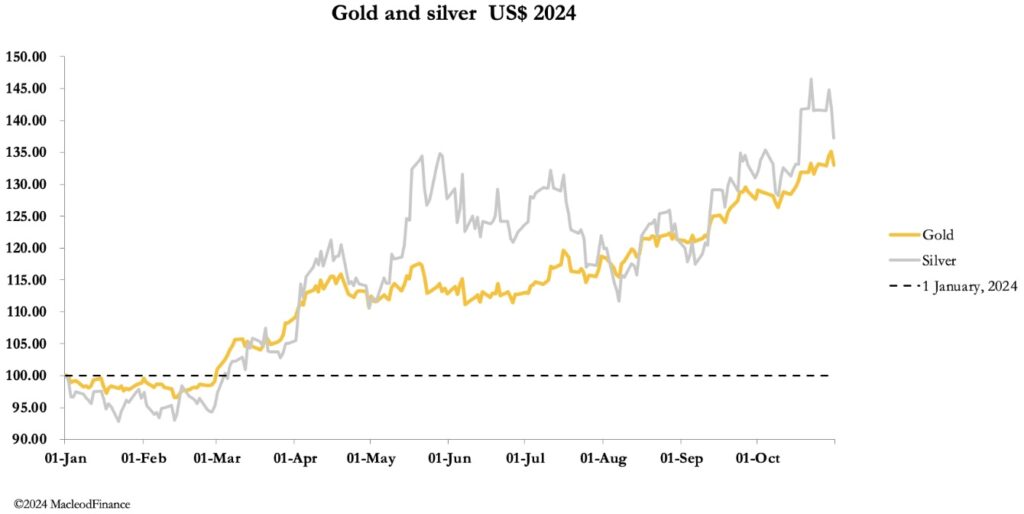

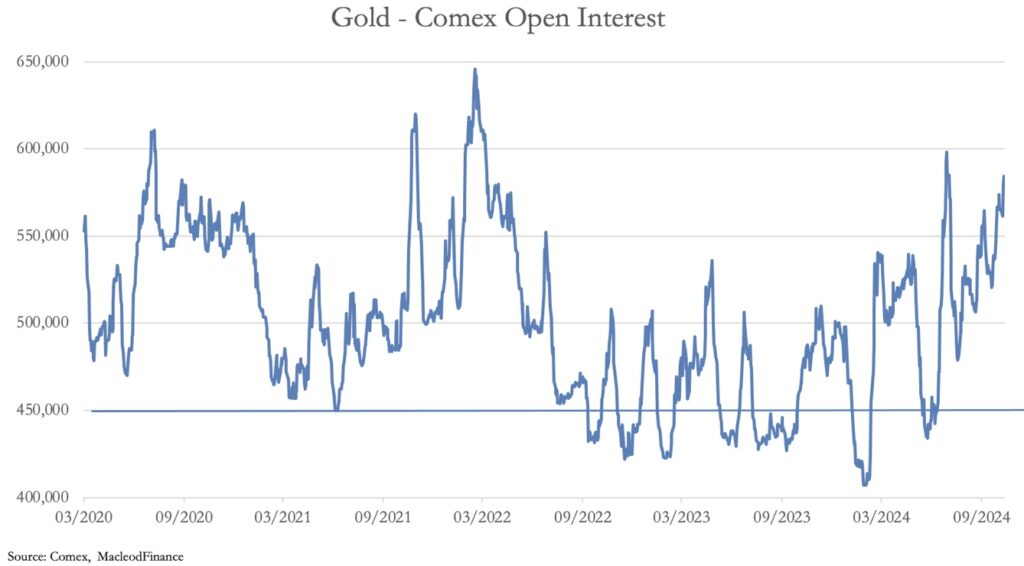

Clearly, gold and silver are on pause, consolidating some spectacular gains this year so far with gold up 33% and silver 37% since January. Given the dollar’s strength against other currencies, it represents a change in trader behaviour from a simple pairs trade between the dollar and gold to pure momentum buying of gold. We can see the extent of it in Comex’s open interest:

This bullishness is not yet at an extreme, but a pullback in the price and open interest would be a healthy development, taking out some of the excessive momentum-chasing and creating buyers for the next leg of the bull market.

Along with a stronger dollar there has been a relentless increase in bond yields, taking the 10-year US Treasury note from 3.6% in mid-September to 4.3% this morning. This is next:

After the election, both foreign and domestic US investors will almost certainly reflect on the new president’s economic policies and the consequences for government finances. The new debt ceiling is due to be set on 3 January, giving extra focus to the debate. If, as seems likely, it is fixed at a level designed to give some spending headroom to the new administration, it is likely that bond yields will rise even further over the next two months in anticipation of the additional funding requirements implied. This could also undermine expectations for lower interest rates.

On the one hand, higher bond yields and the diminishing prospects of lower interest rates are traditionally seen to be a headwind for gold. On the other, the destabilising effect on financial assets with increasing counterparty risk makes gold the perfect safe haven. Indeed, since mid-September when bond yields began to rise, gold also rose from $2500, perhaps reflecting the extra risk to the dollar’s stability from higher Treasury funding costs.

For reference, the next chart updates gold’s technical position.

This suggests that a dip towards the $2600 level in the area of the 55-day moving average would be reasonable, and a move towards $2500 cannot be ruled out. In that event, current bullish sentiment would take a severe dent, with momentum traders stopped out.

We shall see how this plays out in the short-term over the coming weeks. But stackers of physical should welcome pullbacks in gold and silver as opportunities to add to positions. Our last chart puts the outlook for the dollar and all lesser fiat currencies in context. The dollar is nosediving, valued in real legal money which is gold.

GOLD & SILVER: Just Released!

To listen to Alasdair Macleod discuss what to expect next week in the gold and silver markets and much more CLICK HERE OR ON THE IMAGE BELOW.

© 2024 by King World News®. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. However, linking directly to the articles is permitted and encouraged.